FX Review FxTaTrader Weekly Strategy Week 34 / Sunday 16-August-2015

______________________________________

Open/pending positions of last weeks

AUD/USDThis pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk31 where the pair was tipped for going short.

Positions were opened for this pair and one was closed with profit. Unfortunately the second positions was closed on August 10 because of the strong pullback.

The trend is still down, however the momentum has to come back for taking short positions again.

From a longer term perspective the pair succeeded on July 3 to close and break through the lows of March and April at 0,7535. Since then it remains an interesting pair for taking short positions.

The AUD is one of the weakest currencies with a currency score of 3 being above the CAD(2) and the NZD(1). The USD is at the moment one of strongest currency with a score of 6 being below the EUR(7) and the GBP(8).

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area but the histogram is rising and the MACD is consolidating.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 34

Rank: 12

Rating: -

Total outlook: Down

______________________________________

Possible positions for coming week

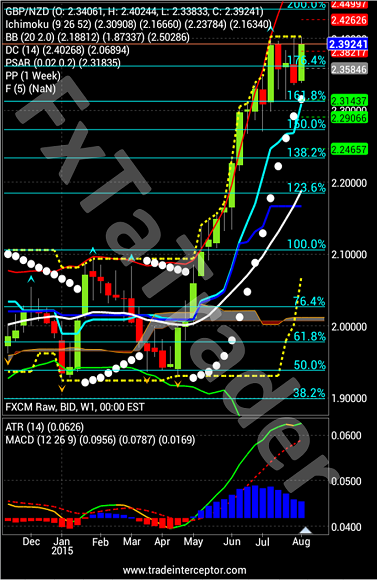

GBP/NZDThis pair will be analyzed in detail. The pair is clearly in an uptrend and it is gaining momentum. From a longer term perspective it broke through a previous significant resistance around 2,1030 on May 11. It is a pair to monitor in the coming week and it is again around a resistance level at 2,400. Once this level gets broken with an increase of momentum it becomes interesting.

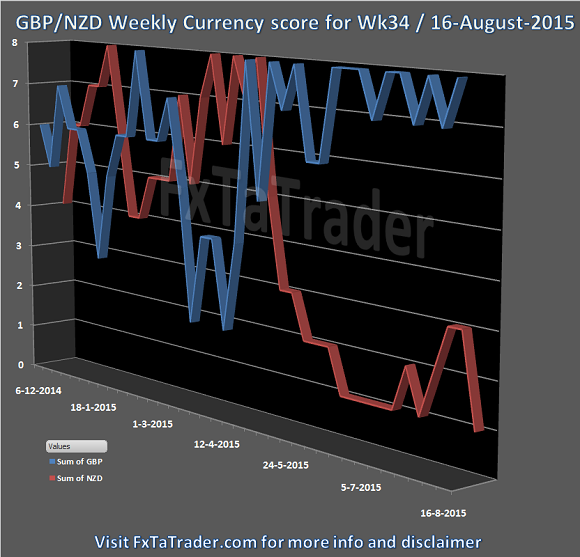

- As can be seen in the Currency Score chart in my previous article of this weekend the GBP has a score of 8 and the NZD a score of 1.

- In the current Ranking and Rating list of this weekend the pair has a rank of 1. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes this an attractive opportunity.

Ranking and rating list

Week 34

Rank: 1

Rating: + + +

Weekly Currency score: Up

Based

on the currency score the pair looked interesting since the end

of May. The USD is a strong currency from a longer term perspective and

after the pullback in May it found the uptrend again. The AUD is a weak

currency from a longer term perspective and it remains weak. This offers an opportunity. With currently a Score

difference of 7 and the USD being better classified it is an

interesting pair for taking positions in the coming week.

______________________________________

- On the monthly(context) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current uptrend.

Weekly chart: Up

- On the weekly(decision) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area and gaining momentum.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Daily chart: Up

- On the daily(timing) chart the indicators are looking strong for going long.

- The Ichimoku is meeting all the conditions.

- The MACD is in positive area but the histogram is consolidating.

- The Parabolic SAR is long and showing the preferred pattern of higher stop loss on opening of new long and short positions.

Total outlook: Up

GBP/NZD Weekly chart

______________________________________

______________________________________