Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - Possible Topping Below $70.00 for Crude Oil

US DOLLAR TECHNICAL ANALYSIS

"Prices are on pace to test April’s

swing bottom anew after a second consecutive day of heavy losses. A

daily close below the 38.2% Fibonacci expansion at 11737 exposes the 50%

level at 11688."

S&P 500 TECHNICAL ANALYSIS

"Prices are edging lower as

expected after putting in a Bearish Engulfing candlestick pattern,

warning that a double top may be taking shape. A break below the 38.2%

Fibonacci retracement at 2065.70 exposes the 50% level at 2047.10."

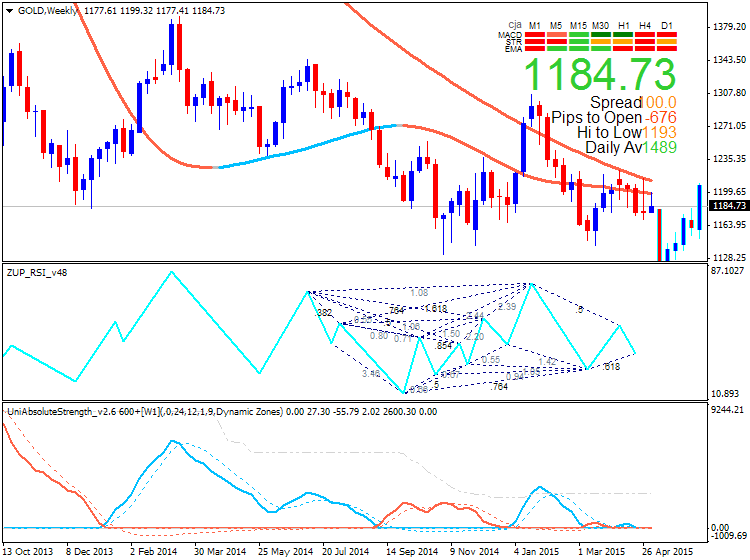

GOLD TECHNICAL ANALYSIS

"Prices continue to oscillate in a

choppy range around the $1200/oz figure. A break below range support at

1178.09 exposes the 38.2% Fibonacci expansion at 1161.16. Range

resistance remains at 1214.64."

CRUDE OIL TECHNICAL ANALYSIS

"Prices put in a Shooting Star

candlestick below resistance at 67.55, the 50% Fibonacci expansion,

hinting at ebbing upside momentum and warning that a move downward may

be ahead. A break below the 38.2% level at 66.09 exposes the 23.6% Fib

at 64.29. Alternatively, a push above the 67.55 targets the 61.8%

expansion at 69.01."