August 15, 1971, US President Richard Nixon announced the decision to

cancel the free convertibility of the dollar into gold (abandoned the

gold standard). In December 1971, in Washington, the Smithsonian

agreement was reached whereby instead of 1% fluctuations of the currency

against the US dollar were allowed fluctuations of 4.5% (9% for

non-dollar currency pairs).

It destroyed the system of stable exchange rates, and became the culminating event of a crisis in the post-war Bretton Woods monetary system.

Replaced by Jamaican currency system, the principles of which were laid in March 1971 on the island of Jamaica with the participation of 20 of the most developed states of the non-communist block. The essence of the changes was to looser policy on gold prices. If earlier exchange rates were stable by virtue of the gold standard, after making such a floating rate of gold has led to the inevitable fluctuations in exchange rates between currencies. This gave rise to a relatively new field of activity – trade in foreign exchange, when the exchange rate began to depend not only on the gold equivalent of the currency, but also by market demand / supply on it.

Quickly enough, there were some issues to discuss that in 1975 French President Valery Giscard d’Estaing and Chancellor Helmut Schmidt proposed the heads of other leading countries of the West to gather in a narrow informal circle for dialogue confidentially. The first summit of the “Big Eight” (then only six participants) was held in Rambouillet, involving the United States, Germany, Britain, France, Italy and Japan (in 1976 Canada joined the work of the club, and in 1998 – Russia). One of the main topics of discussion was the structural transformation of the international monetary system.January 8, 1976 at a meeting of IMF member countries in Kingston (Jamaica), adopted a new agreement on the device the international monetary system, which has the form of amendments to the charter of the IMF. The system replaced the Bretton Woods monetary system. From this point freely floating rates have become the main method of exchange.Formation of system of floating exchange rates has resulted in three significant results:

- Importers, exporters, and serving their banking institutions were forced to become regular participants in the foreign exchange market as the currency exchange rates may affect the financial results of their work with both the positive and negative side.

- Central banks were able to have an impact on the currency and the impact on the economic situation in the country by market methods, rather than just administrative.

- Courses of the most liquid national currencies are formed on the basis of the search market equilibrium point between the current demand and available supply and changes in demand and supply in the market causes displacement of the exchange rate in one direction or another.

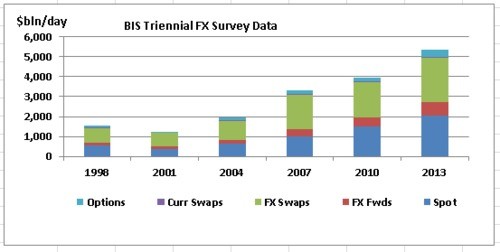

Daily Turnover of Forex

It is estimated that the daily turnover in the forex market was:1977 – $

5 billion1987 – 600 billionat the end of 1992 – $ 1 trillionin 1997 –

1.2 trillion dollarsin 2000 – 1.5 trillion dollarsin 2005-2006, the

volume of daily turnover on the FOREX market fluctuated, according to

various estimates, from 2 to 4.5 trillion dollars2010 – $ 4 trillion.

This predicted further growth intraday turnover to $ 10 trillion in

2020.Bank of International Settlements periodically conducts large-scale

study of the Forex market every three years, starting in 1989. The

final report contains information of the speed of the market, the

structure and dynamics. The last report was released in December 2010

and is available on the official website.