Fundamental Weekly Forecasts for US Dollar, USDCHF, USDJPY, and GOLD: SNB Shocker Fuels Highest Swiss Franc Volatility vs. Euro Since 1975,

US Dollar Forecast - The SNB’s decision to drop the EURCHF cap leveraged volatility and raised expectations of ECB stimulus

Volatility has been building for months and

currencies have been at the forefront of that development – the

short-term FX reading is at its highest level in three years. With the

SNB’s fireworks this past week, the appetite for safety has risen and

its outlets have diminished. Dependency on a global pool of stimulus is driven by new bouts of economic hardship and its limitations are more discernable.

If the ECB doesn’t fulfill expectations with the next infusion, it

could potentially trigger a correction in European markets that quickly

spreads through a susceptible global system.

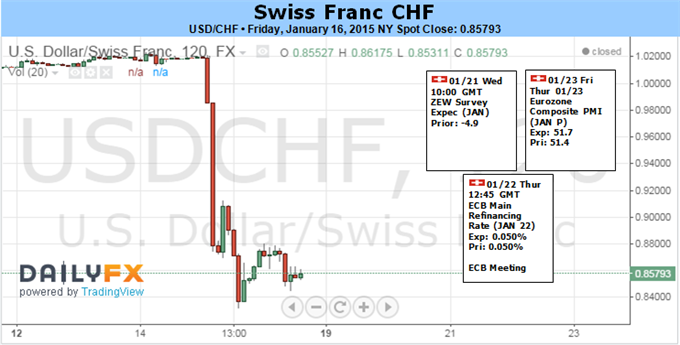

Swiss Franc Forecast - SNB Shocker Fuels Highest Swiss Franc Volatility vs. Euro Since 1975

Measuring the fallout from the SNB’s actions is likely to be protracted however.The full breadth of the various ripple effects will probably emerge over weeks and months, not hours and days.The Franc now looks gravely overvalued against currencies whose central banks are set to tighten policy this year, with the US Dollar

standing out as particularly notable. It seems prudent to let the dust

settle before taking advantage of such opportunities however.

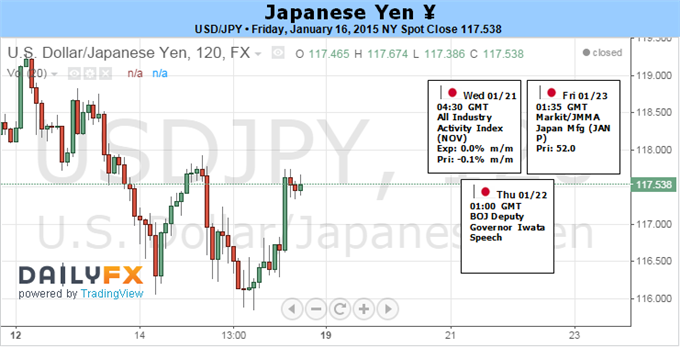

Japanese Yen Forecast - Nikkei (JPN225) Wedging Towards A Big Move

In turn, the December low (115.55) remains in focus

for USD/JPY as the pair continues to carve a string lower highs &

lows in January, and the technical outlook certainly highlights the risk

for a further decline in the exchange rate as the Relative Strength

Index (RSI) preserves the bearish momentum carried over from the

previous month.

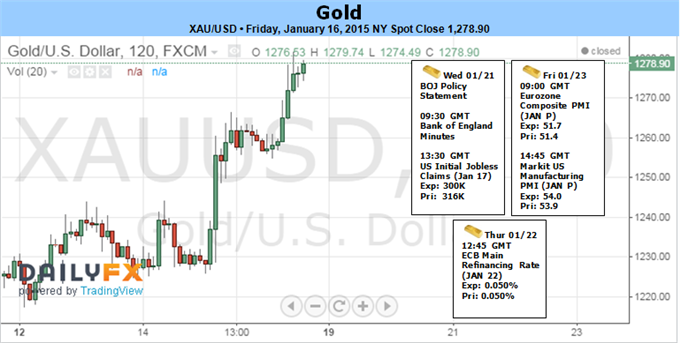

Gold Forecast - Gold Faces Resistance up to 1263

The main event next week will be the European

Central Bank interest rate decision on Thursday where market

participants are looking for a major announcement. On the back of this

week’s shocking move from the SNB, speculation that the ECB will

announce its quantitative easing program has kept European equity

bourses afloat this week despite the losses seen state side. Should the

program underwhelm market participants, look for gold to remain

supported with the technical picture suggesting the medium-term outlook

remains constructive.