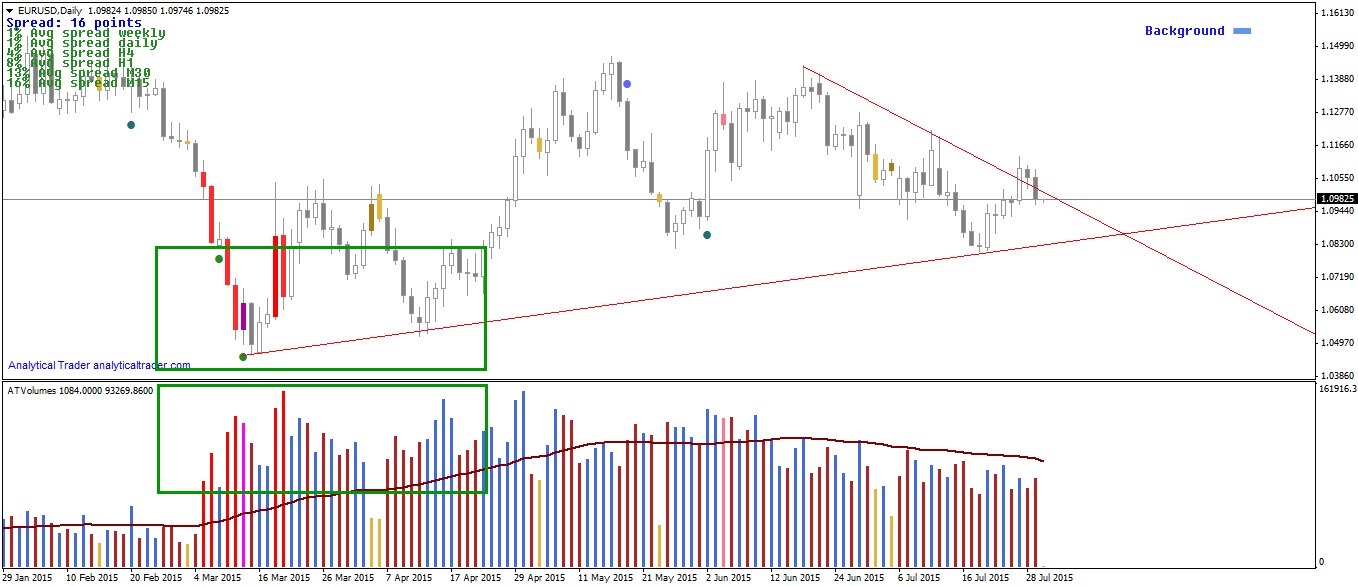

In March and beginning of April, while there were plenty of bad news for the Euro, with some commentators even speculating the Euro-zone would break, the professional money was actually accumulating. They do this using the added liquidity of people selling in panic, which allowed them to buy Euro’s without making the prices go against them. This can be seen by the green dots (Major Demand) of AT – VSA, and the very high volumes in that area.

Since then, prices have rallied and are now near the up trendline. It could see higher prices if the current downtrend in the lower timeframe’s is broken, and so it might be useful to check how’s H4 doing.

The down trendline was recently broken, but as the prices rose above it, the volumes dried out, in a clear demonstration of no demand. The last bar finally rejected the down trendline, on very high volume (red bar). This is bearish for the moment being, and I’d like to see this trendline being broken to take a long position.