0

110

The

Currency Score analysis is one of the parameters used for the

Ranking and Rating list which was published earlier this weekend.

Besides this analysis and the corresponding chart I also provide the

Forex ranking and rating list.

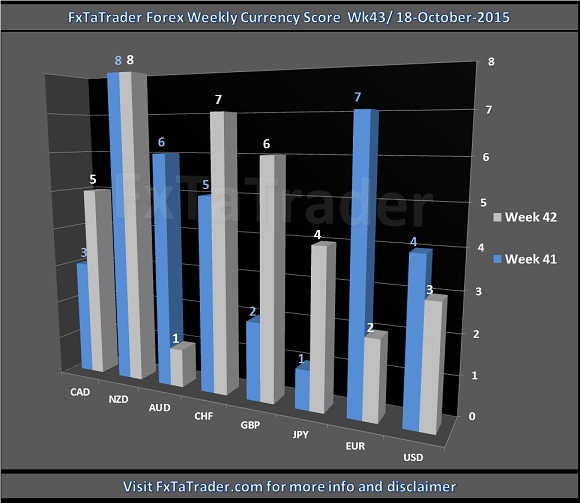

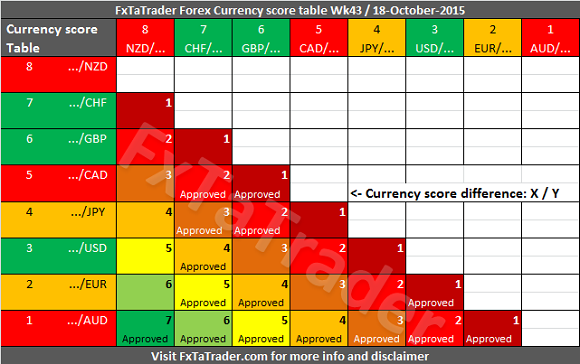

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. This article will provide my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 time frames, the monthly, weekly, daily and 4 hours. The result of the technical analysis is the 2 screenshots in this article showing the Currency Score and the Currency Score Difference.

According to the Ranking and Rating list already published this weekend

the following pair combinations look interesting:

The technical analysis is the most important issue to consider

before taking positions. The Weekly Chart is analyzed. I prefer

the Bollinger Band for defining where a pair is in the chart. Once a

pair is outside a Bollinger Band it is in a strong trend which can

cause a strong pullback. Although this may be a good opportunity for

other analysts I avoid taking positions because of the possible

unexpected strong pullback. Positions are only opened inside the

Bollinger Band and this may be at the start of a possible trend or on a

good pullback in an existing trend.

When trading according to the FxTaTrader Strategy some rules are in place. For more information see the page on my blog FxTaTrader Strategy. Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

It is recommended to read the page Currency score explained and Models in practice for a better understanding of the article. This article will provide my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 time frames, the monthly, weekly, daily and 4 hours. The result of the technical analysis is the 2 screenshots in this article showing the Currency Score and the Currency Score Difference.

______________________________________

Last 3 months currency classification

The last 3 months currency classifications from a longer term perspective are provided for reference purposes. The necessary charts can be found in the previous article Weekly Currency Score Wk34. The currencies are classified for the coming weeks as follows:- Strong: GBP / USD / CHF. The preferred range is from 6 to 8.

- Average: EUR / JPY. The preferred range is from 4 to 5.

- Weak: NZD / AUD / CAD. The preferred range is from 1 to 3.

______________________________________

Currency Score

For analyzing the best pairs to trade this classification is the first issue. When looking at the most recent score that is used for the coming period we can see in the screenshot below the following deviations:- The USD has a score of 3. This is a strong currency and it should have by preference a score from 6 or 8. It has a score at the moment of an average currency.

- The EUR has a score of 2. This is an average currency and it should have by preference a score from 4 to 5. It has a score at the moment of a weak currency.

- The NZD has a score of 8. This is a weak currency and it should have by preference a score from 1 to 3. It has a score at the moment of a strong currency.

- The CAD has a score of 5. This is a weak currency and it should have by preference a score from 1 to 3. It has a score at the moment of an average currency.

- Half of the currencies are at the right level when looking at the last 3 months currency classification. This is better than the previous week when only the CAD was at the right level.

- There is most probably a pullback for the USD when looking at the market as a whole. The uptrend has lost momentum.

- There is a decrease of momentum for the EUR which is getting weaker.

- There is most probably a pullback for the NZD and the CAD when looking at the market as a whole. The downtrend has lost momentum.

- The pairs that we may look at are all most probably trending except for the pairs with the JPY which are most probably ranging. Some JPY pairs may be in a trend and having momentum. These can be interesting, check the Ranking and Rating list published this weekend for more information.

- The USD, CAD and NZD may offer a good opportunity to step in. However, it is important to determine if the specific pair is indeed having a pullback. For that reason it is good to see the momentum returning in that pair.

______________________________________

Currency

Score difference

- AUD/JPY

- AUD/USD

______________________________________

- The AUD/USD is in a downtrend and within the Bollinger Band.

- The AUD/JPY is in a downtrend and within the Bollinger Band.

When trading according to the FxTaTrader Strategy some rules are in place. For more information see the page on my blog FxTaTrader Strategy. Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week.

______________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.