- Gold Pullback May Prove Short-lived, Copper Looks To China Data

- What To Make of Gold’s Bullish Move

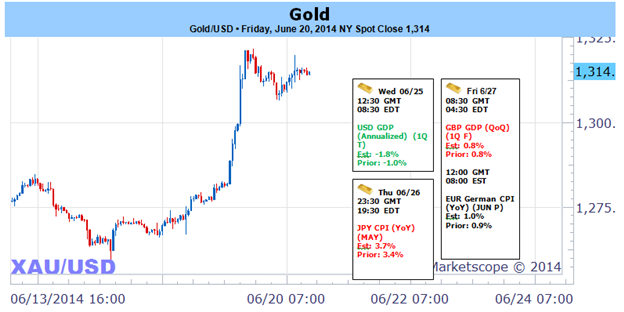

Gold price are sharply higher on the week with the precious metal up

nearly 3% to trade at $1315 ahead of the New York close on Friday.

Thursday saw bullion post its largest daily range in nine months as

prices surged through key technical levels before teetering out just

above the May high. The move comes amid escalating geopolitical

tensions in the Middle East and a more dovish tone from the FOMC this

week as equities continued to march higher. But does this really change

things for the broader gold outlook? The answer is simply- Yes.

As expected the central bank tapered QE purchases by another

$10billion this week bringing the monthly pace of asset purchases down

to $35billion. The accompanying quarterly projections however showed a

slight shift in the committee’s outlook on interest rates with both the

timing and the longer-run rate expectations suggesting a greater

leniency towards a more accommodative stance on monetary policy. During

her presser, central bank chair also talked down the threat of

inflation suggesting that the data remains “noisy” and that underlying

metrics remain in line with the Fed’s broader expectations.

Looking ahead into next week investors will be closely eyeing the

final read on 1Q GDP with consensus estimates calling for another

downward revision from an annualized -1.0% q/q to -1.8% q/q. Durable

goods orders and housing data are also on the docket with existing home

sales, new home sales and the Case Shiller home price index on tap.

The USD remains in a vulnerable state heading into the releases and

should the data disappoint, look for gold to remain well supported with

a pullback early next likely to offer more favorable long-entries.