"THE DIFFERENCE BETWEEN CORRELATION AND REGRESSION

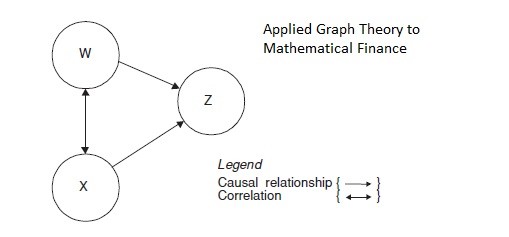

Correlation analysis compares how two random variables vary together. In regression we assume the values taken by the dependent variable are influenced or caused by the independent variables. Therefore, regression provides us with a cause-and-effect modeling framework. Correlation, on the other hand, informs us that two variables may be related, but it tells us nothing about causation. For example, in Figure 12.14 we consider two random variables, W and X, and a dependent variable Z. If increasing values of W and increasing values of X tend to influence Z in the same direction, then W and X will be positively correlated, but not causally related; however, W and X do cause Z."

A valuable reference for understanding operational risk Operational Risk with Excel and VBA is a practical guide that only discusses statistical methods that have been shown to work in an operational risk management context. It brings together a wide variety of statistical methods and models that have proven their worth, and contains a concise treatment of the topic. This book provides readers with clear explanations, relevant information, and comprehensive examples of statistical methods for operational risk management in the real world.

Nigel Da Costa Lewis (Stamford, CT) is president and CEO of StatMetrics, a quantitative research boutique.

He received his PhD from Cambridge University.

If you would like to read the book, Please Read More -> Sources.