Weekly Technical and Fundamental Analysis of Gold – March 17th

Global gold was unable to continue the rally from the previous week and started to correct itself in the past week. The main reason for this was the increase in the yield rate of the ten-year US Treasury bonds.

In fact, the global gold ounce dropped by about 1.06% in the week ending on March 15th.

The important session of the upcoming week will be the Federal Reserve of America, which will show us whether global gold will open new highs or continue its corrections and declines.

Gold market situation in the past week:

Last week, with the start of the working day, global gold opened at a price of $2179 and went up to $2189. Since this expensive metal had successfully reached a historical peak of $2195 in the previous working day, no momentum was seen on Monday.

This led to gold finishing itself with a very small change on Monday.

Then came Tuesday, the day the market awaited an important report on the Consumer Price Index (CPI) or inflation in America.

On Tuesday, the US Bureau of Labor Statistics announced that annual inflation in America, measured by changes in the Consumer Price Index (CPI), increased from 3.1% in January to 3.2% in February.

Additionally, American consumer inflation and core inflation (meaning CPI and Core CPI) both increased by 0.4% on a monthly scale.

This excellent report caused the yield rate of the ten-year US Treasury bonds to increase by about 1%, and global gold, which had been on an upward trend for 9 consecutive days, to come crashing down.

In fact, the global gold ounce dropped by over 1% on Tuesday.

On Wednesday, due to the lack of any significant fundamental news in the market, global gold started to correct its losses from the previous day and managed to increase around the key level of $2180.

Then came Thursday, the day the market awaited an important report on Producer Price Index (PPI) in America.

On Thursday, the Bureau of Labor Statistics (BLS) announced that the Producer Price Index (PPI) had increased by 1.6% annually in February. This figure followed a 1% increase in January and exceeded market expectations of 1.1% with a significant margin.

Additionally, other data from the United States showed that retail sales increased by 0.6% monthly in February after a 1.1% decrease in January.

As you are aware, America also releases important reports on its unemployment claims on Thursdays. According to the latest reports, the number of first-time unemployment benefit claimants decreased from 210,000 to 209,000 in the week ending March 9.

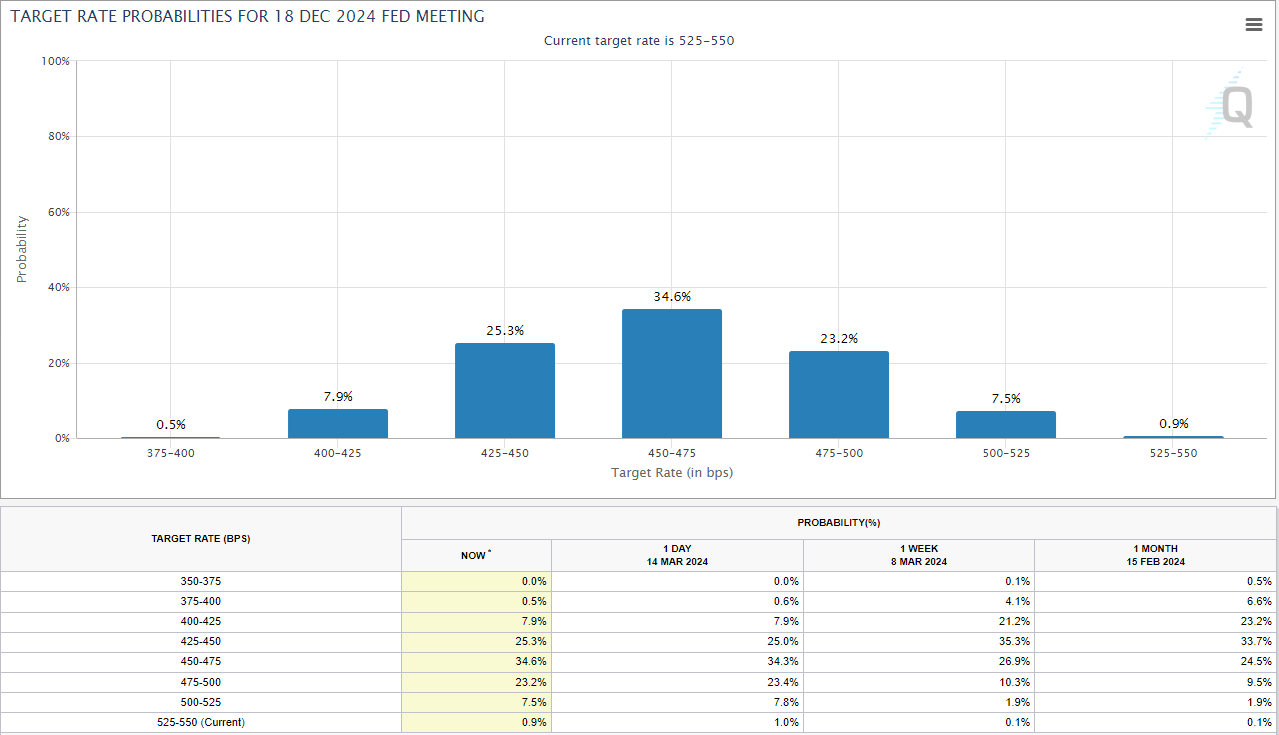

Immediately after the release of this data, investors began speculating that it is unlikely for the Federal Reserve to raise interest rates in June!

According to the well-known CME Group tool, the probability of the Federal Reserve keeping interest rates unchanged in June within the range of 5.25 to 5.5% increased from under 30% to 40%.

The yield rate of the ten-year US Treasury bonds also increased to its highest level in the past three weeks, exceeding 4.3% after the release of this data.

Gold, which typically has a negative and inverse relationship with the ten-year bond yield rate, immediately dropped below 2160 and actually fell to $2152.

On Friday, as the bond yield rate started to correct lower, global gold managed to climb back up to $2172 but turned red again before the market closed the week, falling to around $2156.

Gold review next week

Next week, the most important event in the forex market is on Wednesday, when the Federal Reserve is expected to announce its monetary policy decisions along with the revised Summary of Economic Projections (SEP), also known as the dot plot.

It should be noted that the Federal Reserve is not expected to adjust its interest rates at this meeting.

If you remember, the Federal Reserve’s dot plot in December 2023 indicated that policymakers forecast a total reduction of 75 basis points in interest rates by 2024.

The popular CME Group tool also showed that the market is pricing in over 70% probability for three 25-basis-point interest rate cuts in 2024 up to this point.

If for any reason the Federal Reserve’s dot plot next week shows that the central bank is only planning to reduce interest rates by 50 basis points instead of 75, the initial reaction of the dollar to this news will be sharply bullish.

Additionally, don’t forget that investors will pay close attention to the Federal Reserve’s inflation forecasts.

If the inflation forecast for 2024, as shown in the December dot plot, remains around 2.4% despite the reduction in interest rates from 75 to 50 basis points, the US dollar will remain strong or even strengthen further.

On the contrary, if the dot plot indicates that the policymakers at the Federal Reserve prefer to reduce interest rates by the same 75 basis points as before, the US dollar will come under selling pressure from market bears.

Furthermore, any prediction of a decrease in inflation will also put pressure on the US dollar. If this scenario plays out, the yield rate of US ten-year Treasury bonds will begin to decline, and this important factor will cause global gold to rise.

Don’t forget that as soon as the market’s emotional reactions to the Federal Reserve’s policy statement and economic outlook fade, the market’s focus will turn to the remarks of the Federal Reserve Chairman, Jerome Powell.

Of course, the only thing the market is confident about up to this point is that Powell is not expected to touch interest rates in the May meeting (meaning the meeting two months later), but there are some uncertainties about the meeting in June.

- If Powell leaves the door open for interest rate cuts in June, the US dollar may remain flexible against its competitors even if the dot plot points to a hawkish outlook in short-term policy.

- If Powell takes a cautious tone about inflation outlook and refrains from showing a shift in Federal Reserve policies in his June meeting, XAU/USD will likely remain under downward pressure.

Remember that next week, central banks of Japan and England will also hold their pre-scheduled meetings.

While these two events may not directly impact gold, they will affect the global ounce through their influence on the US dollar.

Keep in mind that there is speculation about Japan’s Bank of Japan (BoJ) authorities planning to change their negative interest rate policies.

If for any reason BoJ increases its interest rates early next Tuesday, capital will flow out of the dollar and move towards global gold.

However, assessing and predicting the important meeting of the Bank of England (BoE) is a bit more challenging because this significant event is scheduled for Thursday, right after the Federal Reserve meeting on Wednesday.

Overall, if both of these major central banks take a hawkish tone in their actions and statements, global gold will face a serious challenge.

If the Federal Reserve acts hawkish and the BoE adopts a more cautious stance on expanding restrictive policies, this divergence between the two central banks of the US and England will be perceived, and the US dollar will start to strengthen.

In this scenario, global gold may attract capital that has exited from the British pound.

Weekly technical analysis of gold

The floor and ceiling of the gold price last week was 2150 and 2189. If you open the gold daily chart right now and draw an RSI indicator, you will see that the tip of this indicator is moving downwards in the overbought zone and is showing the number 68.

This means that control is still in the hands of market bulls, but global gold has finally started to correct itself from its historical high area.

Furthermore, if you draw an ascending channel on the daily timeframe, you will notice that global gold, which had broken out of its channel ceiling, has returned inside this channel.

Key support levels in the analysis of global gold ounce:

If gold is expected to decline, the first significant support level will be the important area of $2150. If gold penetrates below this area, the next important price level is $2140. If market bears push gold lower, the next key levels will be $2130 and $2120.

Key resistance levels in the analysis of global gold ounce:

If gold increases, the first important resistance level will be $2160. If gold successfully surpasses this area, the next important level is $2170. If market bulls manage to push the gold price higher, the next resistance levels will be $2180 and $2195.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor