On the eve of the Fed meeting and the publication of an interest rate decision on Wednesday, the US dollar is rising against commodity currencies, including against the New Zealand dollar.

Most market participants expect that the Fed will announce the first interest rate increase in 2018, as well as give slightly more positive predictions about the growth of the US economy in the next 2 years. The forecast of economists for 2018 envisages US GDP growth of 2.7%, as well as a decrease in unemployment to 3.9% by the middle of the year and 3.8% by December.

At the same time, many market participants will look for signals in the Federal Reserve's statement regarding the possibility of accelerating rates of rate hikes this year in order to prevent overheating of the economy. The Fed's inclination towards more aggressive policy tightening may support the dollar, as raising borrowing costs in the US makes the dollar more attractive to investors.

If the Fed leaves its forecast for 3 rate increases this year, the US dollar may fall, as the probability that rates will be raised this year 3 times is already taken into account in the dollar quotes.

On the same day, when the decision of the Federal Reserve on the rates will be published, the RBNZ meeting on monetary policy in New Zealand will conclude. The RBNZ decision on the rates will be published on Wednesday at 20:00 (GMT).

As expected, the interest rate will remain at the same level of 1.75%. The New Zealand currency remains robust against the US dollar, despite the threat of a trade war between China and the United States, the largest trade and economic partners of New Zealand.

According to the data released last week, New Zealand's GDP grew by 0.6% in the fourth quarter (+ 2.9% in annual terms). This is quite strong data, indicating a stable state of the New Zealand economy, which remains one of the fastest growing in the world. Nevertheless, the RBNZ is unlikely to go on to tighten monetary policy, economists expect, until mid-2019.

If, however, the accompanying statement of the RBNZ, which will also be published on Wednesday at 20:00 (GMT), contain signals on the possibility of tightening monetary policy in the near future, then the New Zealand dollar may strengthen, including against the US dollar, even in spite of The Fed's plans to tighten monetary policy in the US.

From the news for today we are waiting for the data with the results of the milk auction organized by the New Zealand company Fonterra (specialized trading platform GlobalDairyTrade - GDT), which will be published after 13:00 (GMT).

The main part of the New Zealand economy is the timber and agricultural complex, and a significant part of the New Zealand export is dairy products, primarily milk powder. If the data points to another decline in world prices for dairy products, primarily for milk powder, the New Zealand dollar will decrease. Two weeks ago, the price index for dairy products, prepared by Global Dairy Trade, came out with a slight decrease (-0.6%) against the previous values of -0.5%, + 5.9%, + 4.9%, +2.2 % and + 0.4%.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

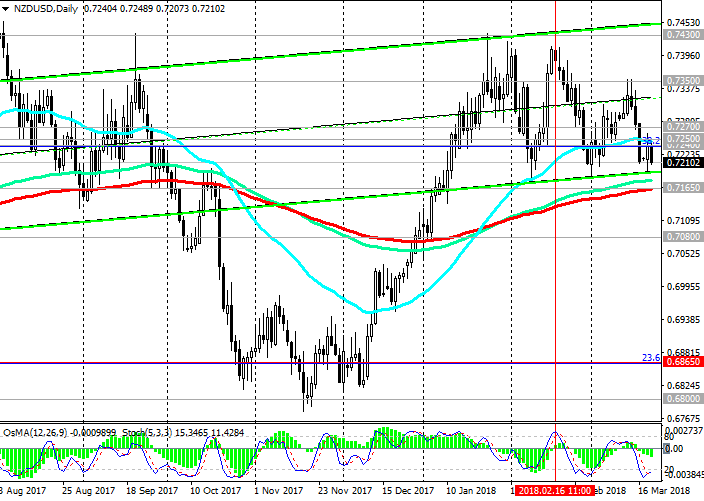

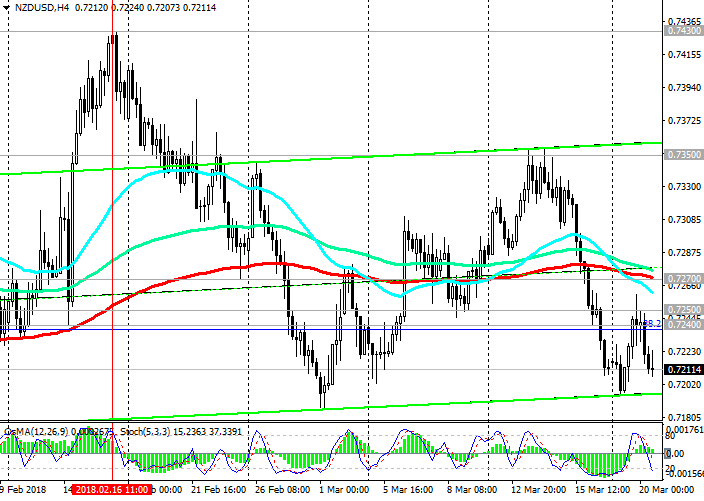

Support levels: 0.7180, 0.7165, 0.7080,

0.6865, 0.6800

Resistance levels: 0.7240, 0.7250, 0.7270, 0.7350, 0.7400, 0.7430, 0.7500, 0.7550

Trading Scenarios

Sell in the market. Stop-Loss 0.7230. Take-Profit 0.7180, 0.7165, 0.7080, 0.6865, 0.6800

Buy Stop 0.7230. Stop-Loss 0.7190. Take-Profit 0.7240, 0.7250, 0.7270, 0.7350, 0.7400, 0.7430, 0.7500

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com