Quick Technical Overview - GOLD: ranging bearish condition by direction

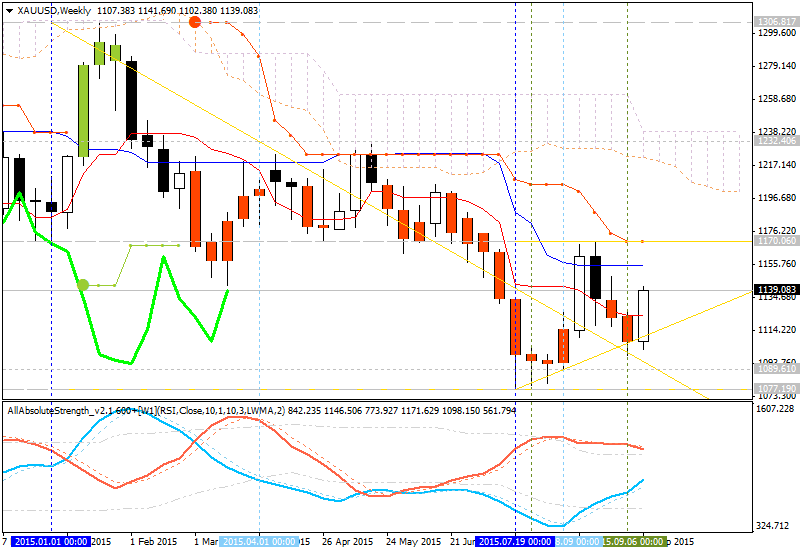

Ichimoku analysis.

Weekly price is on bearish ranging market

condition within 1077.19 key support level and 1170.06 key resistance level. Both levels are located to be below Ichimoku cloud in the bearish area of the chart. The symmetric triangle pattern was broken by price from below to above for 1170.06 as a next target. Chinkou Span line is located below the price indicating the ranging bearish condition by direction.

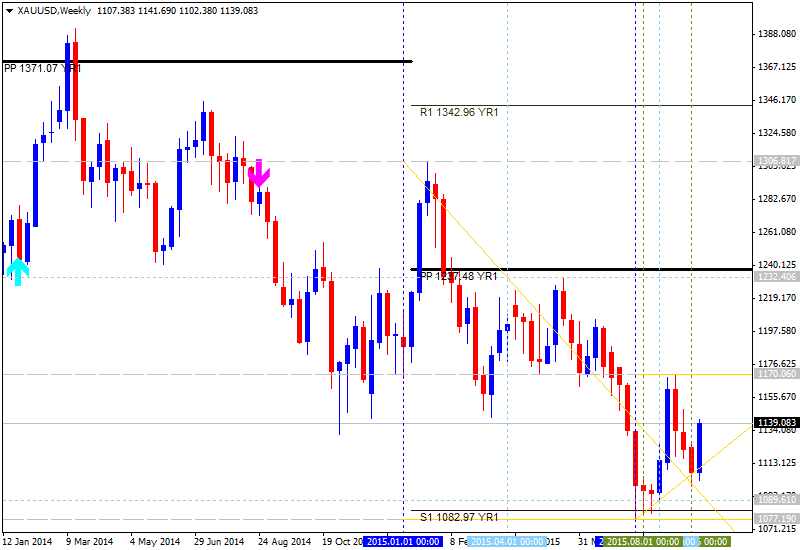

Pivot

Points.

The price is below

Central YR1 Pivot at 1237.48 with S1 YR1 Pivot at 1082.97 as the next bearish target. If the price breaks this S1 YR1 Pivot at 1082.97 so the bearish trend will be continuing; if the price breaks Central YR1 Pivot at 1237.48 from below to above - we may see the reversal of the price movement to the primary bullish condition with the secondary ranging.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| XAU/USD |

1082.97 |

1237.48 |

1342.96 |