Deloitte: Five key market indicators to watch after UK election - Analysis

While the U.K. general election, which is taking place today, was considered to be the most tightening, analysts suggest how best to estimate what investors make of it after the results are ready.

Ian Stewart, chief UK economist at Deloitte, has come up with key things to watch on Friday and the following days. The Guardian has picked up five main indicators he underscored.

The latest survey of big companies' chief financial officers carried out by Deloitte, highlighted their worries over policy shakeups, following the election. The second biggest fear was the potential turmoil of a vote on Britain’s membership of the EU, as promised by David Cameron.

1. Market expectations for interest rates

The lines below show where traders expect three-month interest rates – which run at similar levels to base rates – to be at the end of this year, next year, 2017 and 2018. Over the past year, financial markets have lowered their expectations for interest rates, as the charts show.

"If the general election ushers in sustained political uncertainty that seems likely to weigh on growth, market expectations for interest rates are likely to drop further. Conversely, if the new government were decisively to break with austerity and seek to boost the economy through more public spending, interest rate expectations are likely to rise,” Stewart writes.

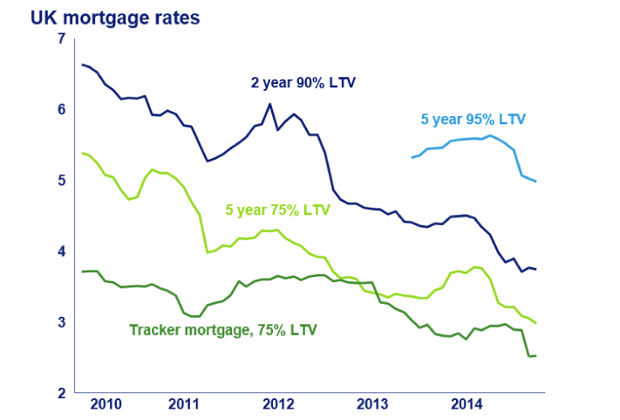

2. Mortgage rates

Mortgage rates are likely to move, depending on the election outcome, similar to market expectations for base rates, as set by the Bank of England.

3. FTSE 100

There are concerns that an inconclusive outcome could knock confidence, while recently FTSE 100 has stayed at all-time highs. A number of strategists warned that a Labour government, or Labour-led coalition, could put shares in banks, bookmakers and energy companies under pressure. In the meantime, the prospect of an EU referendum under the Conservatives could knock the whole index back, analysts warn.

4. Forex volatility

“If the election – as seems quite likely – delivers no clear winner, and a period of deal-making as parties try to build viable alliances, this measure is likely to rise,” says Stewart.

5. Gilt-Bund gap

This shows the gap between the yield, or interest rate, on benchmark

10-year UK government bonds (gilts) and on 10-year German government

bonds (Bunds). During the time of instability in the eurozone, both Bunds and gilts have been seen as safe-haven

investments, thus

their yields are lower than the equivalent interest rates on French,

Spanish and other bonds (yields move inversely to the price of a bond.

So a lower yield indicates higher demand).

While yields on gilts are higher than yields on Bunds, the gap between the two has widened since 2012, as shown in the chart below:

Looking at the spread, or gap, between Bund and gilt yields gives an indication of (among other things) the relative risks investors attach to each economy and ultimately each government’s credit-worthiness. If the spread widens, for example, it shows investors have a preference for owning German government bonds relative to gilts.

After the election outcome is clear, this is one to watch but will not necessarily be easy to interpret.

As the Guardian reports referring to Mr Stewart, if spreads were to increase notably following the election result, this could be interpreted as a sign of:

a) Improved confidence in the UK’s growth outlook, therefore an expectation of rising interest rates

b) Concerns that a lack of fiscal tightening will usher in higher base rates or cause growing worries about the UK’s credit-worthiness

c) Higher risk premia on the back of growing political uncertainty related to the prospect of minority governments and the risk of another election.