EURCHF

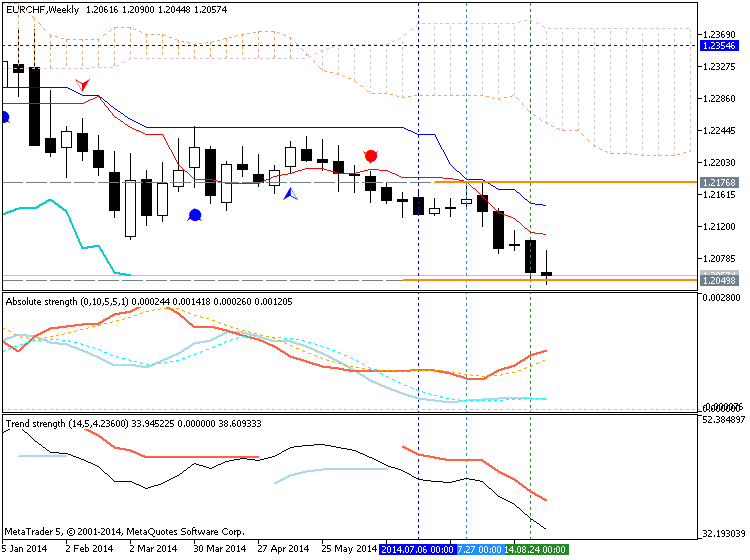

EUR/CHF has far surpassed USD/CHF bin terms in liquidity. EUR/CHF is probably one of the safest currencies pairs to trade because its moves are so orderly. It enjoys high volume, but trades in relatively predictable ranges since the Swiss and Euro zone economies are so closely linked.

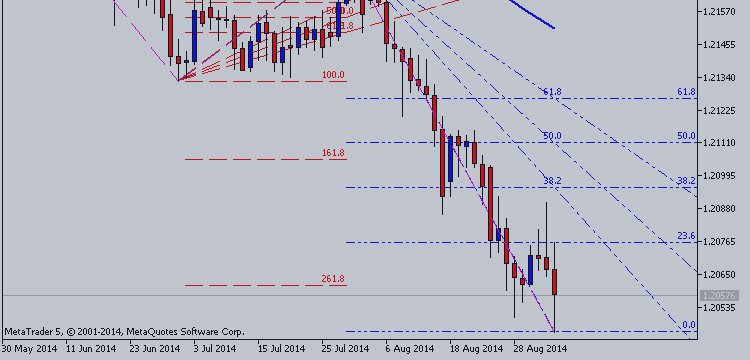

Since EUR/CHF is primarily a range bound pair, traders can use real support and resistance to find entry and exit points for their trades. Because the pair tends to range across all time frames, using support and resistance is an effective trading strategy for short and long term traders alike!

The pair moves independently only during times of geopolitical

tension or risk, when there is an inflow of capital into the Swiss

franc, a safe haven currency. Breakouts like this are temporary and

generally last 1-2 months.

What moved EURCHF

- Gold

Since the Swiss franc is partly tied to the value of gold, movements in gold prices will be reflected in this pair. - Swiss Economic data

Swiss economic data is reflected better in EUR/CHF than in USD/CHF. - Geopolitical Event Risks

- When there is geopolitical tension,

buying in the Swiss franc increases since it is a “safe haven” currency,

thus pushing the price up.

Fundamentals to Watch

- Swiss KoF Leading Indicators

A composite of business surveys from various sectors of the economy (industry, retail and wholesale) that is combined to form a leading indicator that aims to project GDP growth approximately 8 months into the future. - Swiss CPI

Consumer Price Index. A measure of inflation in Switzerland; a significant change may have implications for interest rate policy in Switzerland. - Comments from Swiss officials

Watched for any indications of change in Swiss monetary policy. - Swiss GDP

Gross Domestic Product. A measure of growth and productivity in the Swiss economy. - SNB Rate Decisions

Any changes in the interest rate by the Swiss National Bank has implications for the pair as a carry trade. - European GDP

Gross domestic product. A measurement of output, and more importantly, growth in an economy. - European Trade Balance

A measure of how much Europe is importing versus how much it exports. Too many imports mean that the currency will get weaker because more Euros are being sold to purchase foreign goods. - European CPI

Consumer price index, a measure of inflation in Europe. Inflation that is too high or too low may prompt Europe's central bank to raise or lower interest rates. - ECB rate decision

Refers to the European Central Bank's monetary policy. If inflation is too high, the ECB will raise interest rates to slow borrowing and spending. If economic growth is sluggish, lowering interest rates will help boost activity. High interest rates make a currency more attractive.