1. Diversification

Despite the low 0.12% rate of return that many money market funds provide, cash has remained the center of the universe for many investors who seek the security of the dollar.

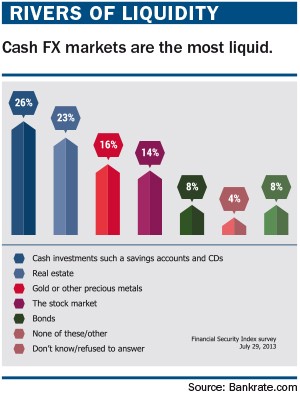

2. Liquidity

With the interbank forex market capturing approximately 95% of the

almost $5 trillion traded in G10 currencies, it provides the liquidity

needed to execute trades seamlessly

3. Regulation

Congress passed legislation in 2000 and 2008 requiring firms acting as counterparties to retail forex transactions, as well as forex pool operators, CTAs and introducing brokers to register with the Commodity Futures Trading Commission (CFTC) and become members of National Futures Association (NFA), the self-regulatory organization for the U.S. derivatives industry.

4. Transparency

Forex traders, whether in futures or the spot market have visibility into their account at all times. Whether they maintain accounts in their own name, at a bank or futures commission merchant (FCM), the underlying structure is the same.

5. Market access

If there is a bank open in the world, chances are the forex market is

open. It is a large, growing and liquid financial market that operates

24 hours a day, five days a week. It is not a market in the traditional

sense because there is no central trading location or exchange. Most of

the trading is conducted through electronic trading networks, permitting

market participants to react to economic events and currency

movements.

6. Leverage

FX trading allows for the use of leverage of up to 50-1, meaning that

you have the ability to control a large amount of one currency using a

small percentage of its true value. While the use of leverage is a

double-edged sword that can work against you as easily as it can work

for you, it creates greater opportunity to profit when used prudently.

7. Carry trading

FX transactions are quoted in pairs because you are buying one

currency while selling another. The first currency quoted is the base

currency and the second currency is the quote currency. The price, or

rate, that is quoted is the amount of the second currency required to

purchase one unit of the first currency. When holding an FX position you

earn interest on the currency you hold vs. the other currency in the

trade. To put on a carry trade, you buy the high interest currency

against a low interest one. For each day that you hold the trade, you

earn the interest difference between the two currencies.

8. No fixed contract size

While currencies can be traded on an exchange as a future, retail customers also have access to a thriving off-exchange over-the-counter (OTC) FX market. Access to the OTC market has key benefits, including the lack of set order sizes.

9. No commission fees

There should be no transaction fees beyond paying the cost of establishing the spread. While this can be more than commissions on futures, most FX accounts trade without commission and there are no exchange fees or data licenses.

10. Ability to find talent

When Congress required firms acting as counterparties to retail FX

transactions, as well as FX pool operators, CTAs and IBs, to register

with the CFTC and become members of NFA, it took an important step in

safeguarding the integrity of the FX marketplace. Before this

legislation was in place, the FX market attracted unqualified

individuals seeking customer funds, given the lure of the largest

actively traded market in the world (measured not only in terms of

market breadth but also in terms of the number of participants).