FX Review FxTaTrader Weekly Strategy Week 16 / Sunday 12-Apr-2015

_______________________________________________________

Open/pending positions of last week

EUR/NZDThis pair will be analyzed briefly, for more information read the article Weekly Review Strategy Wk13 where the pair was tipped for going short. The NZD is a stronger currency from a longer term perspective with a score of 7. The EUR remains weak with a score of 1. With a Currency score difference of 6 and the NZD better classified it is an interesting pair.

One short position was closed last week with a profit of 190 pips (1/2 Weekly ATR) and the pair continued to go down. The downtrend is still strong but with the sharp decline last week and price being around the previous bottom of March 23 at 1,4129 a technical correction may take place in the coming week. Positions will be opened on pullback or if possible it will be on the continuation of the downtrend.

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions.

- The MACD is in negative area with the histogram showing an increase of strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 16

Rank: 3

Rating: ---

Total outlook: Down

_______________________________________________________

This pair will be analyzed briefly. Pending orders are placed to be opened on pullback but none opened yet. Since the pair does not look anymore as interesting as last week all the pending orders will be cancelled. The CHF is an average currency from a longer term perspective with a score of 4. The AUD remains weak but has a score of 3 this week. The pair found the downtrend again a few weeks ago but is currently consolidating as can also be noticed when looking at the Currency score difference of only 1.

- On the weekly(decision) chart the indicators are looking strong for going short.

- In the weekly chart the Ichimoku is meeting all the conditions. However, price is above the MA's.

- The MACD is in negative area but showing with the MACD above the signal line and weakness in the histogram.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Ranking and rating list Week 27

Rank: 27

Rating: =

Total outlook: Down

_______________________________________________________

Possible positions for coming week

GBP/USD

This

pair will be analyzed in detail. The GBP has weakened in the last

weeks but is still a strong currency from a longer term perspective.

There are several combinations possible when looking at the Top 10 of

the Ranking and Rating list. However, it seems best to find a

counterpart currency that is also strong from a longer term

perspective. These are the USD and the NZD, when looking at the Weekly

chart the USD is the best counterpart currency. The pair is clearly in

a downtrend and it seems to be resuming again after the short

consolidation period of the last weeks. The pair broke through the last

bottom of March 18 at 1,4635 but with a very small amount of

pips. This will be monitored in the coming week and if downtrend

resumes positions will be set to be opened at a favorable price.

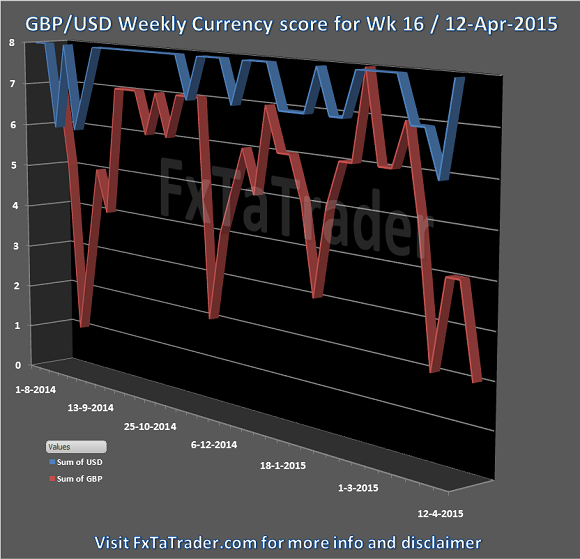

- As can be seen in the Currency Score chart in my previous article of this weekend the USD has a score of 8 and the GBP a score of 2.

- In the current Ranking and Rating list of this weekend the pair has a rank of 2. This list is used as additional information besides the Currency score and the Technical Analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes this an attractive opportunity.

Rank: 2

Rating: - - -

Weekly Currency score: Down

Based on the currency score the pair looked interesting in the last 3 months. The USD is a strong currency from a longer term perspective and had in the last weeks a score between 6 and 8. The GBP is also a strong currency from a longer term perspective but had in the last weeks a score between 2 and 6 with exceptions towards 7 and 8. With currently a Currency Score difference of 6 it is an interesting pair for taking positions in the coming week.

_______________________________________________________

Monthly chart: Down

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current downtrend.

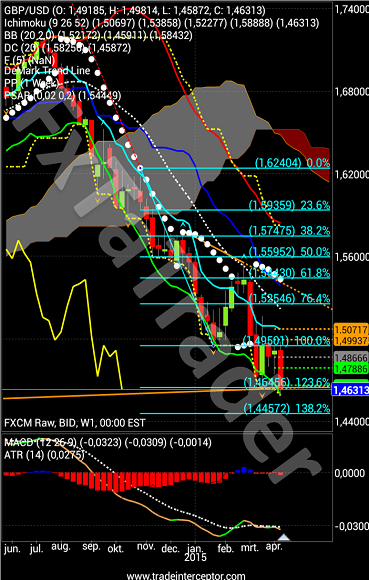

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and gaining strength.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting almost all of the conditions.

- The MACD is in negative area gaining strength.

- The Parabolic SAR is short showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

GBP/USD Weekly chart

_______________________________________________________

_______________________________________________________