EURUSD long-term forecasts updated: more ranging than bearish - Goldman Sachs

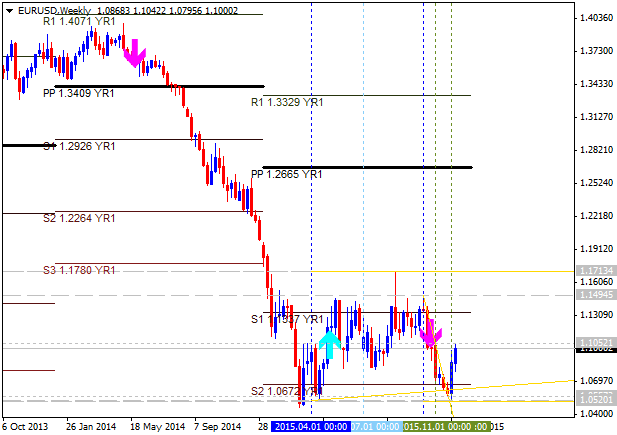

Goldman Sachs updated their long-term forecast for EUR/USD with more bullish than in previous one: the price will be droped to 1.07 for 3 months instead of 1.02 as the previously forecasted, half a year forecast is 1.05 instead of 1.000, and one year fiorecast is 1.0000 instead of 0.9500 previous one.

| Instrument | 3 month forecast | 6 month forecast | 12 month forecast |

|---|---|---|---|

| EUR/USD | 1.0700 vs 1.0200 prev | 1.0500 vs 1.00 prev | 1.00 vs 0.9500 |

According to Goldman Sachs - the price will reach second pivot support level at 1.0672 for 3 months only, and the price will be in the bearish market condition for the ranging within S2 Pivot at 1.0672 and 1.0520 support level. And the bearish trend will be re-started in the second half of 2016 only: price will reach 1.0000 psy level by the end of 2016 for example.

Thus, we will see the ranging bearish market condition since January till June 2016, and the primary bearish condition will be continuing with good breakdown possibility without ranging since July till December 2016.