0

352

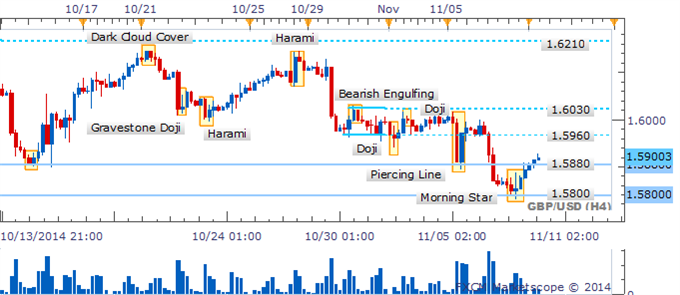

GBPUSD is breaking to be above the 1.5880 mark in the wake of a Harami pattern.

A close above the barrier would help confirm the key reversal formation

and open the prospect of a more sustained recovery. Selling interest

would likely be renewed at the 1.6170 ceiling. A slide back below 1.5880

would see the risks skewed towards the Mid-September 2013 low near

1.5770.

The four hour chart offered an early bounce signal in the form of a

Morning Star formation. With bearish patterns seemingly lacking a push

higher over the session ahead may be achievable. Yet it should be

monitored closely for signs of exhaustion that could be evidenced by

Doji candlesticks.