Economic data signals Bank of England may move before Fed - Analysis

The latest series of data in the U.S. and the U.K. are signaling the right time for the first post-crisis rate rise by the Bank of England may be reached before the Fed decides to move.

Both regulators have been awaiting clear signs that their

economies are regaining ground, with the greatest number of

people in work and much of the output lost following the financial

crisis recaptured.

Compared to the Federal Reserve which still points to low prime-age labor force participation, a quits rate that has remained static for five straight months, and weak wage pressures, the Bank of England is relying more and more on its upbeat productivity forecasts to make a case for holding.

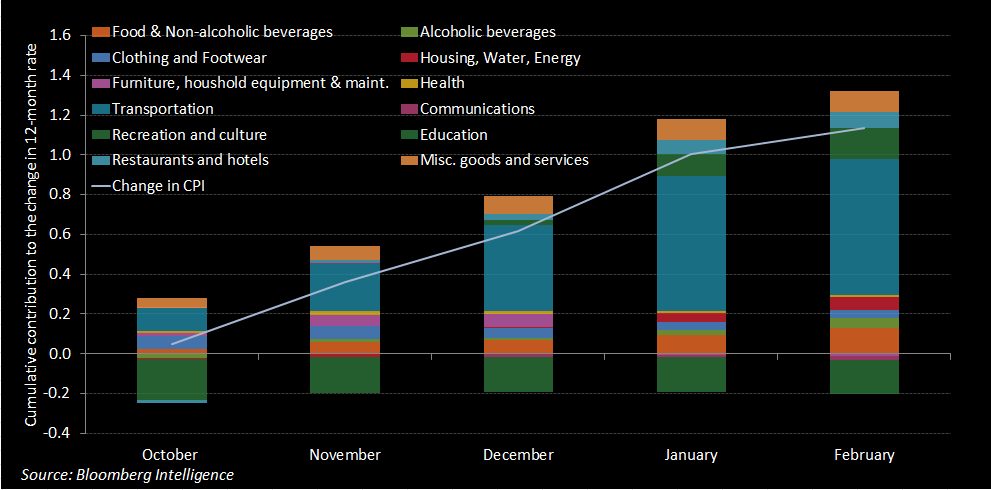

Headline inflation in the U.K. dipped 0.1 percent in September, but it will possibly reverse toward the end of the year as the effects

from commodity prices drop and university tuition fee increases fade.

Bloomberg Intelligence has estimated how these base effects will influence inflation:

Dan Hanson, an economist at Bloomberg Intelligence, suggests that if there no further steep downward movements in global commodity prices, inflation is likely to advance quickly beyond October.

In

the U.S., an increased number of

people coming back into the job market could mitigate this.

Britain's jobless rate, however, remains just above the bank's forecast of the natural rate of unemployment. Since employment as a share of the working-age population is at a record high, and wages and output continue to rise at a robust pace, the bank is relying on productivity growth to eclipse price pressures.

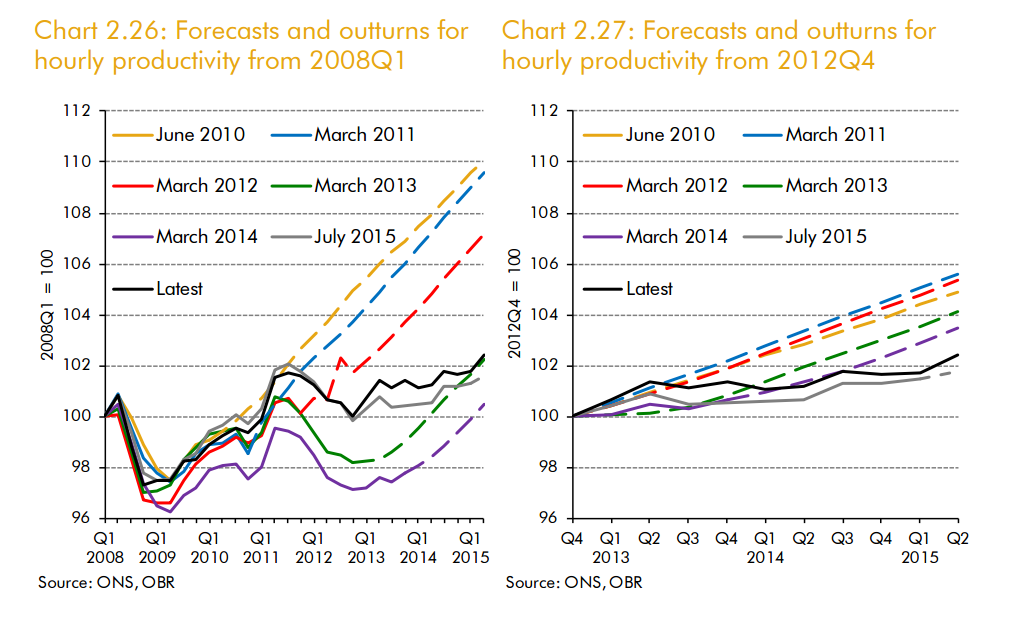

Productivity was flat in 2014 but has after that begun to beat expectations, climbing 0.8 percent in the four quarters through March 2015 and is expected to have been 1.5 percent in the year ended June. Since nominal wage growth is expected to be 3 percent to 4 percent out to 2016, productivity growth would have to average around 1-2 percent for the Bank to hit its 2 percent inflation target.

That would be lower than its pre-crisis average rate of 2.4 percent but substantially above the negligible productivity growth seen since 2008.

However, the record of both the central bank and the Office for Budget Responsibility, the government's budget regulator, at predicting productivity since 2008 has done little to encourage confidence in the current projections. The OBR's forecast below shows the extent of the revisions to the outlook. The graphs demonstrate that both directions contained mistakes in projecting. That suggested that the current outlook could just as easily prove too downbeat as upbeat. At the same time, given the time it has taken for U.K. productivity to start rebounding, the available slack is likely to be lower than the earliest estimates suggested.