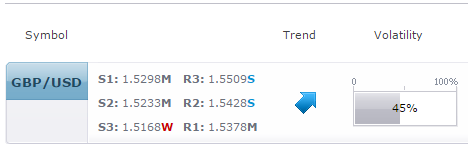

Near-term forecasts for the GBP to USD exchange rate suggests support is fast approaching.

The British pound has been in retreat against the US dollar over the past 3 trading days ensuring those with an interest in the attainment of an October best at 1.60 and above have been thwarted.

However, the GBP to USD exchange rate appears headed towards a significant technical level that could arrest the decline.

"A swift breakout and pullback from the trading range we saw last week saw cable push rapidly lower, but salvation for buyers may be appearing in the form of the rising October trendline. Support may well be found in the area around $1.53, at which point we may see whether the pair can push back on to the $1.5385 area," notes analyst Chris Beauchamp at IG.com, the spread betting and retail brokers.

Beauchamp predicts that a drop through the October hourly trendline would suggest that GBP/USD is heading back towards $1.52, the low of 13 October, with further support available around $1.5150 and then $1.5105.

Longer-Term: 1.55 Range Ahead of Fall Below 1.50

The pound sterling is tipped to maintain recent ranges against the US dollar over the medium-term; a good number of analysts we follow are united in their view that the GBPUSD could close out the year around present levels.

In their latest global forecast note to clients Lloyds Bank say we have seen the GBP to USD conversion trading in a four-point range around 1.55 since May and they believe there is little reason for this to change over the coming months.

"Given the uncertainty over the prospects for monetary policy on both sides of the Atlantic, the inability of GBP/USD to make a decisive break in either direction is perhaps not surprising," say Lloyds.

External pressures, particularly from slowing growth in China, have added to global deflationary and financial market volatility.

"Even if, as we expect, the US raises rates in December, slightly ahead of the UK, the pound should still find some support into early 2016," say Lloyds.

It is argued that this is because an early rate rise in the UK would come as a bigger shock to the market, which is not expecting the first UK policy tightening until early 2017.

However, looking through 2016 the prospect of a decline 1.50 becomes possible owing to a more agressive interest rate raising regime in the United States:

"While the pound should receive a lift from a prospective rise in UK short-dated bond yields, there are formidable obstacles to the pound’s sustained outperformance. Potential EU referendum risk, a still large current account deficit and more acute fiscal austerity should push sterling lower in H2 2016. We target 1.45 by end 2016."