Analytical Review of the Stocks of The Boeing Company

The Boeing Company, #BA [NYSE]

Industrial goods, Aircraft and space industry, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 1.08;

Capitalization – 72.65 В;

Return on share - 5.30%;

Income - 5.17 B;

Average volume – 5.37 М;

P/E - 14.58;

ATR – 4.68.

Analytical review:

- The company ranks the fifth on capitalization in the sector of industrial goods among the issuers trading in the American market.

- In the last month the price of company’s shares has grown by 9%. It is expected that the rise in price will be continued.

- According to the last report company’s revenue in the fiscal year of 2015 has grown by 5.9%. However, net profit of the Boeing Company fell by 4.9% to 5.17 млрд. USD due to pressure from strong USD and high completion in the market.

- Company’s management expects the rise in demand for planes in the South East Asia. The company evaluates the rise of 550 billion USD within 20 years.

- By next summer the company is going to dismiss over 4000 employees in order to cut costs. The company tries to maintain high level of profit against strong competitor: Airbus Group. In the near future the company plans to revise conditions of cooperation with the main suppliers in order to improve efficiency of work and reduce surplus of goods.

- Over 75% of company’s shares belong to the institutional funds. The most part of the shares belong to Capital World Investors (6.65%) and Evercore Trust Company (6.40%).

Summary:

- Despite negative last report, the company has growth potential. Increasing demand for planes in the South East Asia, successful implementation of company’s cost cutting program will cause the rise in the company’s stocks.

- Most of the stocks of The Boeing Company belong to the institutional funds.

- It is likely that company’s stocks will rise in price in the near future.

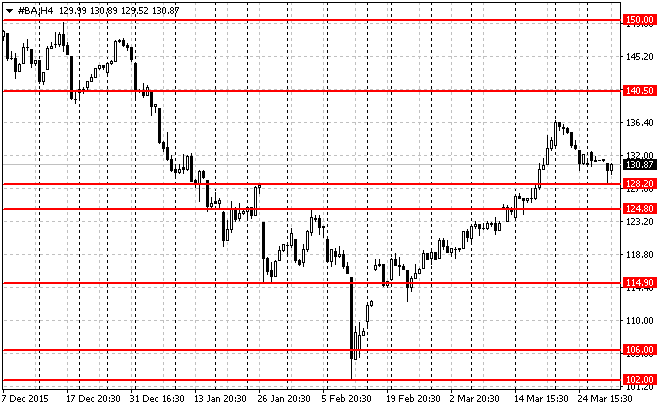

Trading tips for CFD of The Boeing Company

Medium-term trading: at the moment the issuer has broken out and consolidated above the local resistance level of 128.20 USD. If the price maintains and tests the demand zone of 124.80-128.20, and in case of the respective confirmations (such as the pattern Price Action), we recommend to open long positions. Risk per trade is not more than 2% of capital. Take profit can be placed in parts at the levels of 138.00 USD, 144.00 USD and 149.00 USD with the use of trailing stop.

Short-term trading: at the moment on the chart with the timeframe 15М the issuer is traded at the local support level of 130.10 USD. If the price maintains and tests this level we recommend to open long positions. Risk per trade is not more than 2% of capital. Stop order can be placed slightly below the signal level. Take profit can be placed in parts at the levels of 132.50 USD, 134.60 USD and 136.40 USD with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com