Video Manual and Free to Download: Ichimoku - Invalid Kumo Breakouts

5 December 2014, 03:11

0

1 255

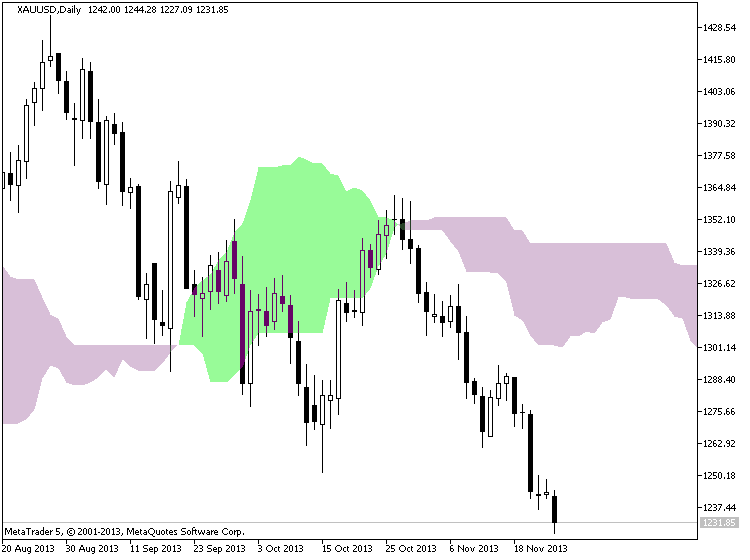

Here's a look at a few Kumo Breakouts and why they are not valid breakouts.

==============

Ichimoku threads/posts on mql5.com forum

- The theory of the signals

- Ichimoku alert indicator with arrows

- Ichimoku alert indicator improved : warning alert mode was fixed and autosettings feature was added

============

Ichimoku indicator description

- Tenkan Sen - moving average of the highest high and lowest low over the last 9 trading days. (Highest high + Lowest low) / 2 over the last 9 trading days

- Kijun Sen - moving average of the highest high and lowest low over the last 26 trading days. (Highest high + Lowest low) / 2 over the last 26 trading days.

- Senkou Span A - the average of the Tenkan Sen and Kijun Sen, plotted 26 days ahead. (Tenkan Sen + Kijun Sen) / 2 plotted 26 days ahead

- Senkou Span B

- the average of the highest high and lowest low over the last 52 days,

plotted 26 days ahead. (Highest high + Lowest low) / 2 over the last 52

trading days plotted 26 days ahead.

- Chikou Span - the closing price plotted 26 days behind.

=============

Tenkan Sen / Kijun Sen Cross

The Tenkan Sen / Kijun Sen Cross signal occurs when the Tenkan Sen (Turning line) crosses the Kijun Sen (Standard line).

A bullish signal occurs when the Tenkan Sen crosses from below to above the Kijun Sen

- A weak bullish signal occurs when the cross is below the Kumo.

- A neutral bullish signal occurs when the cross is inside the Kumo.

- A strong bullish signal occurs when the cross is above the Kumo.

- A weak bearish signal occurs when the cross is above the Kumo.

- A neutral bearish signal occurs when the cross is inside the Kumo.

- A strong bearish signal occurs when the cross is below the Kumo.

Kijun Sen Cross

The Kijun Sen Cross signal occurs when the price crosses the Kijun Sen (Standard line).

A bullish signal occurs when the price crosses from below to above the Kijun Sen

- A weak bullish signal occurs when the cross is below the Kumo.

- A neutral bullish signal occurs when the cross is inside the Kumo.

- A strong bullish signal occurs when the cross is above the Kumo.

- A weak bearish signal occurs when the cross is above the Kumo.

- A neutral bearish signal occurs when the cross is inside the Kumo.

- A strong bearish signal occurs when the cross is below the Kumo.