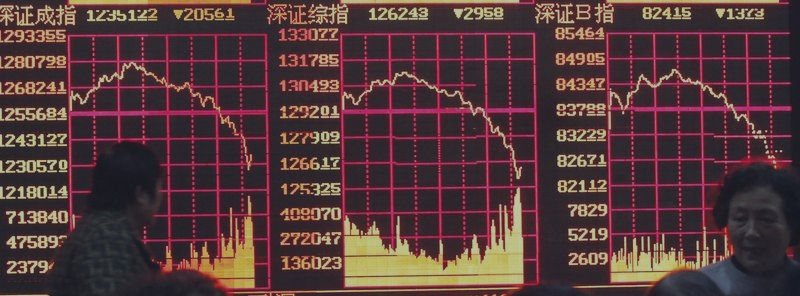

Chinese stocks fall to 4-month lows as stakes in banks are cut; Margin financing rules tightened

On Thursday China's mainland markets were the main losers in Asia, as worries over tighter requirements on margin financing spurred selloff.

Separately, filings signaled that China Central Huijin Investment Ltd., a unit of China's sovereign wealth fund China Investment Corp. (CIC), cut its stakes in the country's biggest state-owned banks for the first time.

On Thursday China's key Shanghai Composite declined 6.5 percent to 4,620.27, marking its biggest one-day loss since January 19 and

breaking an eight-session winning streak.

The CSI 300 index of the largest listed companies in Shanghai and Shenzhen tumbled 6.7 percent, while the start-up board ChiNext sank 5.4 percent.

Local media reports said the filings to Hong Kong Exchanges &

Clearing showed that China Central Huijin sold 300 million

Shanghai-listed shares of Industrial and Commercial Bank of China Ltd.

(ICBC)

and 280 million Shanghai-listed shares of China Construction Bank Corporation on Tuesday, for a combined

amount of over 3.5 billion yuan ($560 million), MarketWatch reported.

In Shanghai, financial stocks suffered a huge selloff, with China Construction Bank Corporation, ICBC, Agricultural Bank of China and Bank of China Ltd. all losing more than 5%.

The selloff was also driven as in recent days several brokers tightened up their margin-financing rules, including increasing the amount of cash clients must put down for their deposits.