The Futures Mag portal asked few experts what indicators they look to in today's markets to stay successful. Here's what they said.

Moving Averages still useful

The entire psychology of ‘trend’ analysis (vs. short-term trading or

long-term valuations) rests on timeless precepts. That leaves classical

patterns and moving averages useful after so many ‘new’ or ‘ground-breaking’ analysis developments.

Balance of Power (BOP)

It measures the strength of bulls versus bears by looking at their respective abilities to push price to an extreme level. It is great not only for timing market entries but also for identifying when trends are looking exhausted. It’s also useful in trying to tell when markets are entering range-bound territory.

Technical and Fundamental Analysis

"Our indicators used to be all about America’s thirst for oil and

geopolitics disrupting supply, we’re channeling the band Kansas and have

gone past the point of no return. Now when we’re trading WTI it’s all

about U.S. production and the pace of economic growth. We used to talk

about how a $10 increase in the price of crude oil would decrease GDP by

0.5%."

Carl Larry, The President of Oil Outlooks and Opinions LLC.

Momentum, Chart Technicals, and Volume

John Caiazzo. He has over 40 years of experience at brokerage firms across the United States.

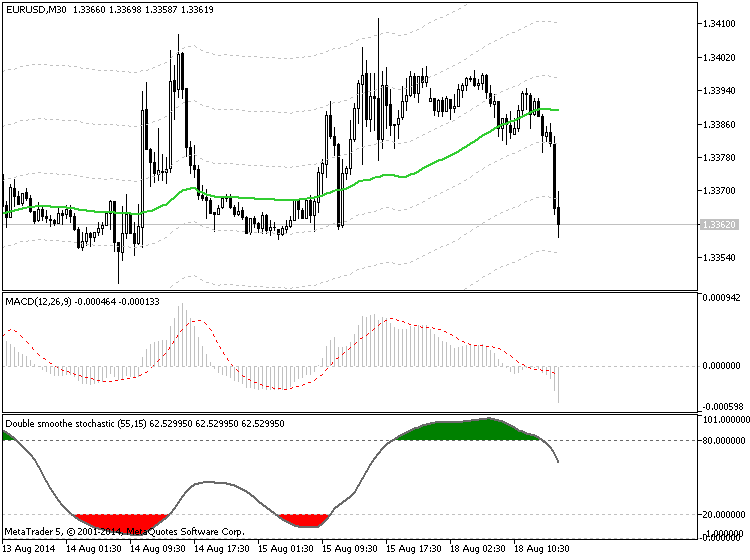

MACD

"Traders can easily modify the widely used Moving Average

Convergence-Divergence (MACD) indicator to display this information by

changing the settings for the first period to 1 and the second period to

100 (ignore the signal line). These parameters tell your trading

software to calculate the difference between the “1-period moving

average” (or the current price) and the 100-period moving average. When

this difference reaches an extreme level, it is often a signal that the

market is overbought and may be due for a pullback."

Matt Weller, the Senior Technical Analyst.