The Simple Math Behind Greece's Complicated Situation.

"Life is truly straightforward, yet we demand making it entangled." - Confucius

Occam's Razor is a much of the time cited guideline which expresses that when one is confronted with a huge number of apparently complex potential outcomes, the most straightforward methodology or clarification is best. As the ECB and Greece battle about terms of yet another bailout we utilize this guideline to help better handle Greece's critical circumstance.

The proportion of obligation to GDP is a standout amongst the most fundamental and famous measures used to focus a definitive capacity of a sovereign country to benefit its obligation. Consider a nation which has an obligation to GDP proportion of 100%, and an adjusted spending plan (barring interest installments). In this nation, it can be said that the interest rate on its obligation and the development rate of its GDP must be equivalent for the proportion to stay unaltered. In this case a 2% interest rate with a 1% GDP development rate would bring about an increment from 100% to 101% in the obligation to GDP proportion. As the proportion ascends over 100%, the interest rate must be lower than the GDP development rate or the proportion will keep on rising. At an obligation to GDP proportion of 150%, a 2% interest rate would oblige a 3% development rate to stay stable at 150%.

Greece has a present obligation to GDP proportion of 170%, and taking into account current bailout terms, it will probably develop to well more than 200%. So applying the rationale from over, Greece's GDP development rate before the current bailout should have been be 1.70 times more noteworthy than the rate of interest Greece pays on its obligation just to keep its proportion steady. Taking after are a few actualities which will permit us make judgments on Greece's capacity to enhance or if nothing else maintain its obligation to GDP proportion:

Since 1970 Greece's best 5-year annualized GDP development rate was +1.50% with a normal of +.46%. In the course of recent years development has arrived at the midpoint of - 0.50%.

Since 1997 Greece's most reduced 5-year normal interest rate on 10 year securities was 3.41% with a normal of 7.50%. In the course of recent years the normal yearly 10 year interest rate was 8.16%

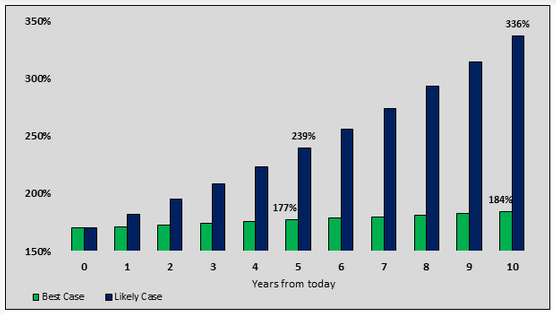

Utilizing Greece's present obligation to GDP proportion as compressed above, we display a best case gauge and a presumable estimate for obligation to GDP over the resulting 10 years. For the best case we accepted Greece's most elevated 1 year GDP development rate (+2.74%) and least intrigue rate (3.58%). The probable case uses Greece's normal 1 year GDP development rate (+0.45%) and normal interest rate (7.55%). In both illustrations we make the exceptionally striking supposition that Greece will run an adjusted spending plan barring interest cost. The outcomes, as plotted underneath, are not reassuring.

Greek credit default swaps (CDS) and bonds have mobilized strongly on trusts that a bailout will help Greece dodge default. We trust the present terms essentially defer the inescapable. In the situations above we were extremely liberal with the suspicion that Greece will run an adjusted spending plan. Consider that since 1990, Greece has found the middle value of an aggregate spending plan shortfall equivalent to 8.17% of GDP and has never run a surplus about-facing to no less than 1990.

One of the objectives of the present round of transactions are basic changes intended to help Greece reverse its upsetting obligation to GDP proportion. Changes are basic if Greece is to ever turn out to be monetarily feasible. That said, changes are generally disagreeable, require significant investment to institute and take much more to show results. We trust default, or the politically right term "obligation pardoning", is the probably result. At the point when joined with changes, Default is the main alternative which leaves Greece with a battling opportunity to abstain from being in the same circumstance a couple of years from now. The CDS and security markets are likely over-responding today as they did with the former bailouts of 2011 and 2012. https://www.mql5.com/en/signals/120434#!tab=history

"Life is truly straightforward, yet we demand making it entangled." - Confucius

Occam's Razor is a much of the time cited guideline which expresses that when one is confronted with a huge number of apparently complex potential outcomes, the most straightforward methodology or clarification is best. As the ECB and Greece battle about terms of yet another bailout we utilize this guideline to help better handle Greece's critical circumstance.

The proportion of obligation to GDP is a standout amongst the most fundamental and famous measures used to focus a definitive capacity of a sovereign country to benefit its obligation. Consider a nation which has an obligation to GDP proportion of 100%, and an adjusted spending plan (barring interest installments). In this nation, it can be said that the interest rate on its obligation and the development rate of its GDP must be equivalent for the proportion to stay unaltered. In this case a 2% interest rate with a 1% GDP development rate would bring about an increment from 100% to 101% in the obligation to GDP proportion. As the proportion ascends over 100%, the interest rate must be lower than the GDP development rate or the proportion will keep on rising. At an obligation to GDP proportion of 150%, a 2% interest rate would oblige a 3% development rate to stay stable at 150%.

Greece has a present obligation to GDP proportion of 170%, and taking into account current bailout terms, it will probably develop to well more than 200%. So applying the rationale from over, Greece's GDP development rate before the current bailout should have been be 1.70 times more noteworthy than the rate of interest Greece pays on its obligation just to keep its proportion steady. Taking after are a few actualities which will permit us make judgments on Greece's capacity to enhance or if nothing else maintain its obligation to GDP proportion:

Since 1970 Greece's best 5-year annualized GDP development rate was +1.50% with a normal of +.46%. In the course of recent years development has arrived at the midpoint of - 0.50%.

Since 1997 Greece's most reduced 5-year normal interest rate on 10 year securities was 3.41% with a normal of 7.50%. In the course of recent years the normal yearly 10 year interest rate was 8.16%

Utilizing Greece's present obligation to GDP proportion as compressed above, we display a best case gauge and a presumable estimate for obligation to GDP over the resulting 10 years. For the best case we accepted Greece's most elevated 1 year GDP development rate (+2.74%) and least intrigue rate (3.58%). The probable case uses Greece's normal 1 year GDP development rate (+0.45%) and normal interest rate (7.55%). In both illustrations we make the exceptionally striking supposition that Greece will run an adjusted spending plan barring interest cost. The outcomes, as plotted underneath, are not reassuring.

Obligation to GDP Scenarios :

Greek credit default swaps (CDS) and bonds have mobilized strongly on trusts that a bailout will help Greece dodge default. We trust the present terms essentially defer the inescapable. In the situations above we were extremely liberal with the suspicion that Greece will run an adjusted spending plan. Consider that since 1990, Greece has found the middle value of an aggregate spending plan shortfall equivalent to 8.17% of GDP and has never run a surplus about-facing to no less than 1990.

One of the objectives of the present round of transactions are basic changes intended to help Greece reverse its upsetting obligation to GDP proportion. Changes are basic if Greece is to ever turn out to be monetarily feasible. That said, changes are generally disagreeable, require significant investment to institute and take much more to show results. We trust default, or the politically right term "obligation pardoning", is the probably result. At the point when joined with changes, Default is the main alternative which leaves Greece with a battling opportunity to abstain from being in the same circumstance a couple of years from now. The CDS and security markets are likely over-responding today as they did with the former bailouts of 2011 and 2012. https://www.mql5.com/en/signals/120434#!tab=history