Technical Analysis for CRUDE OIL, GOLD, US DOLLAR INDEX and S&P 500

US DOLLAR TECHNICAL ANALYSIS

Prices corrected modestly lower after

hitting the highest level in 14 months against its top counterparts.A

daily close below the 14.6% Fibonacci retracementat 10874 exposes the

23.6% level at 10836. Alternatively, a turn above the 23.6% Fib

expansion at 10919 clears the way for a test of the 38.2% threshold at

10976.

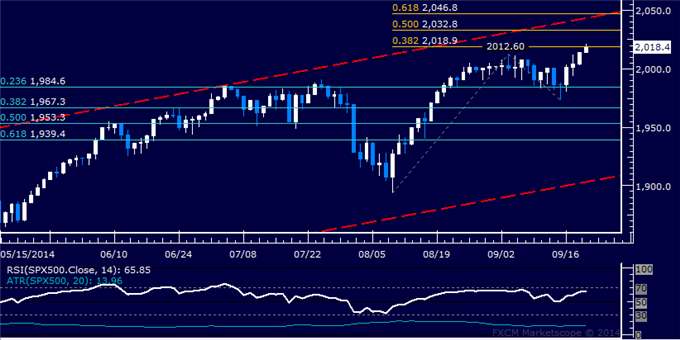

S&P 500 TECHNICAL ANALYSIS

Prices are testing resistance in the

2012.60-18.90 area marked by the September 3 high and the 38.2%

Fibonacci expansion. A break above this barrier on a daily closing basis

exposes the 50% level at 2032.80. Alternatively, a reversal below the

23.6% Fib retracement at 1984.60 targets the 38.2% threshold at 1967.30.

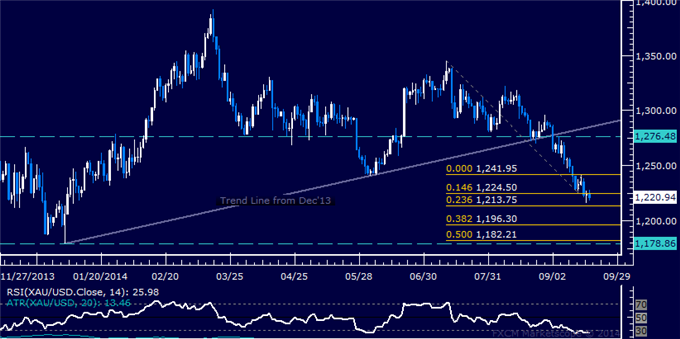

GOLD TECHNICAL ANALYSIS

Prices broke downward, with sellers now aiming

to challenge the 23.6% Fibonacci expansion at 1213.75. A break below

this barrier on a daily closing basis exposes the 38.2% level at

1196.30. Alternatively, a reversal above the 14.6% Fib at 1224.50

targets the September 16 high at 1241.95

CRUDE OIL TECHNICAL ANALYSIS

Prices are edging higher as expected

after putting in a bullish Piercing Line candlestick pattern above

support at 96.73, the mid-April 2013 low. Near-term resistance is at

99.47, the 14.6% Fibonacci retracement, with a break above that on a

daily closing basis exposing the 23.6% level at 101.18.