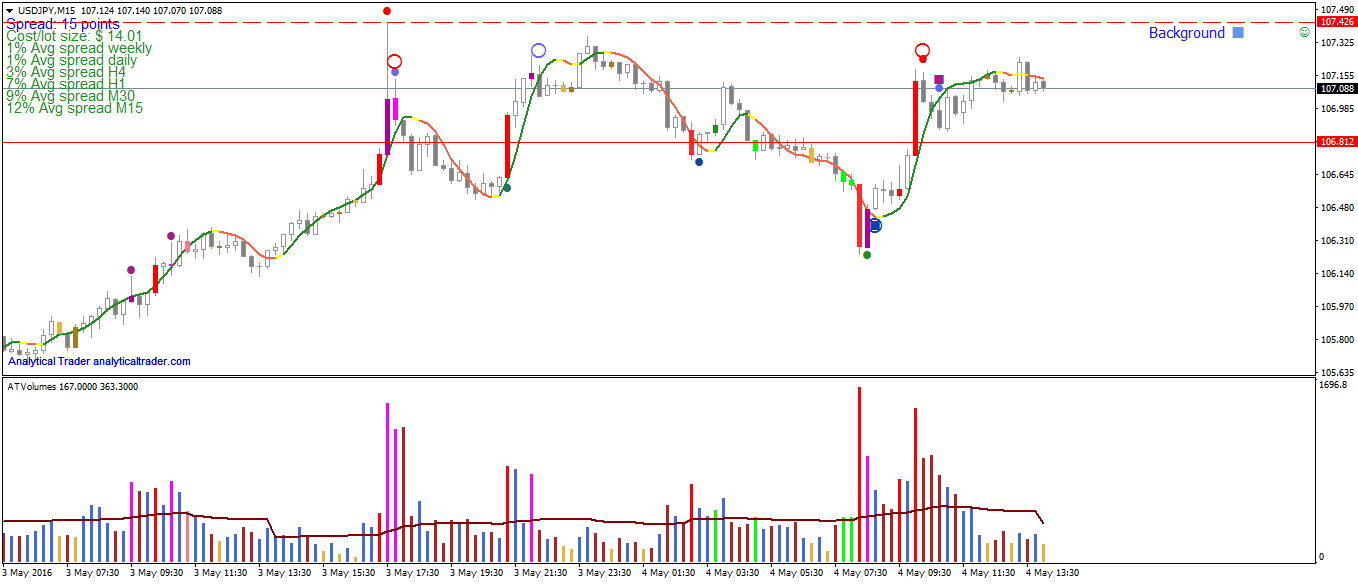

USDJPY

On the last post I noted that USDJPY was on a trading range, and the closest zone to watch was between 106.200 – 106.300. Prices reached that zone on the Asian session, and did so on wide high volume bars, breaking-out 106.200 to the downside, which also made the background turn to weak. The price was still sustained for a few hours after demand, but a few hours before London’s open, the activity spiked up again and more selling showed up again as a wide-range down bar, closing on its lows. These lower prices didn’t held up for long though, and after one more demand signal from VSA, the prices broke a down trendline and kept the uptrend until heavy supply hit the market and turned it sideways, onto the trading range we are seeing at the present. USDJPY is also getting to the break-out point of 107.600 support, which is important because that is the last point where many sellers got in. I would like to see a small rally after this downtrend, or the background turning weak, to consider taking short positions.

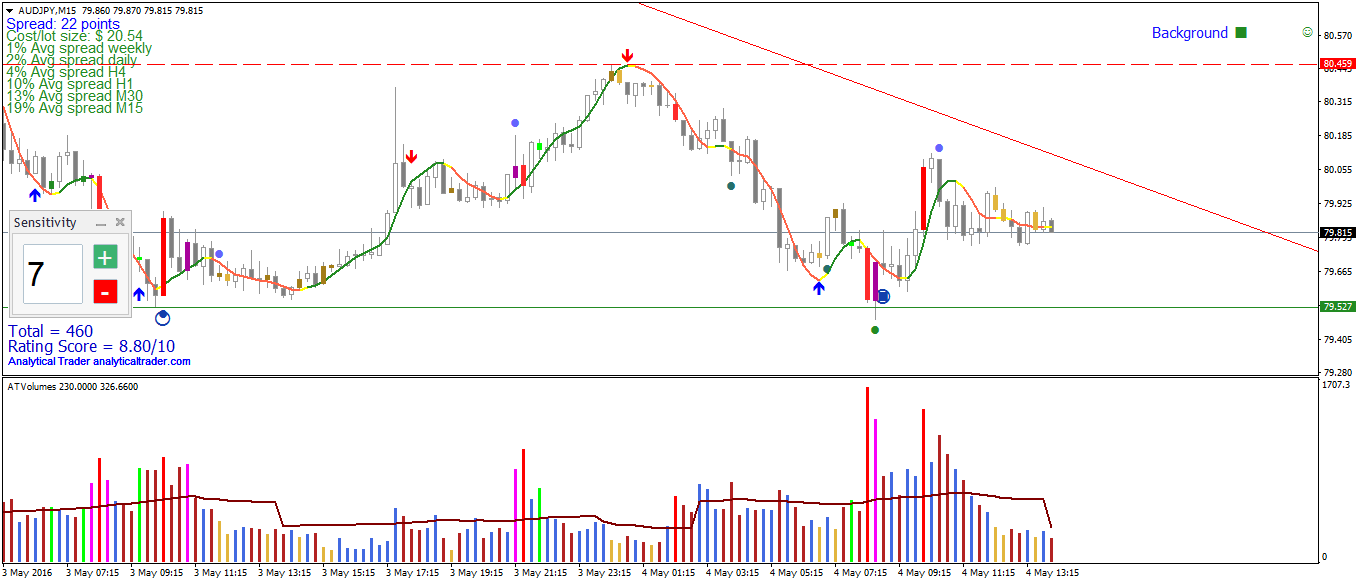

AUDJPY

This pair is near a support, at 79.527, and near a down trendline now at 80.100. Yesterday we have seen more demand above the formed support, though the rally after it failed spectacularly after there was no follow-up to the very high volume candle, with VSA showing a minor Supply signal 2 bars afterwards. The correction is showing low volumes, hinting at a temporary lack of supply, and the background is very strong. Reversals at sensitivity 7 have a good record on this pair and timeframe, even weeks back, and one near the support would be a possible long entry point. The safest would be to wait for the trendline break though, for confirmation. Meanwhile the prices are reaching the demand zone and it’s also important to be on the look-out for selling in the form of wide high volume down bars, like was seen on USDJPY yesterday on a similar occasion. Together with USDJPY, if the price/development confirms it, they could be two good pairs to trade against each other (one long and one short), since they are positively correlated by 50% due to the Yen.