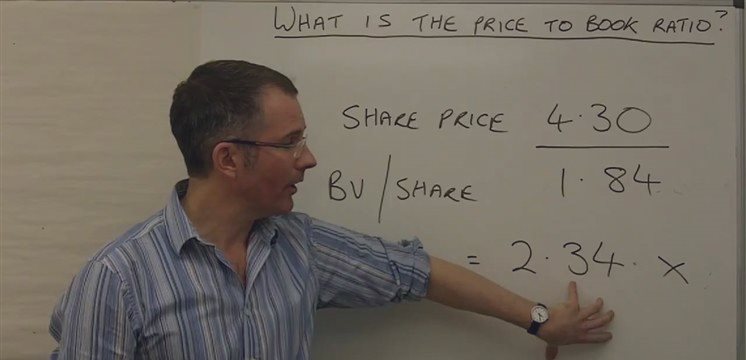

HowTo Trade - The Video: Introduction to the Price/Book Ratio: Use it to Find Outperforming Stocks

Market Capitalization / (Total Assets - Intangible Assets - Liabilities)

If a price/book ratio is below 1, it suggests the potential to buy a company and sell its assets right away for a profit. Low price/book ratios are generally desired by value investors. Of course, not every stock with a low price/book ratio is worth buying, as some may have assets that are overvalued on their books, may take a long time to sell (if at all), and may have negative earnings from operations.

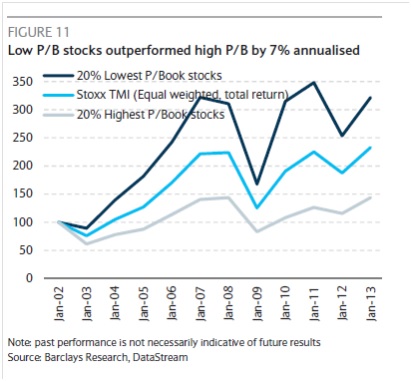

2. There is some evidence that suggests stocks with a low price/book ratio outperform the market. Consider the chart below.

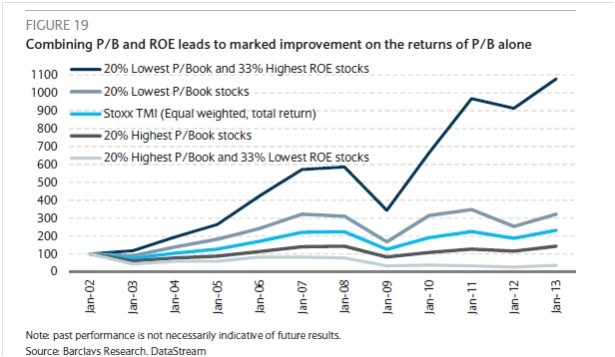

3. Some evidence suggests the price/book ratio becomes even more

valuable when combined with other screens -- namely return on equity.

The chart below illustrates the outperformance of stocks in the bottom

20% of price/book ratio and the top 33% based on return on equity; we

can see they significantly outperform the market. Return on equity is

essentially income divided by net assets; it is an attempt to measure

how much income is earned relative to assets used to generate them. When

stocks have a low price/book ratio, that suggests the company's assets

are cheap; when stocks have a high return on equity, that suggests the

company's assets are good at generating income. Many value investors

appreciate the intuitive appeal of combining these screens to find the

best companies worthy of investment.