Do not go for emerging markets defensive stocks - Analyst

Joe Gubler from Causeway Capital Management has a piece of advice to those seeking a shelter as China's economy weakens and U.S. rates are edging up.

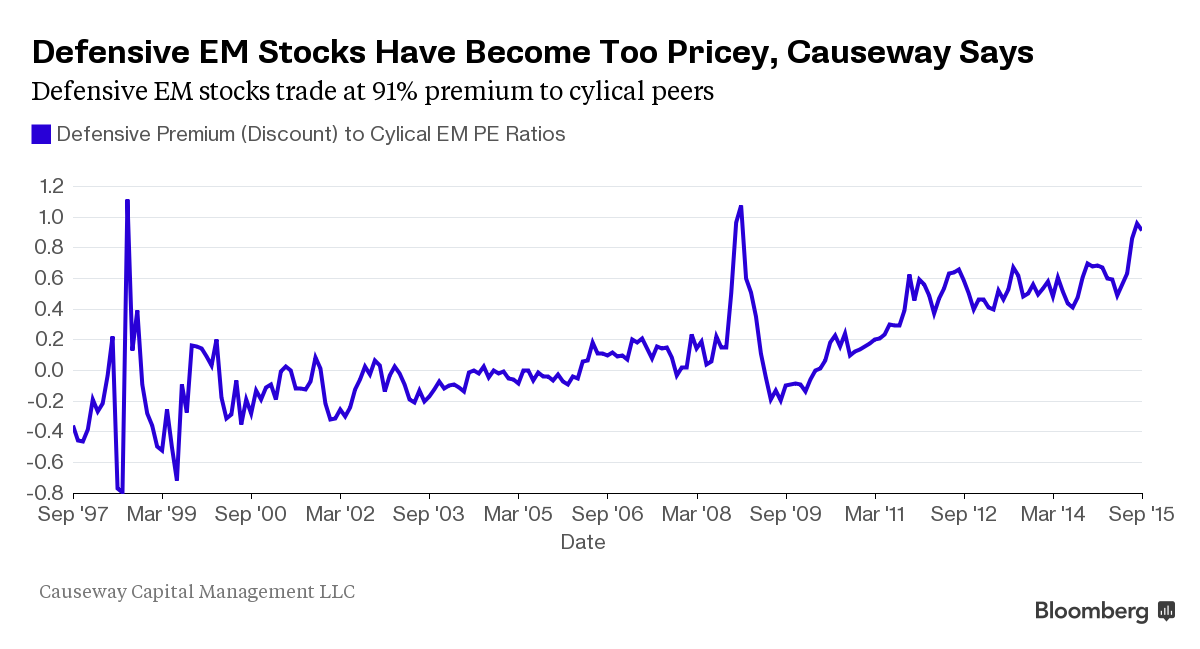

Don't look for defensive stocks, he says. Why so? The price-to-earnings ratio of stocks that tend to survive in an economic downturn - such as food and beverage businesses as well as health-care providers - traded at a 91% premium to their cyclical peers on the MSCI Emerging Markets gauge in September, the largest gap since 2008.

Historically, as Gubler says, the premium investors desire to pay for these types of securities is about 7 percent whose Causeway Emerging Markets Fund has beaten 86 percent of peers in the last five years.

People suppose this trade is safe, however, "if you get the prices wrong, it’s not nearly as safe as what people were hoping for," said Gubler.

If you’re planning to go for cyclical stocks, pick them in developing

markets where the economy is not disastrous. Gubler thinks oil refiners in

Turkey and Poland are attractive, because they’re benefiting from strong demand for gas

even as oil prices have slumped.

Gubler owns Kia Motors Corp., the South Korean carmaker, while he’s underweight companies in Brazil, Malaysia, and Indonesia.

He hasn’t totally given up on defensive stocks, he’s just captious. One of his picks is Dr. Reddy’s Laboratories Ltd., the Indian maker of generic drugs.

Cyclicality should not become a make-or-break bet, he says.