PRODUCER PRICE INDEX

- PPI stands for the Producer Price Index.

- PPI comes out the second week of each month.

- Forex traders can use PPI as a leading indicator to forecast consumer inflation measured by the Consumer Price Index (CPI)

In the 1950’s gasoline was $0.27, apartment rent was $42/month and a movie ticket was $0.48. In addition, the US dollar was worth 9 times what is worth now. Inflation reduces domestic buying power and that is why central banks fight so hard to beat back inflation by raising the interest rate. Forex traders are well aware that interest rates are the main driver of currency movement. Investors seek higher yields and will migrate capital from low yielding assets and currencies to high yielding assets and currencies. This is why traders pay special attention to the Producer Price Index because it alerts them to the rise and fall of inflation which could, in turn, lead to a rise and fall of currency rates.

What is PPI?

Released monthly in the second week of each month, the Producer Price

Index (PPI) is an indicator used to measure the average change in

selling price, over time, received for finished goods.Retailers that

have to pay more for finished goods may have to pass on higher costs to

consumers. This measurement of price change from the view of the seller

can be a leading indicator for consumer inflation that is measured by

the Consumer Price Index (CPI). PPI examines three production areas;

commodity-based, industrial-based, and stage-of-processing-based

companies. Released by the Bureau of Labor Statistics, PPI is created

using data collected from a mailed survey of retailers selected

randomly.

Traders can see changes in PPI expressed in a percentage change from the previous year or month to month.

Why Look at PPI?

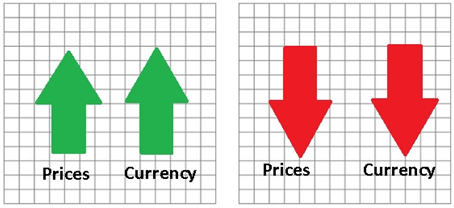

Forex traders use the Producer Price Index to find the direction of prices and a measurement of inflation. Rising prices in the form of inflation lowers the purchasing power of a country’s currency because consumers can buy less goods and services for each unit of currency. This decrease in consumer buying power usually triggers a central bank response to raise interest rates. A rising PPI could indicate that consumer prices could rise leading to higher interest rates. The increase in interest rates stimulates the demand for that currency as investors chase yield. This inflow of capital results in a higher exchange rate. On the other hand, a stable or falling PPI insures that interest rates will remain low. This results in a lower relative currency exchange rate. As you can see, using the information found in PPI can give traders an advantage when seeking out strong and weak currencies.