NZD/USD: fall in business confidence and commodities prices

Current trend

The ANZ Business Confidence in New Zealand for August fell to -29.1 points and reached its lowest level for 6 years.

The pair remains under pressure amid a slowdown of the Chinese economy, fall in commodities prices, growing trade deficit in New Zealand (which grew in August to 649 million NZD, 49 million worse than forecasted), the RBNZ tendency to soften its monetary policy, unemployment growth and reduction in participation rates in the country. Furthermore, the Fed is likely to proceed with the interest rates hike in the US later in the year.

This week, markets are waiting for the Non-Farm Payrolls from the US that are due on Friday. Should the forecasted 220 thousand new places be confirmed, the pressure on the pair would increase.

Support and resistance

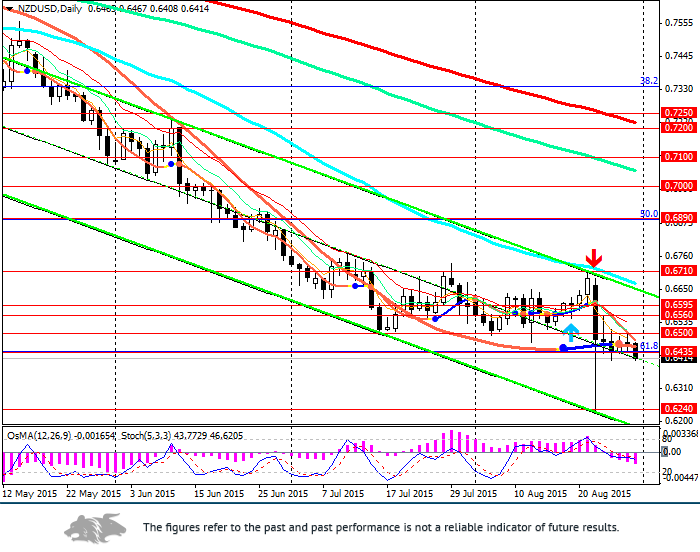

The pair broke down the support level at 0.6435 (61.8% Fibonacci). Today’s close below this level would open the way to the levels of 0.6200, 0.6000 (2006 lows), 0.5000 (2009 lows).

OsMA and Stochastic on the 4-hour and daily charts give sell signals.

Support levels: 0.6400, 0.6240.

Resistance levels: 0.6435, 0.6500, 0.6560, 0.6595, 0.6710.

Trading tips

Open short positions from the current levels and from 0.6440, 0.6500, 0.6560, 0.6595 with targets at 0.6400, 0.6350, 0.6300, 0.6250 and stop-loss at 0.6620.

Long positions are not considered.