On the eve, the DXY dollar index has reached its minimum for more than three years near the 90.13 mark, and for the year of 2017 the index has decreased by almost 10%, which was the strongest annual decline since 2003. At the beginning of the European session, the DXY index is near the 90.50 mark.

After a many-day decline today for the first time there is a recovery in the US dollar.

In general, the negative attitude of investors to the US dollar remains. Expectations that soon the world's largest central banks will begin to wind down their stimulus programs for national economies and begin to raise interest rates, increase the attractiveness of major world currencies and reduce the attractiveness of the dollar.

After strong growth over a period of ten years, American stock markets are receding into the background, and the largest regional stock markets, such as the European and Japanese stock markets, are coming to the fore. And this increases the demand for the euro and yen, for which the national stock assets are acquired. In this sense, commodity currencies, such as Canadian, Australian and New Zealand dollars, which are especially sensitive to the cost of primary commodities on the world market, also keep pace. The observed large-scale weakening of the US dollar contributes to higher commodity prices. This fully applies to oil and gas, metallic ores, as well as to agricultural products.

The main part of the New Zealand economy is the timber and agricultural complex, and a significant part of the New Zealand export is dairy products, primarily milk powder.

In the last 203-th auction GDT (Global Dairy Trade), held on January 2, 2018, the price index for dairy products increased by 2.2%. Prices for powdered milk increased by 4.2%. The weighted average world price for dairy products was 3,124 USD / kg. And, although the prices are on average lower than the prices for the level of a year ago, there has recently been a slight increase in the price of dairy products. This, in particular, is contributed by the weakening of the US dollar, as commodity prices are mainly in US dollars.

The general elections in New Zealand that took place at the end of September, as a result of which the conservative government, which achieved significant growth in the New Zealand economy, resigned, led to the fall of the New Zealand dollar. The business-sentiment of producers in the agricultural sector, the leading industry in New Zealand's economy, is still at a low level, reflecting a negative reaction to the new government.

Nevertheless, the NZD / USD pair recovered completely after the fall against the background of the September elections in New Zealand. This was facilitated also by the weakening of the US dollar/

So far, the negative attitude of investors to the US dollar remains, and the positive dynamics of the pair NZD / USD still prevails.

From the news for today, we are waiting for the publication of the results of the next dairy auction (in the period after 14:00 GMT). Two weeks ago, the price index for dairy products, prepared by Global Dairy Trade, came out with a value of 2.2% (against the previous value of + 0.4%). If the prices for dairy products rise again, the New Zealand dollar will strengthen, including in the pair NZD / USD. The decline in world prices for dairy products will hurt the quotations of the New Zealand dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

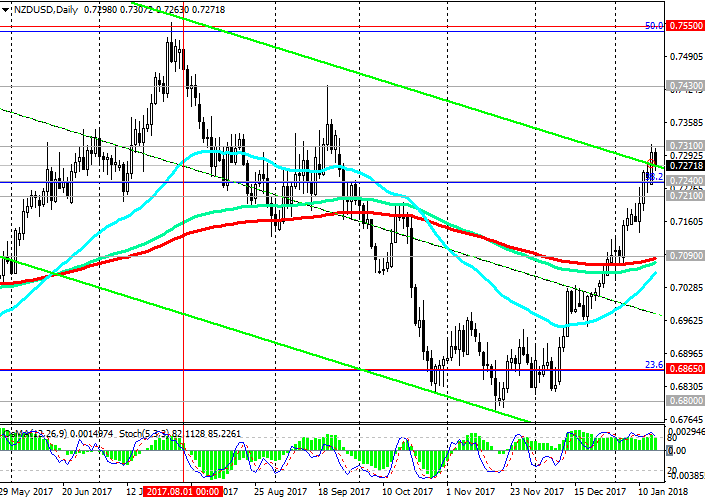

Support levels: 0.7240, 0.7210, 0.7090,

0.7000, 0.6865, 0.6800

Resistance levels: 0.7310, 0.7430, 0.7550

Trading Scenarios

Sell Stop 0.7255. Stop-Loss 0.7315. Take-Profit 0.7240, 0.7210, 0.7090

Buy Stop 0.7315. Stop-Loss 0.7225. Take-Profit 0.7430, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com