Roberto Jacobs / Profil

- Bilgiler

|

10+ yıl

deneyim

|

3

ürünler

|

78

demo sürümleri

|

|

28

işler

|

0

sinyaller

|

0

aboneler

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Sergey Golubev

The economic outlook if the Fed does not trigger a recession is quite positive and gets better as time goes by. Consumer spending is likely to grow just in pace with the economy. Few consumers are stretching beyond their incomes, and few are withdrawing from spending...

4

Roberto Jacobs

Sergey Golubev

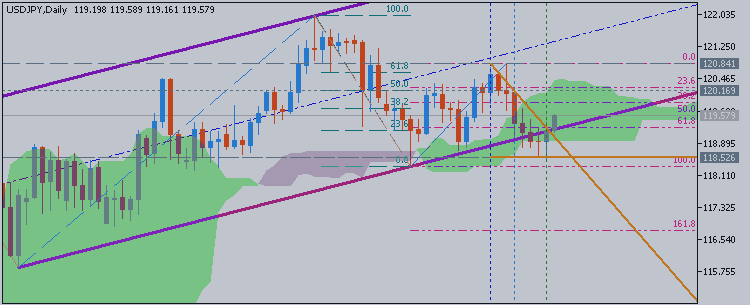

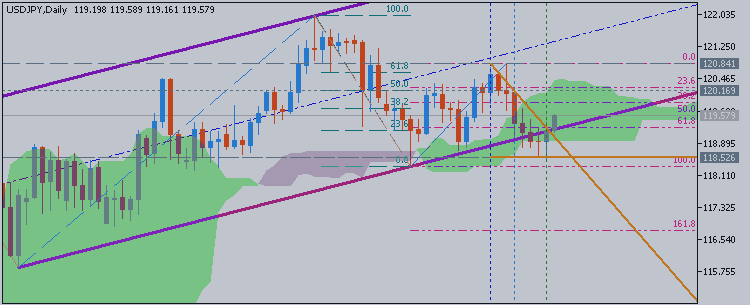

Tenkan-sen line is located above Kijun-sen line of Ichimoku indicator with 122.02 resistance and 118.32 support levels on W1 timeframe for the uptrend to be continuing...

4

Roberto Jacobs

Sergey Golubev

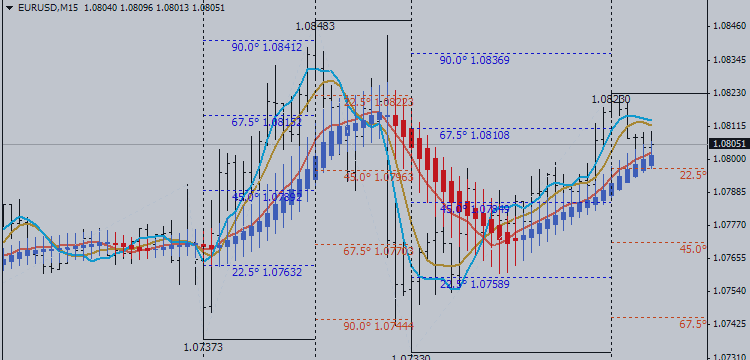

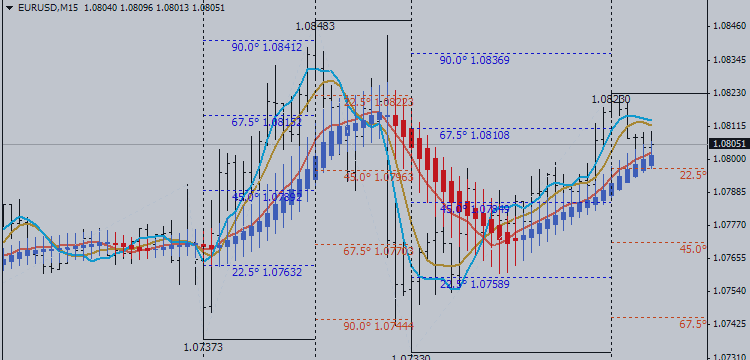

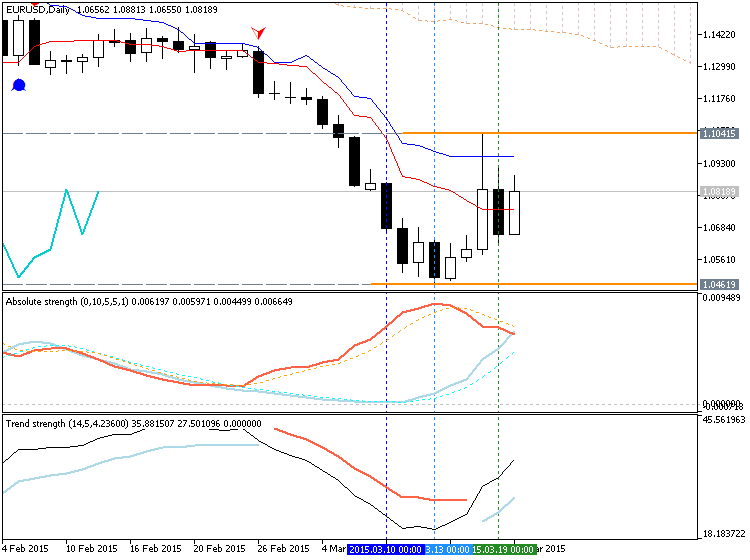

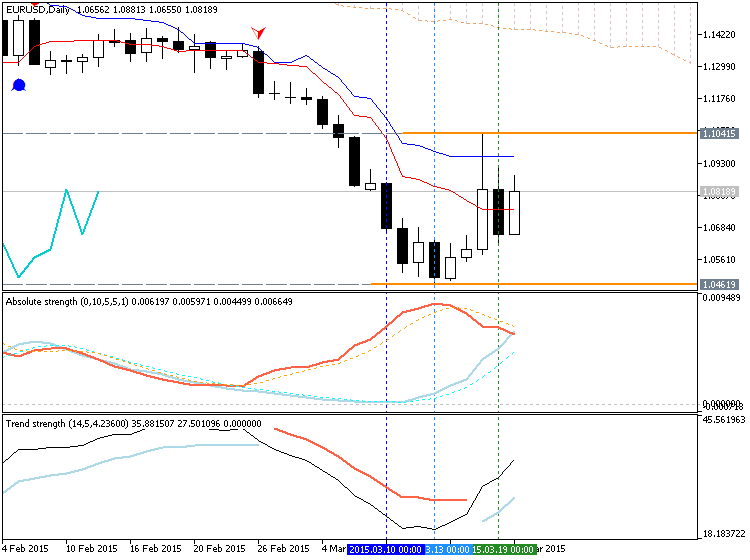

Tenkan-sen line is below Kijun-sen line of Ichimoku indicator on W1 timeframe with 1.0461 support level for primary bearish market condition. AbsoluteStrength indicator and TrendStrength indicators are marking for ranging market condition to be started in the middle of the March for weekly price...

4

Roberto Jacobs

Sergey Golubev

JP Morgan's EUR/USD forecast profile is unchanged this month and continues to show a slower decline for the rest of the year, after an unprecedented -11% drop in Q1. JPM's Quarter-end targets are 1.07 in Q2, 1.06 in Q3 and 1.05 in Q4...

3

Roberto Jacobs

Sergey Golubev

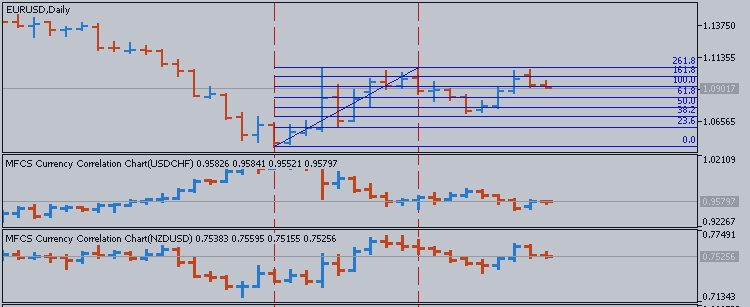

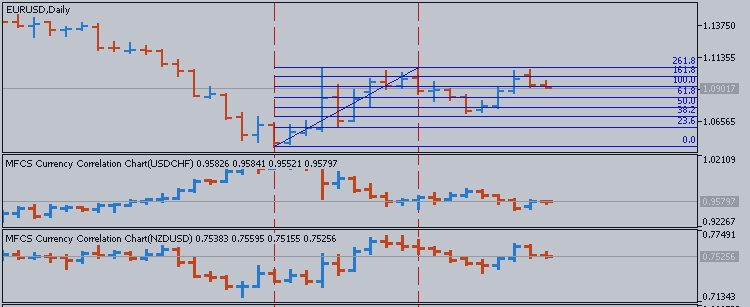

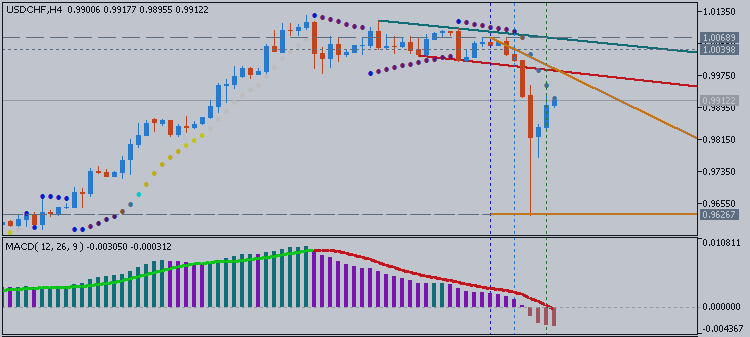

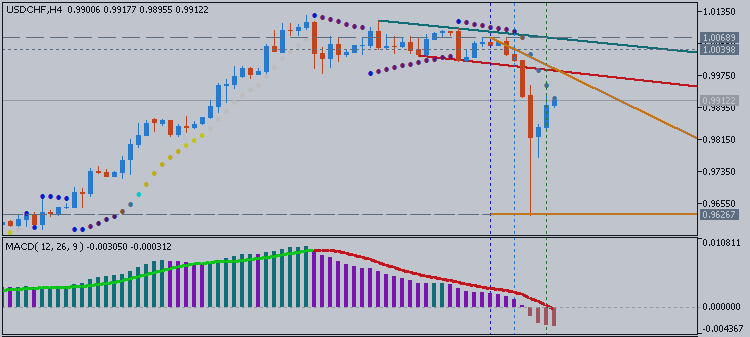

EURUSD correlation with both pairs USDCHF and NZDUSD is very strong. EURUSD holds positive correlation with NZDUSD in an hourly time frame ONLY while it establishes strong negative correlation with USDCHF pair both in an hourly and daily time frame...

2

Roberto Jacobs

Sergey Golubev

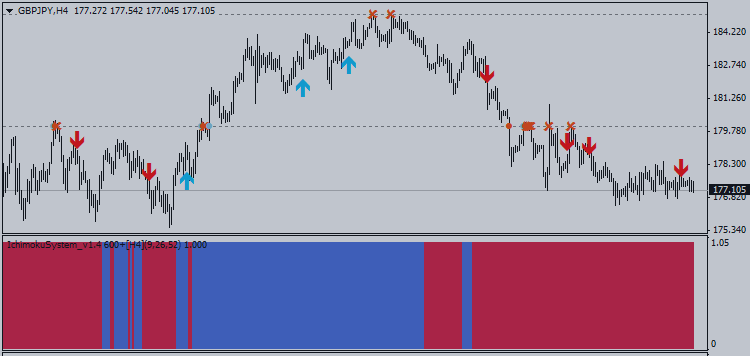

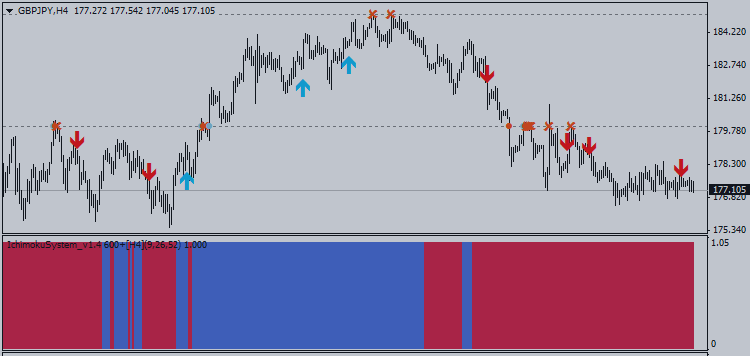

By examining the daily chart of the GBPJPY pair, we easily can notice that the pair has moved aggressively downwards during the previous period after placing a short-term top in the 185.00 regions. The psychological areas of 185.00 intersect with 61.8% Fibonacci of the major decline from 189...

2

Roberto Jacobs

Sergey Golubev

• iPhone Killer: The Secret History of the Apple Watch (Wired) • Renegades of Junk: The Rise and Fall of the Drexel Empire (Bloomberg) • Wall Street Executives from the Financial Crisis of 2008: Where Are They Now...

3

Roberto Jacobs

Sergey Golubev

Since the beginning of January 2014 stocks have shown signs of institutional selling. This can be seen in the small capitalization stocks index the Russell 2000. This group of stocks generally leads the S&P 500. The chart posted below shows some of my analysis of the SP500 index...

3

Roberto Jacobs

Sergey Golubev

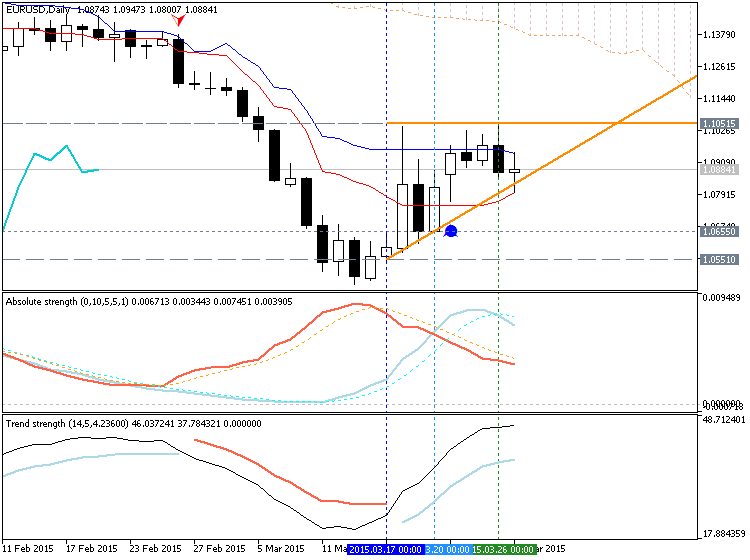

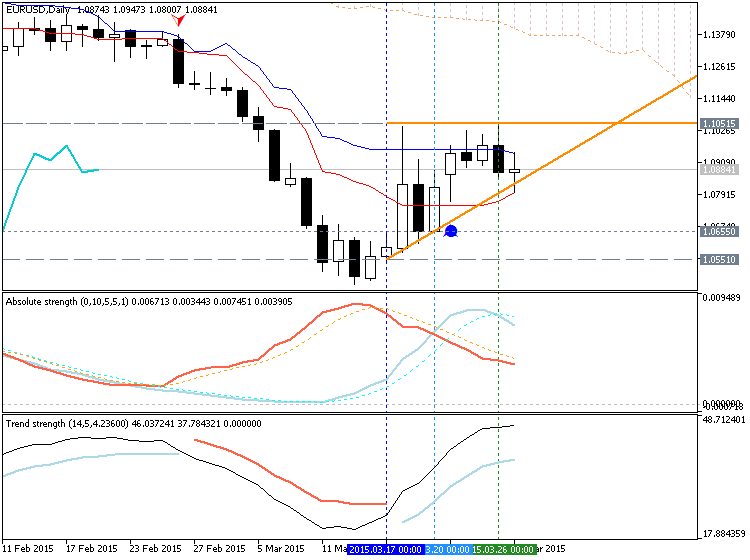

EURUSD Technical Analysis 2015, 29.03 - 05.04: Bearish Ranging Within 1.0551 and 1.1051

D1 price is on ranging bearish market condition: The price is located below Ichimoku cloud/kumo and far below Sinkou Span A line Chinkou Span line is too far for any possible reversal of the price movement from bearish to the bullish Nearest support

Roberto Jacobs

Matthew Todorovski

March 24, 2015 Santiago, Chile French paper Le Parisien didn't mince words in the headline: "La chasse au cash est lancee". Basically 'hunting season on cash is launched'...

2

Roberto Jacobs

Sergey Golubev

Ichimoku Trading Strategies For Finding Winning Trades by Hubert Senters | Real Traders Webinar A brief look at the terminology, signals and methods for taking trades using Ichimoku Kinko Hyo. ============== Ichimoku threads/posts on mql5.com forum The theory of the signals...

2

Roberto Jacobs

ForexLine kodunu yayınladı

ForexLine indicator provide signals for trade, white line (sell signal) and the blue line (buy signal).

Sosyal ağlarda paylaş · 6

5849

Pankaj D Costa

2015.03.24

Thanks for sharing. Looks good as per image, will see in the real platform. Thanks again.

Roberto Jacobs

FMOneEA kodunu yayınladı

FMOneEA is a scalping Expert Advisor based on MA and MACD indicators.

Sosyal ağlarda paylaş · 4

14465

Matthew Todorovski

2015.03.24

Thank you for sharing! You could sell this as a product in MQL Market and make money, but instead you are freely sharing the product and code for the benefit of everyone! You are very kind - thank you very much sir!

Roberto Jacobs

Sergey Golubev

Strong Dollar Hammers Profits at U.S. Multinationals (WSJ) Richard Fisher, Often Wrong but Seldom Boring, Leaves the Fed (NY Times) Economists agree: deflation is either good, or bad, or irrelevant (FT Alphaville) Why are so few homes for sale in the Bay Area...

3

Roberto Jacobs

Sergey Golubev

EURUSD Technical Analysis 2015, 22.03 - 29.03: Bearish Ranging with 1.0461 Key Support Level

D1 price is on primary bearish market condition with the secondary ranging: The price is located below Ichimoku cloud/kumo and below Sinkou Span A line Chinkou Span line is located too far for any future possible breakdown/breakout Nearest support

Roberto Jacobs

BB_OsMA kodunu yayınladı

BB_OsMA indicator is the OsMA indicator in the form of spheroid with a deviation as the upper and lower bands.

Sosyal ağlarda paylaş · 4

3365

Roberto Jacobs

FiboPivotCandleBar kodunu yayınladı

This indicator is a composite of several indicators: Fibonacci, Pivot Point, ZigZag, MACD and Moving Average which are combined in this indicator.

Sosyal ağlarda paylaş · 3

13545

Roberto Jacobs

MACD_2ToneColor kodunu yayınladı

Custom MACD indicator with 2 tone color (MACD Up and MACD Down colors).

Sosyal ağlarda paylaş · 3

9364

Roberto Jacobs

MonEx indicator kodunu yayınladı

MonEx indicator is the Weighted Close (HLCC/4) candlestick bar combined with ZigZag indicator.

Sosyal ağlarda paylaş · 3

3644

Roberto Jacobs

Sergey Golubev

The US Dollar moved sharply lower against the Swiss Franc, issuing the largest decline in two months. A daily close below trend line support at 0.9769 exposes the 23.6% Fibonacci retracement at 0.9695. Alternatively, a move above the 14.6% Fib at 0...

3

: