Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - Crude Oil Targets $46.00, Gold En Route to December Top

US DOLLAR TECHNICAL ANALYSIS

Prices look likely to continue

downward following the appearance of a bearish Evening Star candle

pattern having reversed as expected. A daily close below the 14.6%

Fibonacci retracementat 11599 exposes the 23.6% level at 11527.

S&P 500 TECHNICAL ANALYSIS

Prices declined as expected

after putting in a bearish Evening Star candlestick pattern. A secondary

top may now be in place as a corrective bounce is capped by a Dark

Cloud Cover candle setup. Near-term support is at 2028, the 23.6%

Fibonacci retracement, with a break below that exposing the 38.2% level

at 1988.00. Alternatively, a turn above the January 9 high at 2068.60

targets the December 29 top at 2092.60.

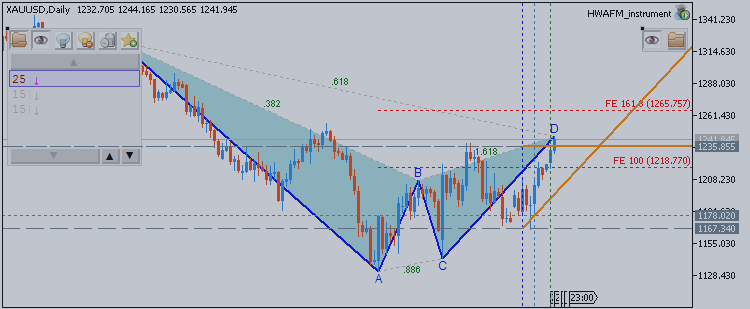

GOLD TECHNICAL ANALYSIS

Prices continue to press upward, with

December’s swing top now in the crosshairs. A break above the 61.8%

Fibonacci expansion at 1233.62 exposes the 76.4% level at 1249.39.

Alternatively, a reversal below the 50% Fib at 1220.88 aims for the

38.2% expansion at 1208.13.

CRUDE OIL TECHNICAL ANALYSIS

Prices accelerated downward, with

sellers now aiming to challenge the 76.4% Fibonacci expansion at 46.00. A

break below that on a daily closing basis exposes the 100% level at

40.55. Alternatively, a turn above the 61.8% Fib at 49.37 targets the

50% expansion at 52.10.