Introducing the "RC ATR Based Trendlines" and an Integrated Trading Strategy

In this article, I present the "RC ATR Based Trendlines," a free indicator for MQL5 designed to identify key trendlines based on the Average True Range (ATR) volatility. This indicator serves as a foundation for an integrated trading system, which is enhanced through the combined use of the "RC ATR Volatility Hedge Zones." Together, these tools offer a robust framework for informed decision-making in the market.

Trading System Overview: Signal Convergence for Precision

The trading strategy outlined here leverages the combined insights of both indicators to confirm trade entries. The premise is simple but precise: both indicators must align for a trade to be initiated. Below are the rules governing the system:

-

Step 1: Trendline Detection

The RC ATR Based Trendlines identifies key bullish or bearish trendlines based on ATR calculations. The trendlines generated by this indicator serve as the primary signal of a potential price movement. These trendlines reflect the broader market structure and highlight emerging trends with increased accuracy due to their volatility-based foundation. -

Step 2: Confirmation via Volatility Hedge Zones

After the trendline is formed, the trader must await a corresponding signal from the RC ATR Volatility Hedge Zones indicator. The signal must align with the trendline:- For a bullish trendline, wait for a bullish signal from the Volatility Hedge Zones. Crucially, this signal should occur above the identified trendline, indicating convergence between trend direction and volatility dynamics.

- For a bearish trendline, wait for a bearish signal, which should occur below the bearish trendline. This ensures that both the direction of the trend and the volatility environment support a short position.

-

Step 3: Trade Execution

A position should only be opened after both the trendline signal from the RC ATR Based Trendlines and the corresponding confirmation from the RC ATR Volatility Hedge Zones have been received. This double confirmation acts as a filter, minimizing false signals and increasing the probability of trade success.

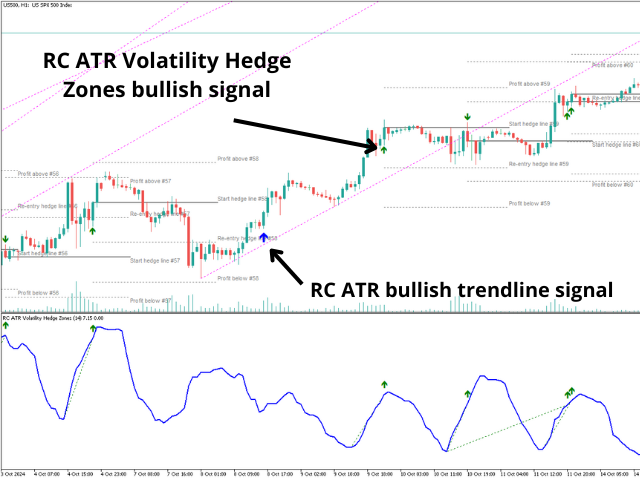

Example: Bullish Setup

Consider a scenario where the RC ATR Based Trendlines identifies and creates a bullish trendline. In this case, the trader would monitor the RC ATR Volatility Hedge Zones for a bullish signal. The trade entry is only valid if the bullish signal from the Volatility Hedge Zones occurs above the bullish trendline. This ensures that volatility is moving in the direction of the trendline, increasing the reliability of the setup. If both conditions are met, a long position may be opened.

For a bearish setup, the process is mirrored: the RC ATR Volatility Hedge Zones should generate a bearish signal below the bearish trendline to validate a short position.

Technical Rationale Behind the Strategy

The strength of this system lies in its reliance on signal convergence. The RC ATR Based Trendlines identifies trends rooted in volatility, while the RC ATR Volatility Hedge Zones assesses the volatility context in which price movement occurs. By waiting for signals to align—both in direction and position relative to the trendline—the system filters out noise and enhances signal reliability.

This convergence strategy ensures that traders are not only trading in the direction of the trend but are also taking positions when volatility confirms the price movement, reducing the risk of premature entries and false breakouts.

Conclusion

The combination of the RC ATR Based Trendlines and RC ATR Volatility Hedge Zones provides a structured approach to trading, rooted in volatility analysis. This system is particularly suitable for traders seeking a methodical, rules-based strategy that minimizes ambiguity in trade signals.

Both indicators are available for free and can be easily integrated into any trader’s workflow. By following the outlined strategy, traders can gain an edge in identifying high-probability trade setups through the convergence of trend and volatility signals.

Explore the indicators and test the strategy in your trading platform to evaluate its effectiveness in live market conditions.

//---

RC ATR Based Trendlines (MT4 version)

RC ATR Based Trendlines (MT5 version)

RC ATR Volatility Hedge Zones (MT4 version)

RC ATR Volatility Hedge Zones (MT5 version)