Weekly Trading Forecast: Will We See More of Last Week’s Exceptional FX and Commodity Volatility?

Weekly Trading Forecast: Will We See More of Last Week’s Exceptional FX and Commodity Volatility?

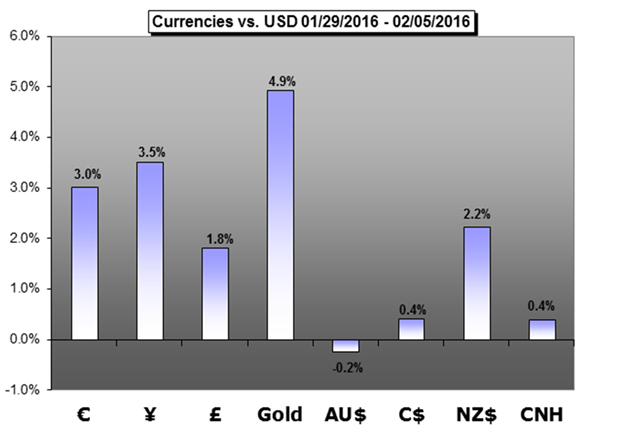

The Dollar suffered one of its most abrupt swoons in years until NFPs stabilized the currency. Oil and gold meanwhile generated remarkable volatility and tentative stabs at trends. Will we see more of these active markets this week?

US Dollar Forecast – Dollar Recovers After Painful Stumble as Market’s Fed Doubts Waver

A number of major market themes were driven this past week; but for FX, the Dollar’s remarkable volatility grabbed most traders’ attention.

British Pound Forecast – GBP/USD 2016 Rebound Vulnerable to Upbeat Fed Testimony

The near-term rebound in GBP/USD may continue to unravel in the week ahead should the Federal Reserve’s semi-annual Humphrey-Hawkins testimony with Chair Janet Yellen highlight a further deviation in the policy outlook.

Japanese Yen Forecast - A Week of Wonder and Befuddlement for the Yen

Last week we looked at the astonishing surprise decision by the Bank of Japan to move to negative interest rates.

Australian Dollar Forecast - Australian Dollar Down Trend May Resume on Yellen Testimony

The Australian Dollar may resume its long-term down trend after rebounding to a monthly high last week as testimony from Fed Chair Yellen reboots US rate hike speculation.

Canadian Dollar Forecast – Highest Unemployment Rate in 2yrs. Stalls CAD Rally

This week’s moves have put the Bank of Canada, and CAD traders in a precarious position.

Chinese Yuan Forecast – PBOC Prepared the Yuan Ahead of One-Week Holiday

Both the offshore (CNH) and onshore yuan (CNY) rates closed higher on Friday after China’s central bank raised the yuan reference against the dollar to a one-month high of 6.5314.

Gold Forecast – Gold’s Luster at Risk as Fed Testimony Looms

Gold prices rallied for a third consecutive week with the precious metal advancing more than 3.5% to trade at 1157 ahead of the New York close on Friday.

y