A bunch of financial information in the impending week will reveal insight into the economy's quality as it entered the second from last quarter. The enormous report will be retail deals, offering a checkup of customers, who have been restless generally. Measures of work business slack and swelling, alongside talks by Federal Reserve approach creators, will give intimations on how shut the national bank is to raising fleeting premium rates.

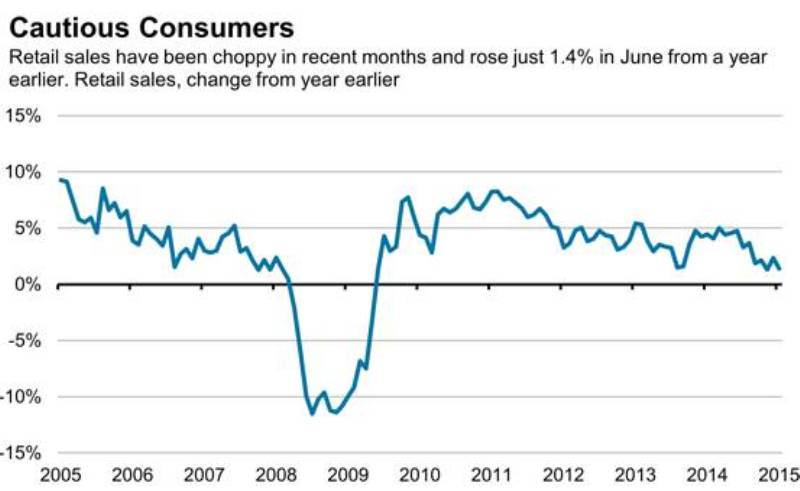

1 Are Americans Boosting Spending?

Thursday, the Commerce Department gauges the amount Americans spent at retailers in July. Retail deals have been uneven, with a decrease in June taking after a major pickup in May. Considering that customer spending reflects more than 66% of monetary yield, the July figure will mirror the economy's life as it started the second from last quarter.

2 What Say You, Fed Policy Makers?

The Fed recommended after its most recent strategy meeting that a September liftoff for interest rates is still likely to work out. Addresses by two individuals from the Federal Open Market Committee could offer pieces of information about the national bank's most recent considering. Atlanta Fed President Dennis Lockhart—who told The Wall Street Journal the Fed is near being prepared to lift rates–speaks Monday in Atlanta. New York Fed President William Dudley speaks Wednesday in Rochester, N.Y.

3 A Checkup on Factories

Friday, the Fed gives a preview of the amount of processing plants, utilities and the mining part created in July with the arrival of the mechanical generation report. Makers have attempted to pick up energy this year in the midst of worldwide monetary burdens that have hit trades. The processing plant measure of the mechanical generation report will demonstrate whether hidden interest is grabbing or keeps on drooping.

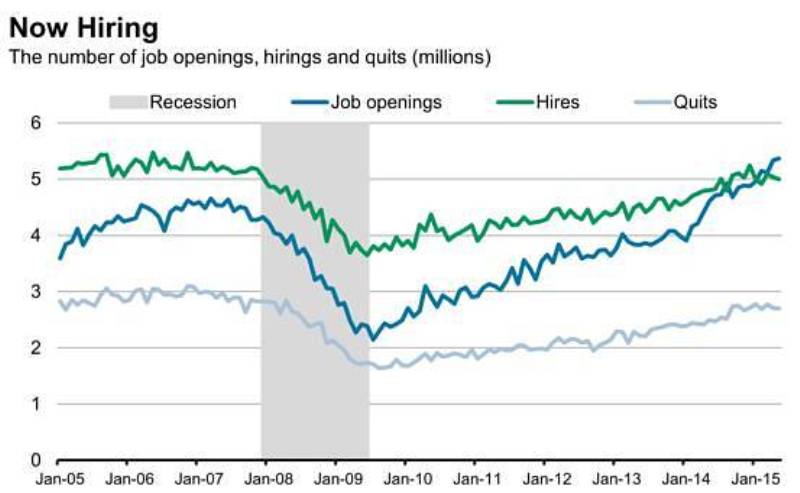

4 Another Measure of Job-Market Slack

The huge month to month work report turned out Friday, yet the administration discharges another key measure of work business sector slack Wednesday. The month to month Job Openings and Labor Turnover Survey, known as Jolts, will uncover whether businesses are attempting to fill more openings, and whether specialists are sufficiently sure to deliberately leave current employments for better ones. Both measures could indicate whether the work business keeps on tightenning, which would put upward weight on wages.

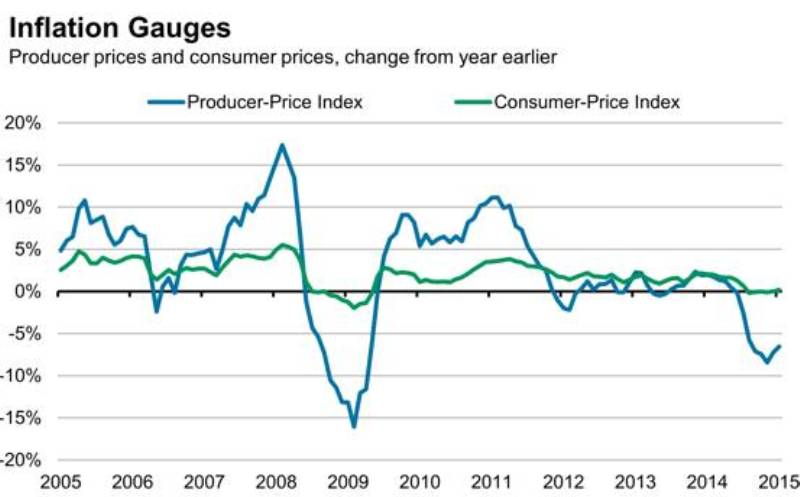

5 Price Measures Could Shine Light on Inflation

Swelling weights have been practically nil over the previous year, however there are signs costs are firming and gradually heading upward. Two measures—Thursday's report on import costs and Friday's arrival of the maker value list—will offer pieces of information on where buyer costs may be going. The Fed needs certainty that swelling is gradually making a beeline for the national bank's 2% yearly focus before it begins to raise premium.