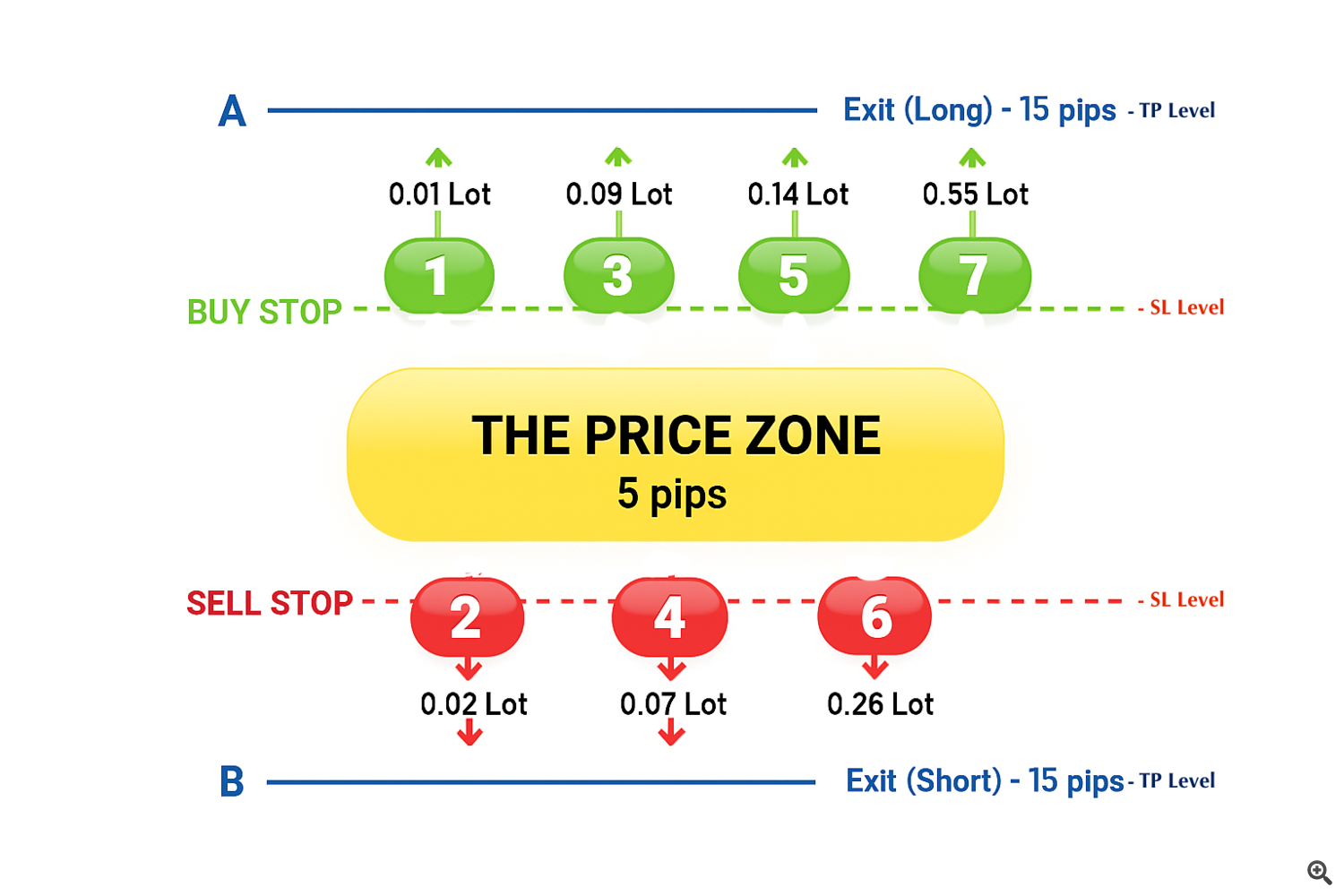

:::: The Strategy Logic ::::

- You don’t have to use the Martingale strategy.

- You can control the drawdown by limiting the number of positions.

- By opening only one position, you can disable both the Hedging and Martingale strategies.

:::: Frequently Asked Questions ::::

EA did not enter a trade!

- Did you wait long enough for it to open a position? The EA doesn’t enter a trade right after it starts; it waits for the conditions to be met.

- Try starting with a very high deposit amount.

- Your account leverage may be insufficient. (margin call issues) Try on accounts with leverage over 500.

- The set files were tested and configured based on a pair with 2 digits after the decimal. If your broker uses 3 digits, add an extra 0 to Spread limit, Tp, and distance values.

- Spread limits may prevent entry. Set them to False.

- Check the weekday permission input values. It may be disabled for weekend or weekday trading in the settings.

- If it's entering trades on backtest but not on live, proper conditions may not have formed yet. You may need to wait for a week.

- Bank holiday protection may be active. Check if today is a bank holiday.

- Try manual trading. Your broker may not be allowing trades.

- If it's none of the above, please check the log (experts) records and send me a message with a screenshot.

Which broker is the best?

The main broker I tested on is PuPrime, and I also did some tests on another broker to see how it performs in different markets: HFM.

- Both brokers offer the best spread values

- PuPrime has become my favorite broker for having the least gap issues, best managing critical spreads, and applying minimal slippage

- Both brokers have high user bases, which allows for higher trading volume and more consistent backtest results

- Although PuPrime is slower compared to others, it has the least slippage issues. Also, it offers the lowest spread and commission.

- Even earning an extra $3–$4 per lot is significant. It can result in 3–5% more monthly profit.

| Leverage Values for Cryptos According to Brokers (500x or higher values is better) |

| FusionMarket = 25x ThinksMarket = 50x AMarkets = 100x ICMarket = 200x Exness = 400x HFM = 500x PUPrime = 500x Vantage = 500x |

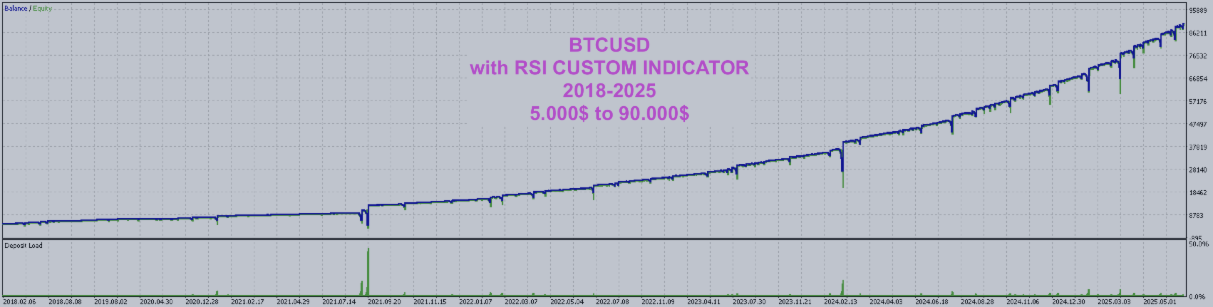

Why can't long-term tests be performed?

Because in continuously bullish markets like gold and BTC, price and volume do not remain constant. Variables such as distance and TP within the EA are defined in fixed points. Each period’s point value does not represent the same price. For example;

BTCUSD was around $20,000 in 2023. If we used a TP value of 2000 points, that would correspond to a 10% price change. But today it is worth $120,000.

If we used the same value for TP, a 2000$ point would result in a 2% change. From a negative perspective, it would stop out at 2%. Because the EA would try to open more trades in a shorter range, it could blow the account. To help you test this, we added the DynamicPips feature. Enthusiasts can experiment to find the optimal values.

However, for FX pairs, somewhat longer-term testing can be performed with proper values.

Just as the margin value of points is not the same, the tick volume in previous years is also different. For example, while gold’s tick volume was around 1M in earlier years, it has been fluctuating between 3–4M in recent years. If this tick volume moves around 5M, we will need to update our set file. The necessary update information will be provided through the EA’s client support channel.

Let’s Look at Its Professionally Designed Features!

2. Spoofing Attack Protection:

This is a defense mechanism developed to prevent manipulations targeting algorithmic traders in the Forex market. Neither centralized exchanges nor brokers should know exactly at what price you will exit a position. This feature is vital, especially for popular robots. Due to manipulations and market conditions, past test results (backtests) may not reflect the future.

-

Hides the actual TP level: Prevents the broker from seeing your Take Profit level, reducing the risk of manipulation.

-

Applies a hidden exit strategy: When the price hits the target, the position is closed manually.

-

Provides a fairer trading environment: Helps complete trades without falling into algorithmic traps used by brokers or market makers.

-

Slippage management: Takes into account potential slippage during sudden exits. In many cases, this slippage can work in favor of the trader. This protection provides a great advantage in low liquidity or aggressive broker environments.

3. Gap Protection Setting:

If this setting is set to true , the EA will open a hedge in the opposite direction when carrying a position over the weekend. In the comment section, it will write "WeekendHedge" This prevents losses caused by weekend gap. The hedge is closed at the specified time, and the EA continues where it left off. If the hedge trade closes in profit or loss, the TP and SL levels of the original trade are updated accordingly.

Thanks to this feature, you can safely include Friday in your trading days.

4. Slippage Protection Feature:

As your balance grows, more trades will be executed. The probability of experiencing slippage increases when opening more trades. Even a single trade may experience slippage due to your broker. To prevent this from negatively affecting the cycle, slippage is calculated after trades are opened, and all entry prices, stop loss levels, and take profit levels are updated.

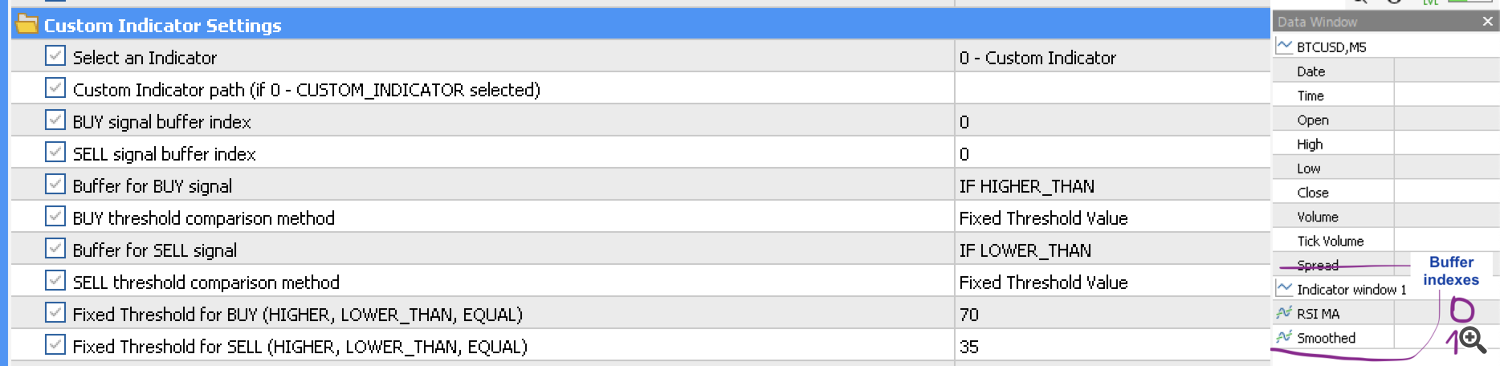

5. Custom Indicator Usage:

Do you have an indicator that gives the best condition to start the cycle? Then you can use it with this robot. Want to try something new? Then start looking for a useful new indicator on the market.

After downloading an indicator from the market, select "Custom Indicator" in the inputs section of the robot. Enter "Market/IndicatorName" in the path section. If entered incorrectly or the indicator is not found, it will show a warning on the chart. After selecting your indicator:

You need to select the Buffer Index. The buffer index usually starts from 0 when the indicator is added to the chart and shows new information in the "Data Window". Subsequent data continues as 1, 2, 3, etc. However, for some indicators, the buffer index may not start from 0. You should confirm this with the indicator creator.

- For buy and sell signals, you must select one of the following: {IF NOT_EMPTY - IF LOWER_THAN - IF HIGHER_THAN - IF EQUAL}

- You must choose a comparison method. {Current Bid price - Fixed Threshold}

For example:

In indicators like Moving Average, you can choose Current Bid price. For indicators like RSI, to give a fixed value, you can choose Fixed Threshold.

For buy signal IF LOWER_THAN => if Current Bid price is selected, and the indicator value falls below the current price, then the condition for a Buy trade is met.

Enables trade entries based on signal crossovers from a second custom indicator, in addition to the options above.

You should use the inputs under the “Second Custom Indicator” section.

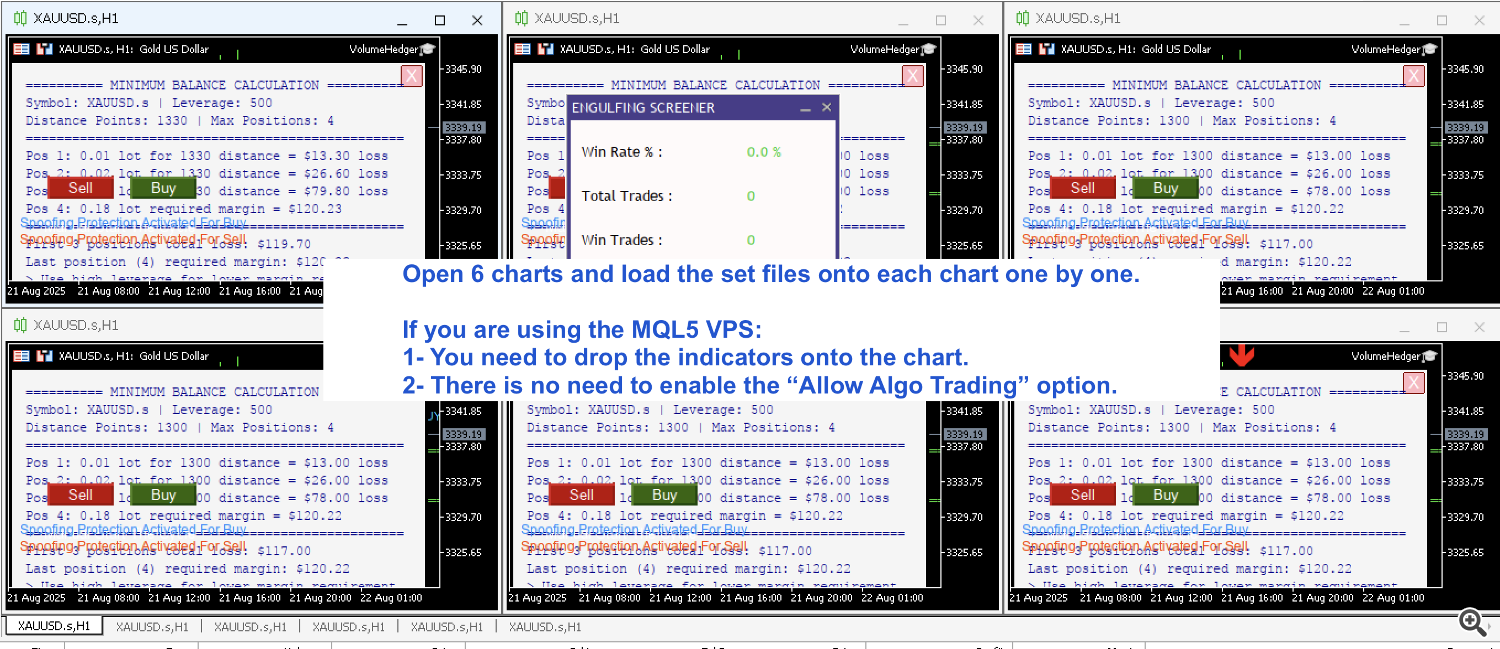

For VPS setup:

If you are using the MetaTrader VPS, you need to drag the indicator onto the chart, because it must be loaded into the VPS during migration. If you are using MetaTrader on a VPS that you connect to via remote access, then you don’t need to load the indicator onto the chart. If someone has done an incorrect setup, it won’t start anyway and you will see the error inside the Expert logs.

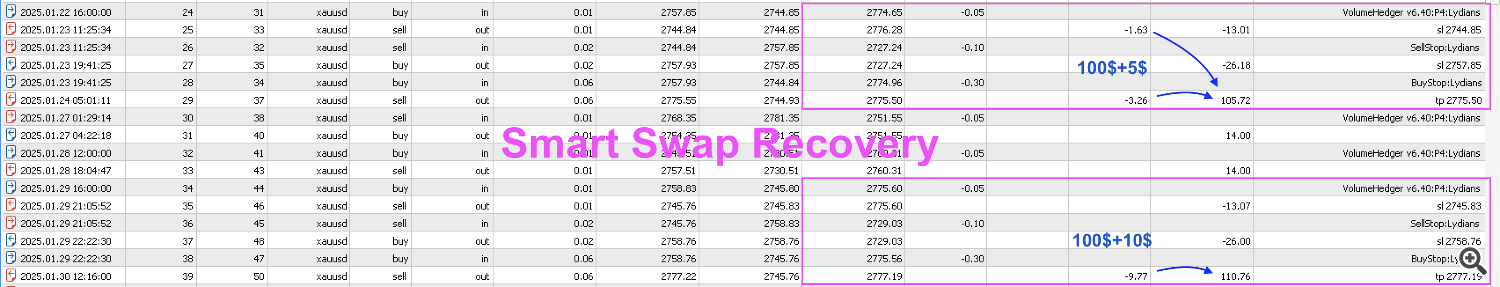

6. Smart Swap Recovery

While this EA is primarily designed as a scalping robot for short-term trades lasting a few hours, it can occasionally hold positions overnight. Moreover, depending on the set file parameters, we can configure it to maintain trades for extended periods. To provide this flexibility while managing costs effectively, we had to address swap charges. Therefore, we implemented TP level updates to ensure that nightly accumulated swap costs don't negatively impact profitability.

7. Manual Trading

When using manual trading, the decision to open the first trade is entirely up to you. Once you’ve opened the initial trade, if your prediction turns out to be incorrect and the first trade hits its stop loss, the management of subsequent trades will be handled automatically by the EA. Keep in mind that the TP and SL values are exactly as defined in your set file. If your set file is configured for a maximum of one position, the EA will not open a second trade in the cycle. Therefore, which set file you use for manual trading is important!

Usage Recommendations:

- Ensure that your account balance is above the minimum balance value shown. Try to add 20% more (depends on the leverage)

- If you have lower leverage, you should have a higher balance.

- You can reduce max pos value to lower drawdown. But sometimes this negatively affects the risk/reward ratio.

- You can earn more by running on multiple charts. However, try using the blocking magic number feature to avoid negatively affecting your equity.

- It can also be used on prop firm funded accounts. But since such systems are designed to make the user lose money by nature, I recommend not wasting time with them.

Note: If you select Manual Trading only, the EA will not enter trades based on the indicator signals defined in the set file. However, it will continue to use the TP and SL values from the set file.

You can open trades manually by using the Buy and Sell buttons on the chart.

Personalized Set Files After Purchasing

I provide support in preparing custom set files for your purchased EA. You can request 1 or 2 set files tailored to your needs.

I prepare different set files based on the balance that varies from person to person. I keep records. This way, I aim for everyone to benefit optimally without disrupting the market’s supply and demand balance.

How Should I Use the Set Files?

You may have noticed that there are many set files included. This is because the EA is highly versatile. If I wanted, I could have created 5 different EAs working with the same logic instead of just one. However, by selling you one EA, my intention was to actually give you the power of five.

Now, let’s see how you should decide which set files to use:

Ignoring the “risk low” or “risk high” labels, there are two main approaches:

1. If you want to risk your entire balance:

You can continue with a single trusted set file (with risk low–risk high options).

Alternatively, you can load several set files to increase profit potential.

2. If you want to risk only part of your balance:

You can use multiple set files but assign a smaller portion of your balance to each.

For example, with a $350 balance, you could load 5 set files at once — requiring a total balance of around $1500.

Each set file typically brings around 30% profit. If one loses, only its allocated balance is affected (about $350). Losses may occur more frequently, but if we know they balance out in the long run, this becomes a profitable strategy.

For instance, if one set file loses $350 in the first month, the others might generate $500 in profit. In this case, despite a 20% drawdown, you still achieve a 30% net gain.

You can also risk only a portion of your balance with a single set file. For example, if one set file risks the whole balance with a 20% expected return, by allocating just 50% of your balance, you could achieve around a 10% return.

Note: The terms “risk low” and “risk high” simply refer to how often losses may occur — not necessarily to overall safety or danger.

*** [ Lesson 1 ] ***

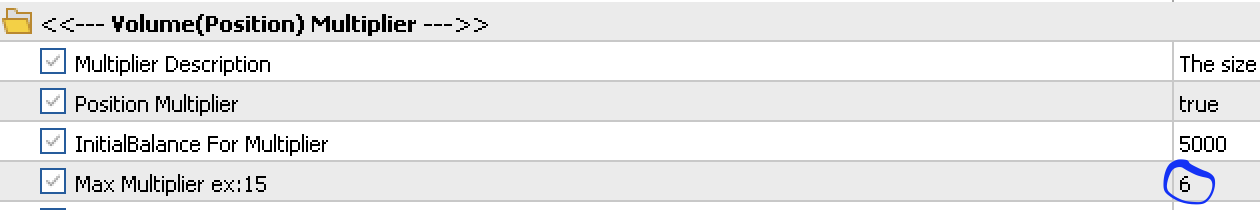

If you don’t want to risk your entire balance, turn off the VolumeMultiplier feature (set it to false) or you can set the max multiplier to 1So, if the set file name includes min350 and you turn off the VolumeMultiplier feature, you will only risk $350 from your balance

*** [ Lesson 2 ] ***

Combined set files are made up of groups. Each folder is one group and is configured to work on multiple charts. So, do not mix the groups with each other. Each group should be used for one account. The required minimum balance is written on the folder. If you deposit more, the multiplier will be activated and more positions will be opened. This way, you can achieve compound growth. However, keep in mind that some combined set files use your entire balance, and you should also consider the risk of a blow-up.

Recommendation: Do not accumulate your profits, meaning do not aim for compound growth. This way, when you eventually face the worst possible loss, you may already have made enough profits. If you make 400% profit and then lose 100%, you will end up with nothing. (It may not always be a 100% loss, sometimes it can be 80%, but I hope you understand the point.)

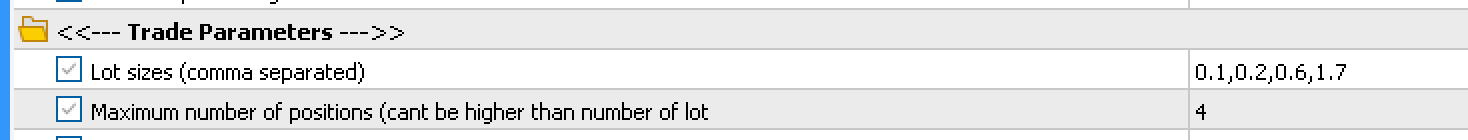

*** [ Lesson 3 ] ***

This is related to the lot size level. If you want to reduce the number of positions opened simultaneously, you should adjust the volume multiplier setting.

For example:

The Lotsizes: 0.01,0.02,0.06,0.17

The Max Multiplier : 6 and your balance is enough for (6 x initialBalance)

it will trade:

1. pos = 0.01,0.01,0.01,0.01,0.01,0.01 (6 amount trades)

2. pos = 0.02,0.02,0.02,0.02,0.02,0.02

3. pos = 0.06,0.06,0.06,0.06,0.06,0.06

4. pos = 0.17,0.17,0.17,0.17,0.17,0.17

*** [ Lesson 4 ] ***

MANUAL TRADING

When using manual trading, the decision to open the first trade is entirely up to you. Once you’ve opened the initial trade, if your prediction turns out to be incorrect and the first trade hits its stop loss, the management of subsequent trades will be handled automatically by the EA.

Keep in mind that the TP and SL values are exactly as defined in your set file. If your set file is configured for a maximum of one position, the EA will not open a second trade in the cycle. Therefore, which set file you use for manual trading is important!

NOTE: You must ensure that the chart you use for manual trading has a different magic number from the other charts. Otherwise, everything can get messed up. When using both manual and algorithmic trading, please open a new chart first, load the correct set file for the pair, and then change the magic number. Set the input to Manual Trading Only.

*** [ Lesson 5 ] ***

SMART MULTIPLIER

When using the Position Multiplier based on your increasing balance, the EA remembers the balance before the cycle started. This means that even if you add or withdraw funds, the opened positions will still act according to the balance before the cycle started.

This is a very clever method.

For example,

if your set file has a multiplier of 1500 and your balance is 4500, the EA will open 3 positions. However, when the first-level positions close with a loss and your balance drops to 4400, you might expect it to open only 2 positions. But since the EA is designed to not recalculate based on the new balance, it will continue to behave as if your balance is still 4500, and therefore open 3 positions again.

*** [ Lesson 6 ] ***

How To Use a Custom Indicator

In the Data Window, indicator data usually starts from index 0 and continues as 1, 2, 3..., unless the developer has defined it otherwise.

You can detect signals by checking the data displayed here. Note that not every indicator you download will contain signal data in this section.

If it does, it will be much easier for you to use.

You can capture signals using the following filters:

Equal, NotEqual, HigherThan, LowerThan, NotEmpty, Between

If you get good results, I would truly appreciate it if you share them with me.

Wishing you the best of luck!