2015-2017 Economic Forecast:: stock market should do well, interest rates will rise and business capital spending will improve

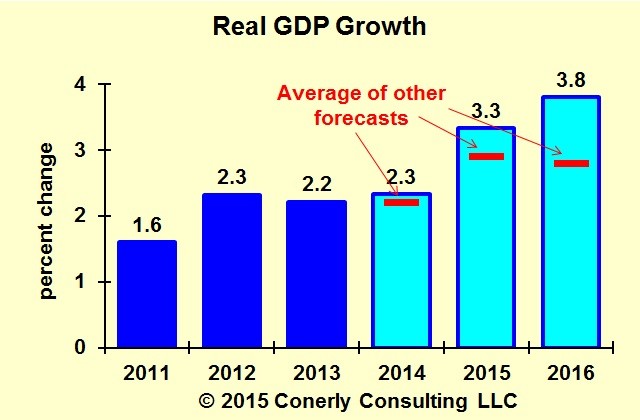

The economic outlook if the Fed does not trigger a recession is quite positive and gets better as time goes by.

Consumer spending is likely to grow just in pace

with the economy. Few consumers are stretching beyond their incomes, and

few are withdrawing from spending. As incomes rise, their spending

rises at about the same rate.

Housing starts are poised to grow significantly. Our population growth justifies 1.2 to 1.4 million starts a year, but we’re at only one million. We are within a tenth of a percent of working off the excess supply that was constructed in the boom, so it’s time to start building. Forecasting is the two years of 10 percent residential construction gains.

Non-residential construction, however, won’t see much acceleration in the next two years, due to continued soft demand. The lack of new construction now means that eventually landlords will be able to command strong rents with little new competition.

Business capital spending will improve. Already it has been strong, but look for even more growth. Manufacturing production has increased five percent over the past 12 months and is well above the pre-recession peak. Look for more companies to add machinery, computers and transportation equipment.

Government spending on transfer payments will continue to grow, but federal discretionary spending will be limited due to budget constraints and Republican resistance to higher taxes. Defense spending will probably be protected, but Congress’s traditional aversion to cutting existing programs means there isn’t much room to increase military budgets. State and local governments will be able to expand their spending by the three-to-five percent revenue gains they reap.

Interest rates will rise in this environment. The Federal Reserve will start pushing short-term interest rates up in the spring. The rate hike will be about one percentage point per year, which is one-third their full-blown speed. Long-term interest rates will rise, primarily due to global economic expansion (which pushes global demand for credit up faster than global supply of savings), with additional help from the Fed’s tightening.

Inflation will remain subdued. The all-items measure will drop with lower oil prices, while core inflation is flat.

Businesses plans should be based on expansion - the odds certainly favor growth. However, every company should acknowledge the risk of recession, and also acknowledge their inability to predict when the next recession will come.

The stock market should do well in this environment, with the positive effects of economic growth outweighing the negative impact of higher interest rates.