- PPI is Producer Price Index.

- PPI comes out the second week of each month.

- Forex traders can use PPI as leading indicator to forecast the Consumer Price Index (CPI) value

In the 50’s gasoline was $0.27, apartment rent was $42/month and a

movie ticket was $0.48. In addition, the US dollar was worth 9 times

what is worth now.

Inflation reduces domestic buying power and that is

why central banks fight so hard to beat back inflation by raising the

interest rate. Forex traders are well aware that interest rates are the

main driver of currency movement. Investors seek higher yields and will

migrate capital from low yielding assets and currencies to high yielding

assets and currencies.

This is why traders pay special attention to the

Producer Price Index because it alerts them to the rise and fall of

inflation which could, in turn, lead to a rise and fall of currency

rates.

What is PPI?

The Producer Price

Index (PPI) is an indicator used to measure the average change in

selling price received for finished goods. Retailers that

have to pay more for finished goods may have to pass on higher costs to

consumers. This measurement of price change from the view of the seller

can be a leading indicator for consumer inflation that is measured by

the Consumer Price Index (CPI). PPI examines three production areas:

- commodity-based,

- industrial-based,

- and stage-of-processing-based

companies.

It is released by the Bureau of Labor Statistics, PPI is created

using data collected from a mailed survey of retailers selected

randomly.

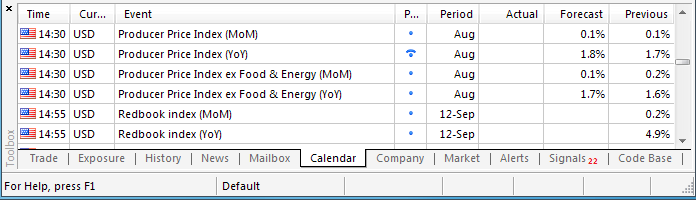

Traders can see changes in PPI expressed in a percentage change from the previous year or month to month using Metatrader 5 Economic Calendar feature:

Why Look at PPI?

Forex traders use the Producer Price Index to find the direction of

prices and a measurement of inflation. Rising prices in the form of

inflation lowers the purchasing power of a country’s currency because

consumers can buy less goods and services for each unit of currency.

This decrease in consumer buying power usually triggers a central bank

response to raise interest rates. A rising PPI could indicate that

consumer prices could rise leading to higher interest rates.