So, what are the oil market pros predicting for prices after the crash of 2014?

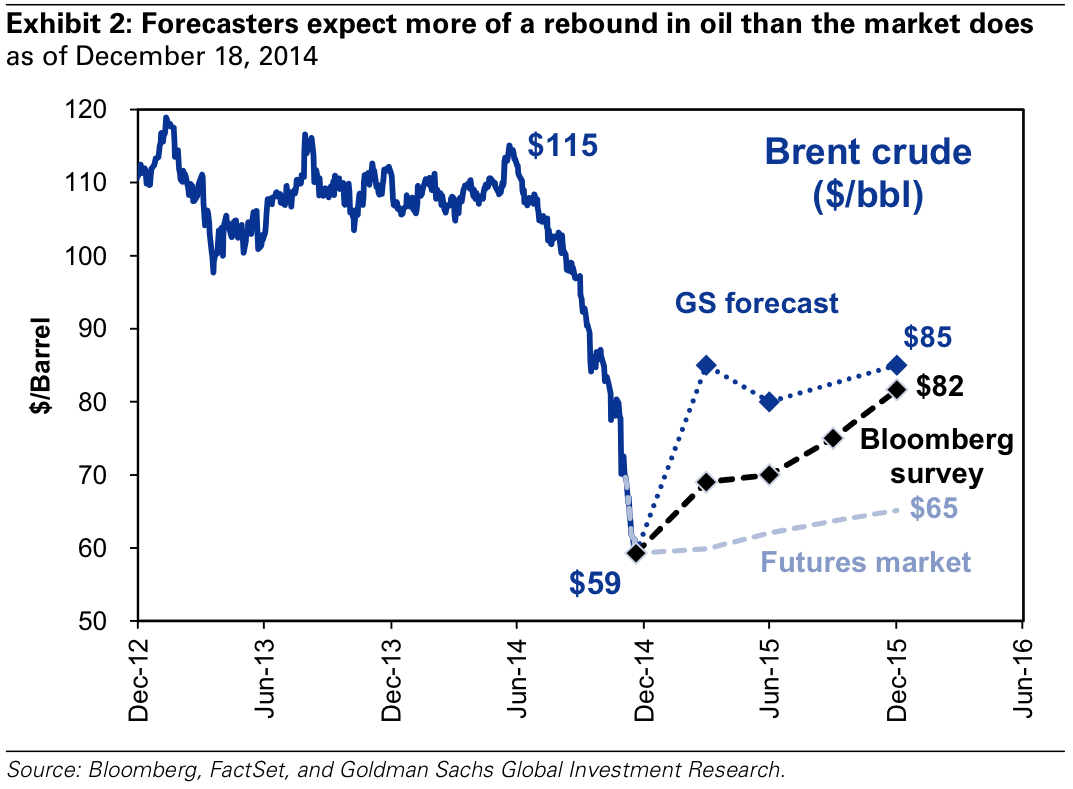

"Forecasters and market participants disagree about the likelihood of a significant rebound in oil prices during the next 12 months," Goldman Sachs' David Kostin wrote. "Many clients share the view priced into the futures market that Brent will remain below $70 by year-end 2015. However, oil producers anticipate a rebound, echoing a Bloomberg survey of professional forecasters that expects Brent to rise by 35% to $82 at year-end 2015 (Exhibit 2)."

Goldman's house view is that Brent eventually rallies to $85 a barrel.

Reuters: "Crude oil prices are likely to bottom out in the first half of 2015, until a possible slowdown in U.S. shale production counters a supply glut exacerbated by OPEC's decision not to cut output, a Reuters monthly survey showed.

The Organization of the Petroleum Exporting Countries' agreement last

month to stand pat on output meant the onus for any supply cutbacks was

now on non-OPEC producers, primarily led by U.S. shale oil, analysts

said."

"Oil prices will be lower, making shale oil production less attractive

for investments, which are necessary to keep shale oil production

growing," Commerzbank's Carsten Fritsch said.