Bloomberg billionaire gauge: Queen Elizabeth II is a relative pauper

On Wednesday, Queen Elizabeth II became the longest-reigning monarch in British history overtaking Queen Victoria. While her country might have lost global influence, she has ruled over an unprecedented period of wealth creation.

Besides economic ups and downs, her time of reigning has been marked by the rise of the super-rich.The

emergence of billionaire businessmen and financiers has left the woman who inherited one of the richest thrones in the world

in 1952 a relative pauper a little over six decades later, albeit one

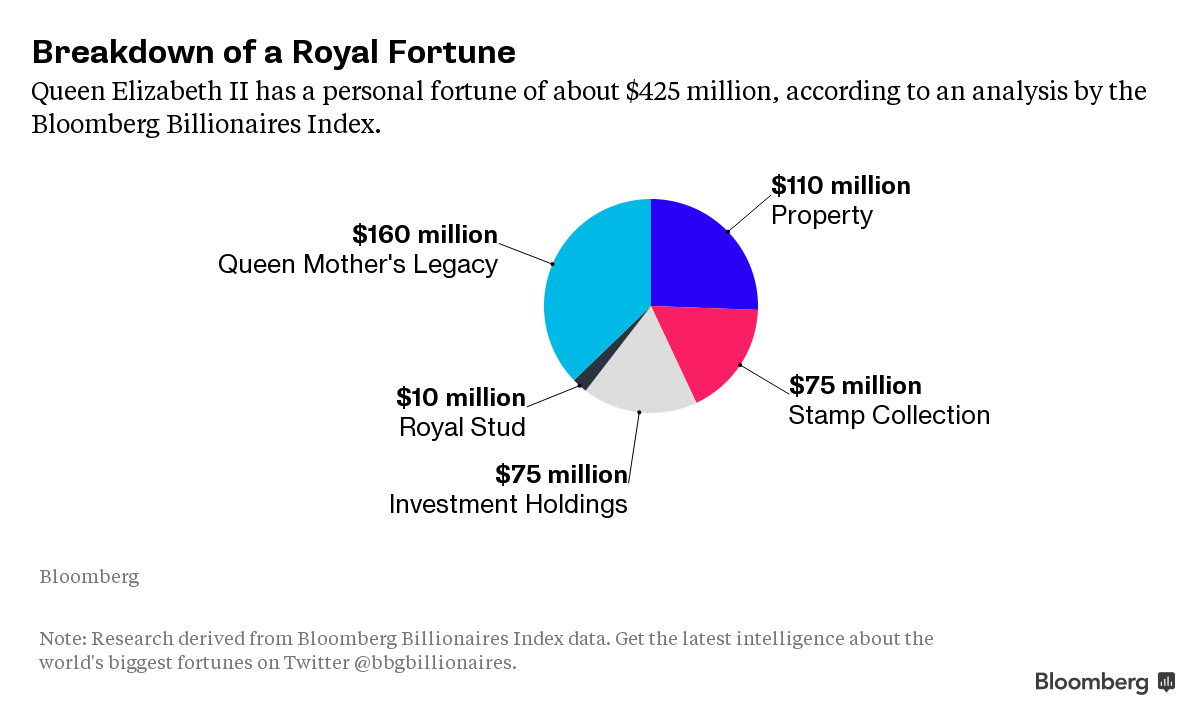

with palaces, stables and an expensive stamp collection, says Bloomberg.

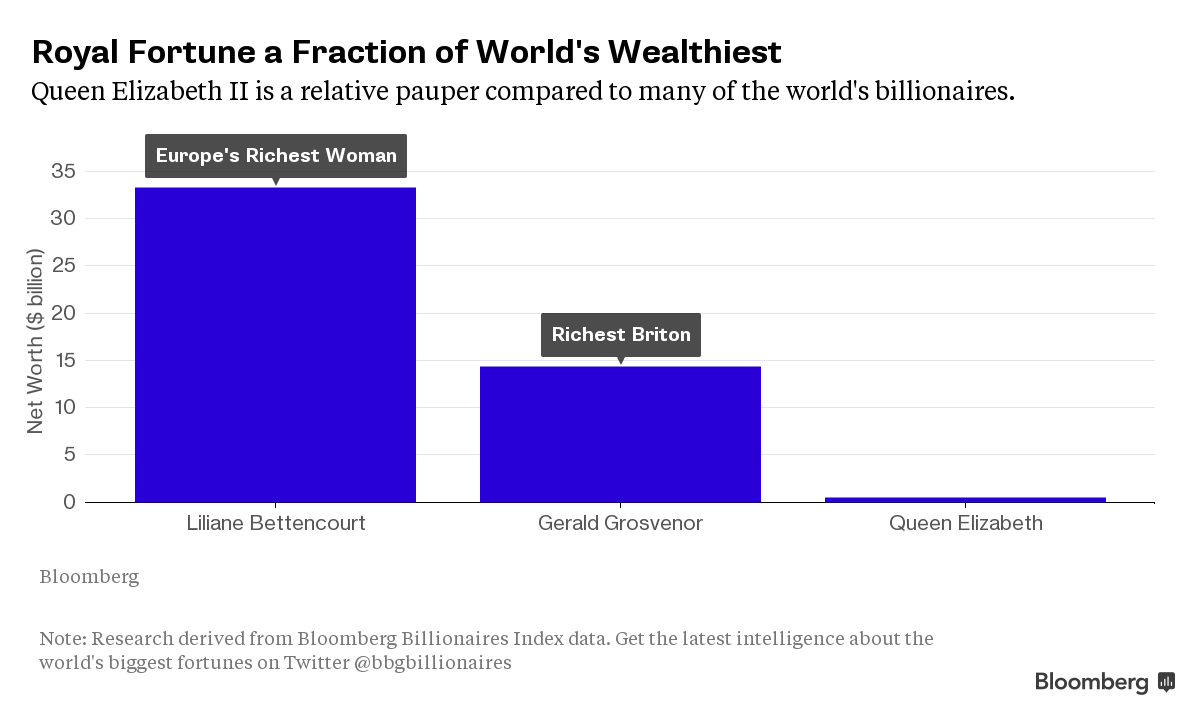

According to the Bloomberg Billionaire Index, the 89-year-old's personal fortune is about $425 million. That’s a mere 3 percent of the wealth of the richest Briton, Gerald Grosvenor, the Duke of Westminster. In comparison, Europe’s richest woman, Liliane Bettencourt, has a $32 billion fortune:

According to a report by brand valuation and strategy consultancy Brand Finance, the monarchy has a value of 57 billion pounds to the U.K., which makes it one of Britain's most valuable institutions. The figure includes tourism and such things as the effect of royal babies on fashion brands.

Meanwhile,

its 20 billion pounds of tangible assets, including Buckingham Palace,

the Crown Jewels and the Royal Art Collection, aren’t the Queen’s private property, as they are held in trust for future generations.

The Bloomberg Billionaires Index estimates that the Queen holds $75 million of investments, $160 million of assets inherited from her mother, personal property of $110 million, a $75 million stamp collection and the $10 million rated Royal Stud.

The value of her investment holdings is derived from a statement by John Colville in the Times of London in 1971, a director at Coutts & Co, the Queen’s bank, which estimated her fortune at 2 million pounds. Bloomberg calculated its appreciated value from an investment allocation of stocks, bonds, commodities and cash that’s averaged about 5 percent a year over the last 25 years. That’s in line with returns typically targeted by similarly wealthy investors.

Elizabeth vs Victoria. Era of millionaires vs Empire

September 9, 2015 marked the day of Elizabeth Alexandra Mary reigning for 63 years and 216 days, thus overtaking her great-great-grandmother Victoria, who cemented Britain’s position as a superpower with an empire occupying almost a quarter of the world’s land area.

That status diminished after the two world wars before Britain’s economy went through a transformation from state-owned industry to the free-market capitalism of the 1980s and 1990s.

A historic era for wealth generation followed after. Self-made billionaires built fortunes of more than $3 trillion since 1995, according to a report by UBS Group AG and PwC.

Property

prices also surged, especially in London and the southeast of

England as salaries and bonuses in the City financial district jumped.

The number of millionaires in the U.K., at least officially, has jumped 41 percent to 715,000 in the past five years alone, according to a report by Barclays Plc.