If Greece defaults, who will be at a loss? (besides Greece herself)

Investors look way more optimistic as they notice creditors and Greece are slowly moving to the last-minute deal, though not everything is going smooth. Anyhow, questions arise on who will be left to hold the bag if Greece defaults.

Greece's Prime Minister Alexis Tsipras was grim when arriving to Brussels to continue negotiations with the country's creditors.

Earlier, he said the refusal of creditors to accept Athens’ latest proposals is not only unprecedented but has “never happened either in Italy, Portugal. Nowhere!”

“This strange stance may hide two possibilities. Either they don’t

want an agreement or they are serving specific interests in Greece,” he said.

“The insistence of certain institutions of not accepting parametric

measures has never happened before - not in Ireland, nor in Portugal,”

Tsipras wrote Wednesday on his Twitter account.

This stance suggests they either don’t want an agreement or serve specific interests in Greece, he said.

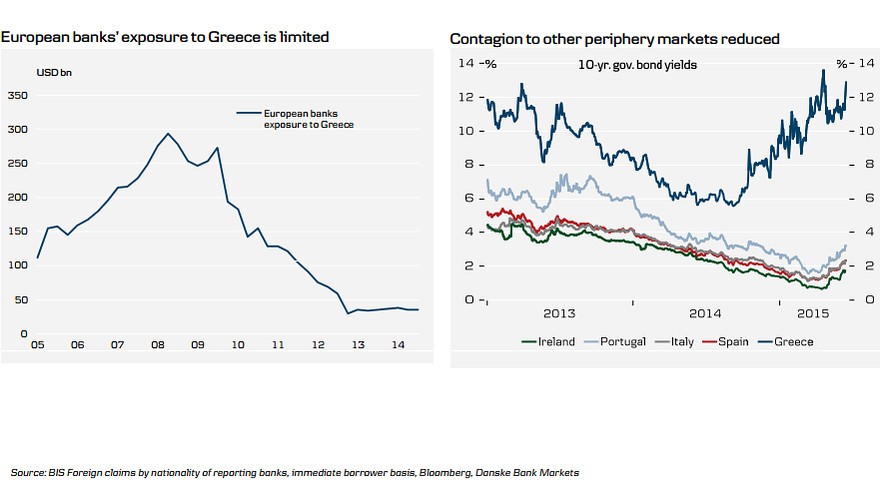

Although these frictions have been going on for several months, markets remained relatively

calm. A different reaction was only at the height of the eurozone debt crisis in 2011 and 2012.

Part of that might simply be down to Greek fatigue, but it also reflects

the fact that eurozone banks and other private-sector participants are

much less exposed to Greece than in the past, says MarketWatch.

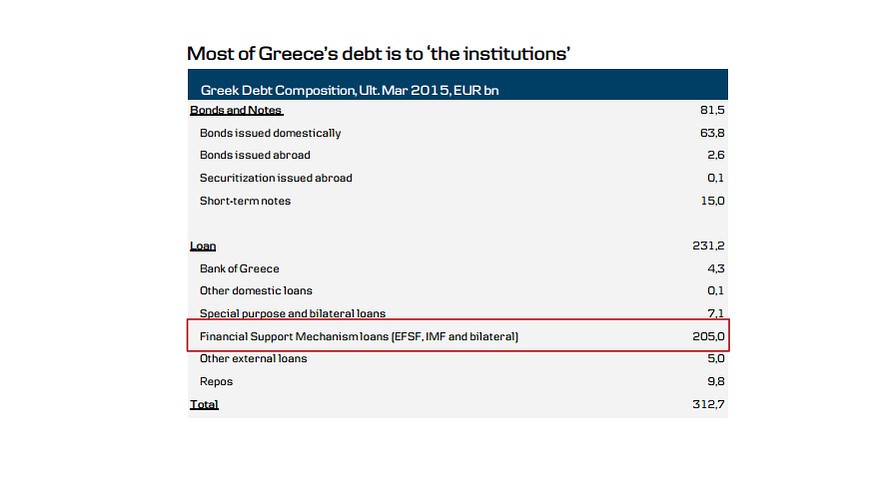

The chart below from Copenhagen-based Danske Bank shows that

Greece’s debt stood at 312.7 billion euros ($349.6 billion), as of March.

Of this 312.7 billion euros, €231.2 billion takes the form of loans, with €205 billion belonging to the institutions, or the “official” sector (vs the private sector) which includes the International Monetary Fund, the eurozone’s European Financial Stability Facility and bilateral loans from eurozone countries.

As so much of Greece's debt is concentrated in the hands of official creditors, this may be a reason for investors to remain positive throughout all the drama, according to analysts.

Analysts at J.P. Morgan Cazenove, in a Monday note urged clients to

get back into German stocks, adding that the private sector has almost no direct exposure to Greece anymore, while eurozone banks trimmed their exposure and leverage levels.

“Eurozone banks show total €5b billion leverage, which contrasts with the system’s €32 billion balance sheet. Regional activity momentum, credit backdrop and the level of the euro are significantly more constructive now versus the ’11 & ’12 episodes,” analysts wrote.

Danske Bank showed in their graphs how European banks have reduced their exposure to Greece (though it has edged higher since bottoming in 2012), with an accompanying chart showing how baneful influence from Greece to other peripheral bond markets has been much more limited this time around:

Indeed, there is a big difference from 2012 when jitters over relatively small Greece sparked epidemy across the Southern periphery of the eurozone. That boosted borrowing costs for Spain, the eurozone’s fourth -largest economy, and Italy, its third-largest, to dangerous levels. Bailout packages for one or both of those countries would likely have exhausted Europe’s resources so much, potentially bringing the entire euro project to a worthless finish.

This is why ECB President Mario Draghi in the summer of 2012 promised to do “whatever it takes” within the lender’s mandate to preserve the euro, eventually setting up the Outright Monetary Transaction, or OMT, program. Never-used option, its existence helped calm contagion fears.

Now, the ECB is carrying out its quantitative easing program in an attempt to wave deflation in the eurozone, with analysts saying that as long as QE is active, worries over debt sustainability for key euro countries will be limited.

Although, this may soothe investors' worries, they should always take into account unforeseen consequences in case Greece defaults or Greece exits the euro.