EUR/USD: FED's Speakers to Gather Most of the Attention this Week

EUR/USD: FED's Speakers to Gather Most of the Attention this Week

The EUR/USD pair closed in the red for a third consecutive week, with the greenback fueled by FOMC's Minutes pointing for a soon-to-come rate hike in the US. On Friday, however, the pair consolidated its weekly losses, with the common currency finding some buyers on slides below the 1.1200 level against its American rival.

The upcoming week will be quite busy in the macroeconomic front, with preliminary PMIs readings for the month of May in the EU quick starting the action this Monday. In the US, PMIs, Durable Goods Orders, and GDP are among the most relevant releases, but attention will mostly focus in FED officials' speeches, spread all through the week, and any wording supporting a June rate hike. Nevertheless, uncertainty over growth will also be among the main themes behind markets' movements.

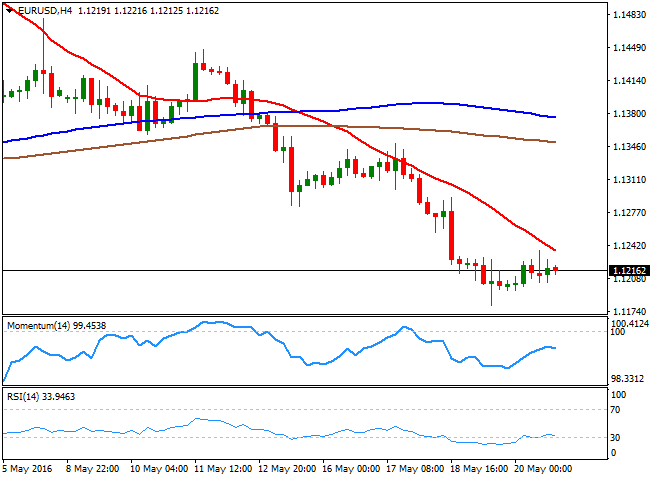

As for the technical picture, the EUR/USD pair has traded as low as 1.1179 last Thursday, and while it's still unable to break below the key 1.1200 figure, bounces from the lows have been quite shallow and contained by selling interest around 1.1280, the level to regain to see the downward pressure easing, at least in the short term. Currently trading around 1.1216, the pair is stuck around its 100 DMA, but the dominant trend is clearly bearish. A daily ascendant trend line coming from this year low of 1.0505 is placed this week in the 1.1050/1.1100 region, a probable bearish target should the dollar keep rallying.

Support levels: 1.1160 1.1120 1.1080

Resistance levels: 1.1245 1.1280 1.1330