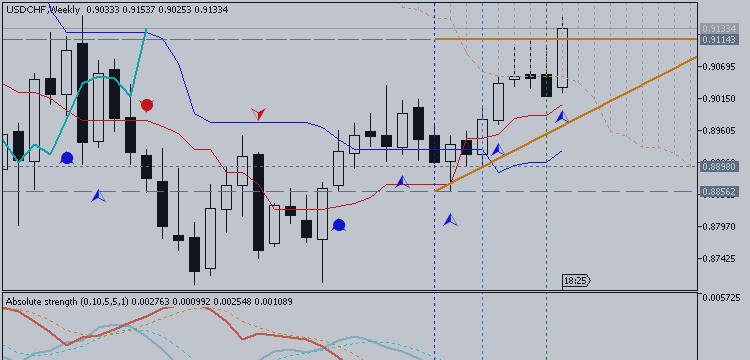

USDCHF is trading pips shy of its YTD high but has pushed above the trendline that extends off of the 2010 and 2013 highs (there is a trendline that extends off of the 1985 and 2001 highs near .9400). The nearly 30 year trendline splits the 50% and 61.8% retracements of the decline from the 2012 high (.9335 and .9485). The rate could press higher into month end towards this zone before reversing.

Axel Rudolph, Senor Technical Analyst at Commerzbank, suggested the pair would remain bid above the 0.9020 level.

Key Quotes

“USD/CHF made an eight month high at .9145 before sliding back down towards the previous August high at .9115”.

“Once

a rise above .9145 has been made, the 200 week moving average at .9157

and then the 55 month moving average at .9349 will be targeted”.

“This

held the topside in 2012 and 2013 and is expected to do so again, at

least for several days. Above here, at .9392, lies the 29 year

downtrend”.