-

Consumer inflation (CPI) stats will look to take control of rate forecasts led astray by Treasury demand

- Volatility measures can’t fall much further, and that imbalance offers immediate benefit to the US Dollar

There was a considerable commotion in the financial markets this past

week with sharp declines in global equities and sizable swells in

volatility measures (the short-term equity-based measure increased

nearly 60 percent on Thursday). Yet, a notable contrast to this chaos

was the more moderate response from FX – and particularly the calm

demeanor of the US Dollar. If the greenback is considered a safe haven, why did it not rally as other capital markets felt the effects of fear? What does this mean for the currency moving forward?

Last week’s volatility originated with two startling headlines: a

downed plane in the disputed territory between Russia and Ukraine, and

the start of a ground offensive in the Gaza Strip. Both carry serious

geopolitical ramifications and thereby generate distinct concern

amongst investors that have increasingly exposed themselves to risky

assets and are dependent on stability. As grave as these concerns are,

we have seen comparable bouts of fear in the past whereby the market

has recognized and acclimated – ultimately returning to ‘status quo’.

What separates the current situation from similar circumstances in the

past is the financial backdrop. Activity levels, positioning and underlying fundamental themes are shifting.

Volatility measures have, in recent weeks, hit multi-year (equity,

emerging markets, commodities) and record (FX and rates) lows. A

natural low is inevitable where real returns (activity adjusted) have

evaporated. The absence of premia in turn dissuades short-term traders –

the primary active market participant through 2014 – looking to buy

dips or “sell volatility”. Anemic volumes and open interest reflect the

steady withdrawal of active market participants and liquidity that is

crucial to stabilize market when fear arises. We can already see this

eroding conditions: in the ‘stickiness’ of this most recent spell of

volatility and a growing divergence in the performance of

‘risk’-sensitive assets.

The dollar represents a safe haven with a particular appeal.

Fronting the world largest and most regulated market, it is prized for

liquidity. That means that temporary jumps in volatility carry far less

weight here than with an equity index or even a Yen cross. Then again,

the current reach for yield in thinner markets represents a perfect

opportunity for the currency as a conditions normalize.

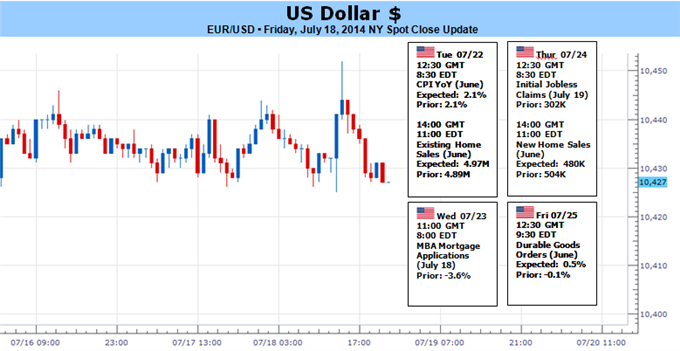

Looking at the docket ahead, there are few events that look to carry

the heft of a definitive change in sentiment. Furthermore, given the

market’s immunity to so many other high-level event risks – FOMC

decision, employment reports, external headlines – it is more likely that optimism will cave to the reality of positioning under its own power.

On the other hand, the docket offers up a listing of key event risk

for the other key driver for the dollar: interest rate expectations.

There is no true level in unemployment that the Fed is necessarily

forced to hike rates at. The need to tighten monetary policy is

developed through inflation pressure. That means the timing on the Fed’ s first hike and subsequent pace depends on readings like Tuesday’s CPI consumer inflation figures

for June. The headline figure is expected to hold at 2.1 percent and

core at 2.0 percent – both conspicuously at the central bank’s target.

While the group’s favored measure is the PCE – which is materially

softer than this reading – the more pressure seen in this

market-favorite, the more pervasive the situation and more likely a bank

response.

Another consideration for interest rate speculation behind the dollar

is the knowledge that there is higher profile event risk due the

following week. July NFPs, 2Q GDP and a FOMC rate decision are all on

the docket another week out. It is commonplace for the market to

weather near-term fundamental turmoil in deference to bigger event risk

on the horizon. So, while there is plenty of favorable opportunity in

both risk trends and rate forecast potential moving forward, we must

bear in mind its timing as a catalyst.