Fundamental Weekly Forecasts for GOLD, US Dollar, NZDUSD, USDJPY, GBPUSD: Gold Target is Still 1345

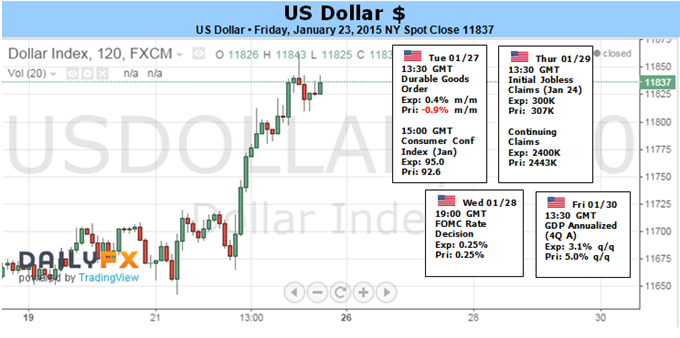

US Dollar Forecast – Can the Fed maintain its drive towards its first rate hike in 2015 when the rest of the world is loosening the reins?

When the Fed meets on Wednesday,

the primary question is whether the group maintains its tone to fuel

speculation of a ‘mid-2015’ rate hike. That doesn’t require

pre-commitment nor any rhetoric materially more hawkish than the last

gathering. Rather, the market needs to simply see a lack of dovish cues

in the monetary policy statement. If that is the case, the Dollar’s rate

bearing will push it even farther off course of its counterparts.

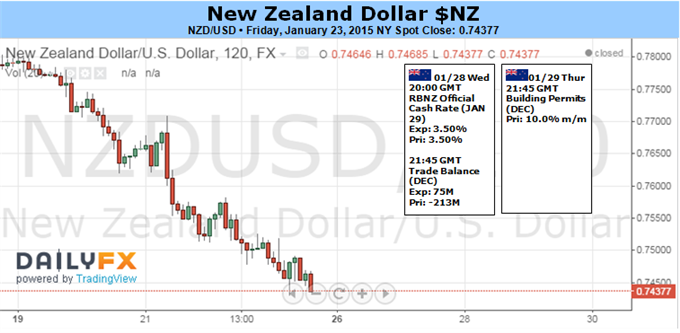

New Zealand Dollar Forecast – Soft 4Q CPI Fuels Dovish Shift in Markets’ New Zealand Policy Bets

New Zealand economic news-flow has continued to

improve relative to consensus forecasts since December’s meeting,

according to data from Citigroup. This has occurred even as the price

for the country’s dairy exports – the largest component of the external

sector – slid to the lowest level since August 2009. That suggests

December’s narrative about domestically-led growth remains largely

unchanged. Meanwhile, Statistics New Zealand – the government agency

that produces CPI figures – chalked up the fourth-quarter slump to

sinking oil

prices. If the RBNZ dismisses ebbing price growth as transitory on this

basis (much like the Federal Reserve, for example), their hawkish

posture may remain unchanged.

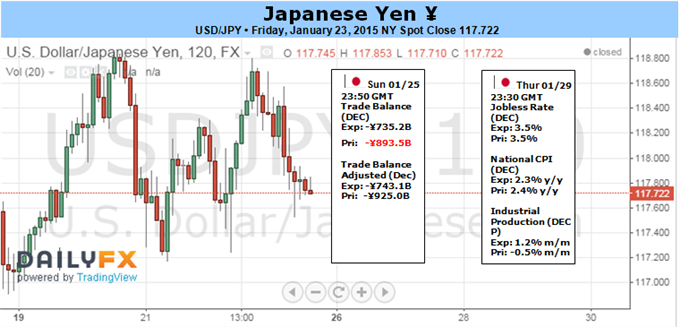

Japanese Yen Forecast – USD/JPY 1 Month into Consolidation

With USD/JPY struggling to push back above the

119.00 handle, the pair faces a risk for move back towards near-term

support around the 117.00 handle, and the dollar-yen may make a more

meaningful run at the January low (115.84) should the bullish sentiment

surrounding the greenback fizzle.

British Pound Forecast – British Pound plummets versus surging US Dollar on diverging central bank policy

Traders should use limited leverage ahead of what

promises to be an important FOMC decision in the days ahead. Reversal

risk is high as positioning data shows large traders are heavily long

the US Dollar. It may take little to force a significant correction.

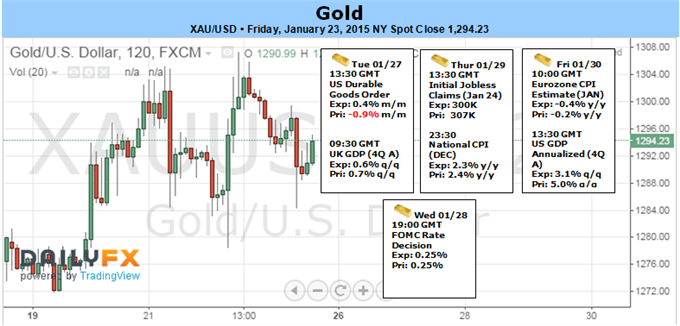

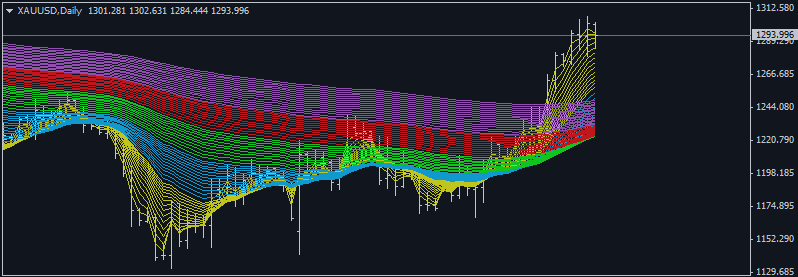

Gold Forecast – Gold Target is Still 1345

Gold remains within the confines of a well-defined

ascending pitchfork formation off the November lows with this week’s

rally coming into resistance at the upper median-line parallel,

currently around $1307. Longs are at risk below this mark near-term with

the broader bias remaining weighted to the topside while above $1263.

Look for a pullback next week to offer favorable long entries with a

breach of the highs targets resistance objectives at $1320/21, the July

high-day close at $1335 and $1345.