Looking at what has been happening on the currency markets the past few weeks, we get the impression that soon our screens will show EUR/USD/CHF = 1.0000.

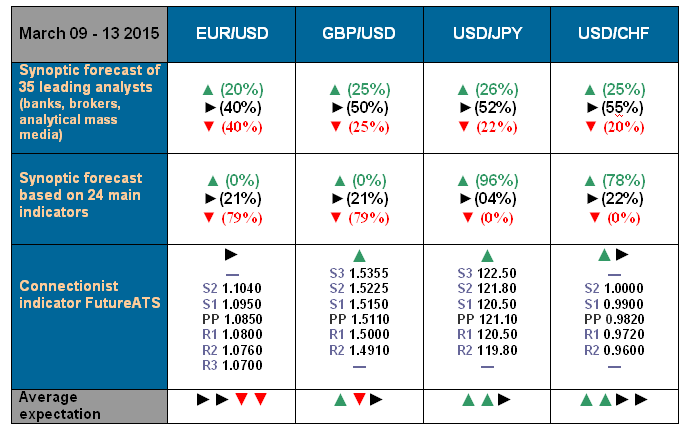

In the meantime, generalising the opinions of 35 analysts from world leading banks and broker companies collected in a table as well as forecasts based on different methods of technical and graphical analysis, we can note that... analysts are at a complete loss: 25% support growth, 25% support a fall and 50% simply shrug. Therefore, in our forecast for the coming week, we will primarily focus on the indicators, and secondly on our own logic and intuition:

- thus for the EUR/USD pair the corridor 1.0760÷1.1225 is most probable, dominated by “bearish” trends and an aspiration of the pair downwards to the level of 1.0700;

- for the GBP/USD pair a rebound to the zone of 1.5225 is possible at the start of the week, followed by a fall all the way down to the 1.4910 mark;

- for the USD/JPY pair the most probable scenario is growth to last week’s maximum of 121.27 and further to the zone of 121.80÷122.50. The support will be at the level of 119.50÷119.80;

- for USD/CHF the previous plan stands – moving step by step up towards the highlight level of 1.0000. The only thing that we can predict is that the movement will be smoother than it was last week.

***

As for last week’s forecast, it turned out to be too “modest”:

- the first half of the week, as predicted, was spent by the EUR/USD pair in a sideways trend, but then, thanks to the actions of the ECB and the news from the USA, the pair easily broke through the lower limit of the corridor and sharply went downwards, proving that the indicators could be much more accurate than the deliberations of highbrow analysts. (Recall that 83% of indicators pointed towards the fall of the pair, whilst only 32% of analysts were of this opinion);

- we had predicted for the GBP/USD pair a fall to the level of 1.5000 and further to 1.4810 in March. But the pair went on to break a record and over the past week it completed a massive chunk of the set task, and did not reach 1.5000 by a mere 30.0 points;

- for USD/JPY a growth to the level of 120.50 was predicted last week. Strictly speaking, this is what happened – the pair completed the weekly session at the 120.81 mark. Yet, just a few hours before that the pair was at the height of 121.27, and only afterwards, apparently remembering our forecast, did it return to the specified zone;

- the USD/CHF pair also easily exceeded the plan. It was predicted a growth to the level of 0.9735, but actually it briskly overcame a rise at an angle of almost 45 degrees and achieved a height of 0.9854, 120.0 points higher than the set target.

Roman Butko, NordFX & Sergey Ershov