Fed on tap: Analysts share their gold, dollar forecasts, trading strategies and defensive measures

By Thursday, market players will have the answer to the most burning question of the recent times: Will the Federal Reserve pull the trigger on the first interest-rate hike since 2006?

Currently the Fed Funds futures contract, a proxy for market

expectations of the Fed Fund rate, is pricing less than a 30% chance

that the central bank increases interest rates on Thursday.

However, analysts and commodity strategists say the chances are closer to 50/50. Gold will suffer, according to some analysts, who forecast the metal to end its third consecutive week in negative territory, but traders refuse to price out the possibility of a rate hike.

Kitco gold survey

The most certain near-term outlook for gold can be described as mixed, given so much indecision in the air ahead of the Fed's monetary policy decision next week.

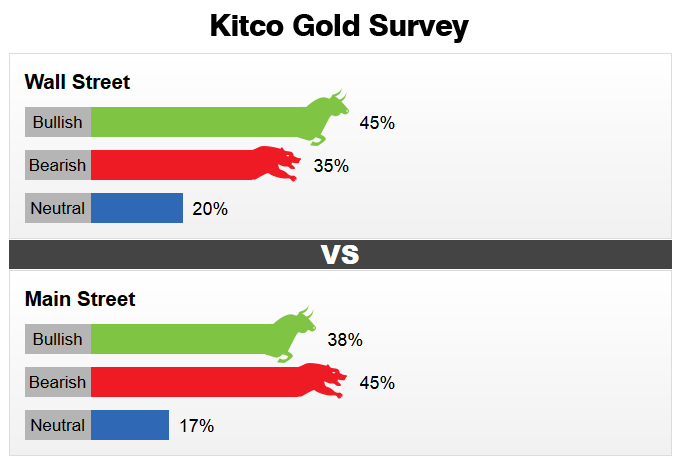

Last week, 195 people voted in the online Kitco news

survey. Among the participants, 74 people, or 38%, were bullish on gold

next week; 81 voters, or 45%, were bearish on the yellow metal; and 34

people, or 17%, neutral.

A week before, 44% of respondents were bullish on gold prices.

Market professionals are slightly at odds with the retail side, with

more strategists expecting to see higher prices this week.

As Kitco reported, out of 35 market experts contacted, 20 responded, of which nine or 45%, said they expect to see higher prices next week. At the same time, seven professionals, or 35%, said they see lower prices, and four people, or 20%, were neutral on gold. Market participants include bullion dealers, investment banks, futures traders and technical-chart analysts.

Most analysts seem to be optimistic

on gold prices and think that the yellow metal could bounce higher if

the Fed delays its rate hike. However gains could be capped as

expectations will only move toward December.

Analysts' views

Ronald-Peter Stoeferle, fund manager at Incrementum AG and author of the In Gold We Trust report, considers that, in the short-term, gold will suffer as it lacks a catalyst to drive prices higher.

He doesn’t think there will be a rate hike in

September, nor for the rest of 2015; but that factor won’t be enough to

turn around the current down trend.

“There are too many deflationary pressures in the global economy and the market has lost confidence in gold,” he said.

In his opinion, gold will retest support at $1,080 an ounce in the near-term.

Sean Lusk, director of commercial hedging at Walsh Trading, recommends traders to look beyond gold’s initial reaction and

volatility after the rate hike. He is expecting to

see some counter-intuitive moves in the gold as a result of the rate increase.

He distinguished two scenarios:

1) If the Fed raises rates, at first it will be U.S. dollar positive and gold negative, but the tightening could create a selloff in the stock markets and capital could start moving into gold.

2) If the central bank postpones, it will be U.S. dollar negative and gold positive in the initial reaction.But the loose monetary policy will back equity markets and capital will flow out of gold and back into stocks.

“If the Fed does hike rates gold could selloff but I think it would be the buy of a lifetime,” he said.

Phil Streible, senior market strategist at RJO Futures, thinks that by using a defensive options straddle strategy, market players can not only avoid losses, but also take advantage of the volatility. One basic strategy would be to buy a 60-day or 90-day 1,080 put gold option and a $1,120 call option, he says.

If the Fed raises rates on September 17, then he would expect gold to fall below support at $1,080, and traders can then lock in profits. After the drop, he would expect to see some strong buying momentum and that could push the metal up to $1,150 or even the last high at $1,170, possibly making the call options profitable.

In case the reverse scenario takes place, if the Fed doesn’t hike, then gold

could climb to $1,150 initially, which put the call option

“in the money”. Meanwhile, after the initial reaction selling pressure

should drive gold prices lower keeping the put option in play.

Traders should now look at taking defensive measures, as currently there are a lot of uncertainties, Streible says.