WEEKLY DIGEST 2014, August 10 - 17 for High Frequency Trading Review

18 August 2014, 07:07

0

728

- This Is the Troubling Future of High-Frequency Trading - The Financial Times reported yesterday that high-frequency traders are leaving investment banks for hedge funds, prop trading houses, and their own startups.

- Nomura hires new trading chief from high frequency trading firm - Nomura has hired Simon Harris as a managing director and head of European single stock flow trading just over a year after he joined HFT firm Maven Securities.

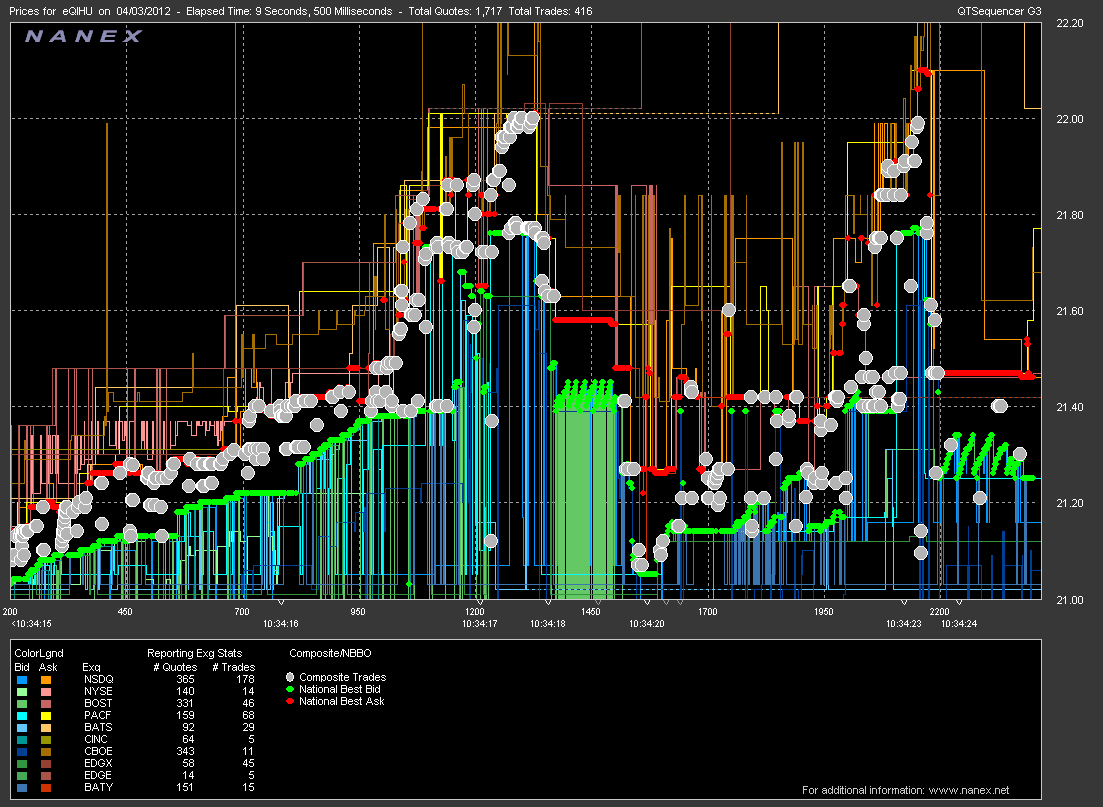

- The high-tech arms race that's causing stock market 'tsunamis' - There is one factor that limits speed: According to Einstein, nothing can travel faster than the speed of light.

- Debate Over High-Frequency Trading on IEX Muddied by Trade Counting - IEX Group Inc., the start-up trading venue operator that promises to protect investors from predatory trading activity, has found itself at the center of a fierce debate about just how much of the trading in its dark pool is done by high-frequency trading.

- The Ethics of High-Frequency Stock Trading - "According to estimates, the trading volume on U.S exchanges executed by high-frequency computers range from 50 percent to 73 percent."

- Weslosky interviews Chris Ecclestone on “Dark Pools” vs. High Frequency Trading - Tracy Weslosky, Editor-in-Chief and Publisher of InvestorIntel, speaks to Chris Ecclestone, a principal and mining strategist at Hallgarten & Company about “dark pools” and High Frequency Trading (HFT).

- Dark Pools: B-Schools Consider High-Frequency Trading As Hiring Surges - A leading business school has revealed it is considering teaching students high-frequency trading, as Europe's electronic trading firms go on a hiring spree.