Almost a week ago, just less a day, I focused on two pairs. USDCHF and USDCAD were relatively overbought and the recommendation was to sell. Last week

Almost a week ago, just less a day, I focused on two pairs. USDCHF and USDCAD were relatively overbought and the recommendation was to sell. Last week, the entry point for USDCHF was at 0.91129 and for USDCAD was at 1.09441.

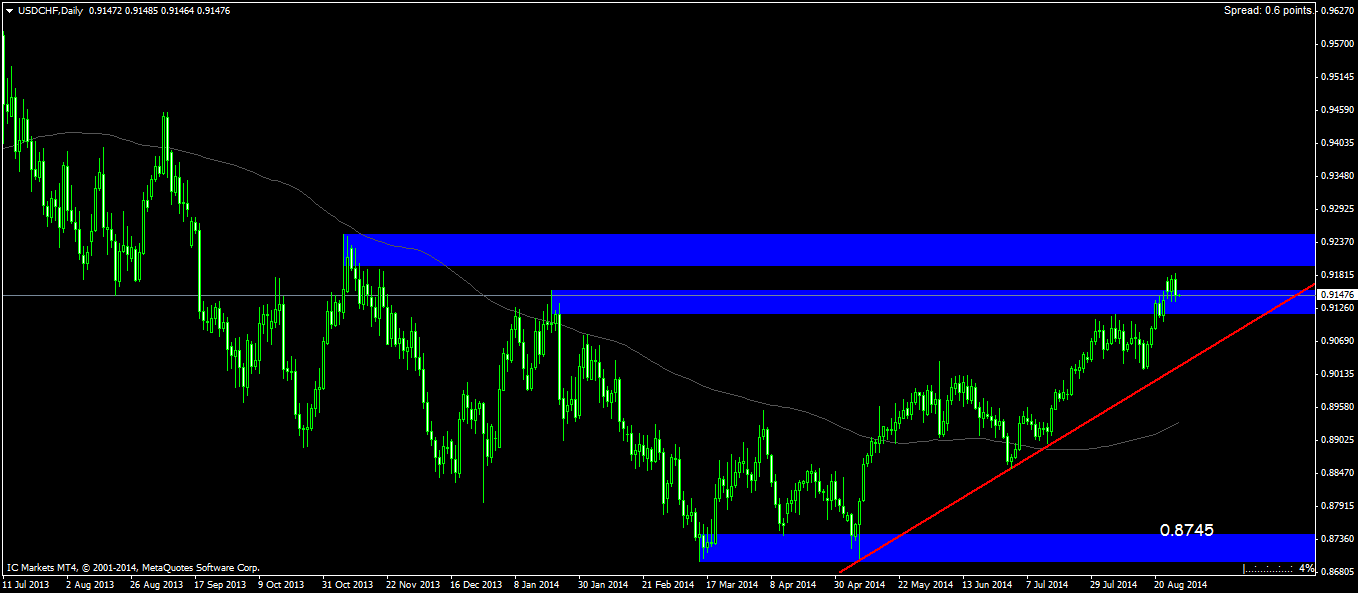

Starting with USDCHF, the current price is 0.91476. This resulted in a losing position of 34 pips.

The price managed to break the first resistance and even gapped up. However, it is no longer a good idea to be doing any trading on this pair. The last three complete candle closes on the daily produced both a bigger overall size and complete body size than the previous. The current candle is still in formation, but it looks to have opened lower. Right now, a second resistance zone has been established for further selling. If selling were to begin now, it is recommended to wait for the actual daily candle close first.

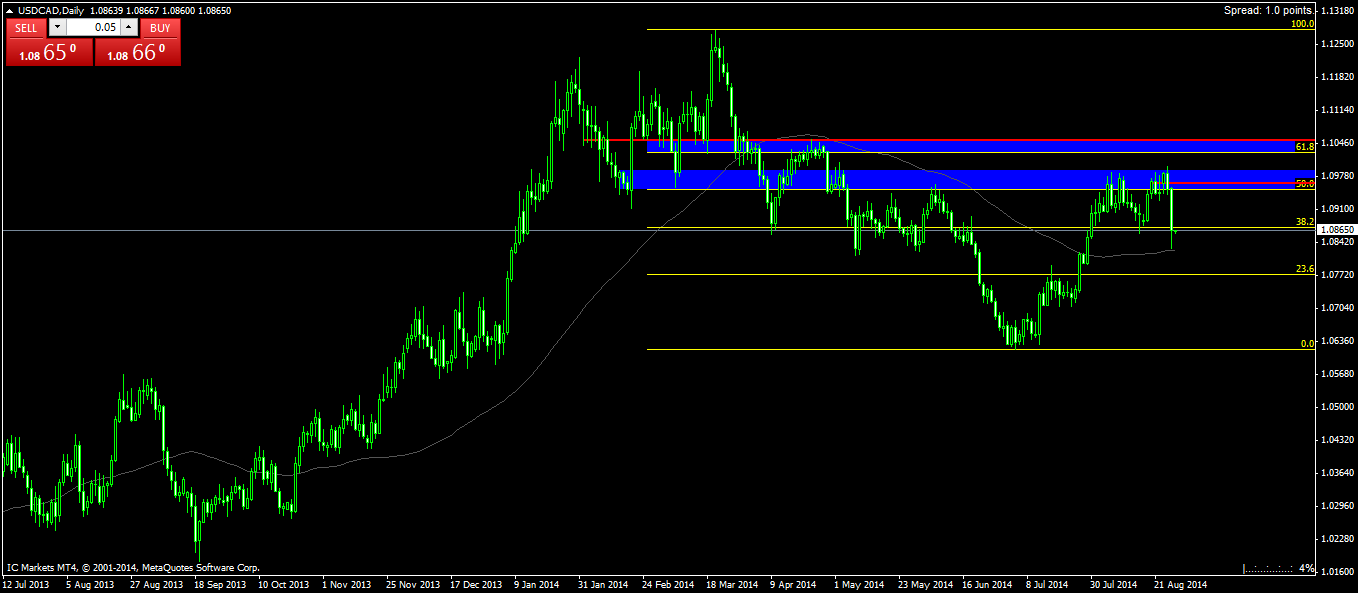

Meanwhile, USDCAD traded lower to 1.08650. This resulted in winning trade of 79 pips, netting an overall win of 45 pips so far.

This pair stalled in the resistance so became slightly worried if it will ever reverse. Based on the recent price movements, I would say this resistance zone has weakened substantially. If price were to enter it again, I don't believe we will see much selling pressure. In either case, these two trades are a win overall. 45 pips may not seem like much for now, but you must target the long run and it just isn't over now.